Koosylvia Myftp Infohost Https WwwBusiness Income & Receipts Tax BIRTServicesCity of 2021-2026

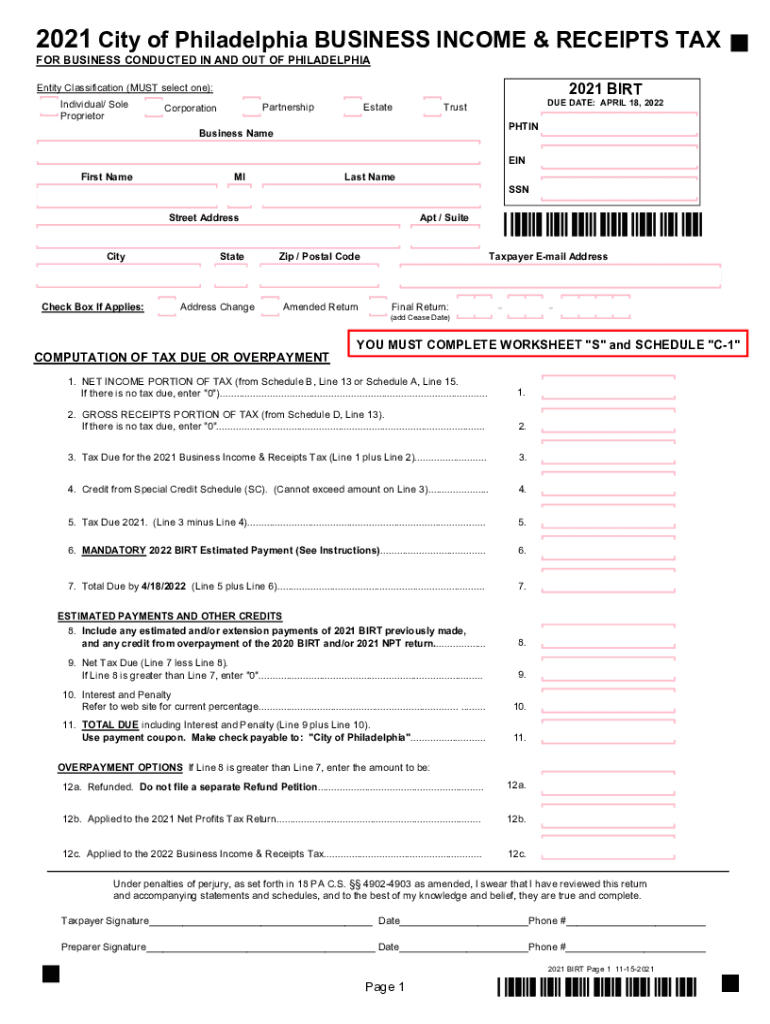

Understanding the PA BIR P1 Receipts Tax Form

The PA BIR P1 receipts tax form is essential for businesses in Pennsylvania that need to report and pay their business income and receipts tax. This form is specifically designed for entities that generate income through various business activities within the state. By accurately completing this form, businesses can ensure compliance with state tax regulations and avoid potential penalties.

Steps to Complete the PA BIR P1 Receipts Tax Form

Filling out the PA BIR P1 receipts tax form involves several key steps. First, gather all necessary financial documents, including income statements and receipts. Next, accurately report your total gross receipts for the tax year. It is important to ensure that all figures are correct to avoid discrepancies. After completing the form, review it thoroughly for any errors before submission.

Filing Deadlines for the PA BIR P1 Receipts Tax Form

Timely submission of the PA BIR P1 receipts tax form is crucial to avoid late fees and penalties. Generally, the form must be filed annually, with specific deadlines depending on the business's fiscal year. Businesses should keep track of these dates to ensure compliance and maintain good standing with the Pennsylvania Department of Revenue.

Required Documents for the PA BIR P1 Receipts Tax Form

To complete the PA BIR P1 receipts tax form, businesses need to provide specific documentation. This includes financial statements that reflect total gross receipts, any relevant deductions, and proof of prior tax payments. Having these documents ready will streamline the filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance with the PA BIR P1 Receipts Tax Form

Failure to file the PA BIR P1 receipts tax form on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand these consequences and prioritize timely filing to avoid unnecessary financial burdens.

Digital vs. Paper Version of the PA BIR P1 Receipts Tax Form

Businesses have the option to file the PA BIR P1 receipts tax form either digitally or on paper. The digital version offers convenience and faster processing times, while the paper version may be preferred by those who are not comfortable with online submissions. Both methods require careful attention to detail to ensure compliance with state regulations.

Quick guide on how to complete koosylviamyftpinfohost https wwwbusiness income ampamp receipts tax birtservicescity of

Effortlessly Prepare Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Manage Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to edit and eSign Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of with ease

- Obtain Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow tailored for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct koosylviamyftpinfohost https wwwbusiness income ampamp receipts tax birtservicescity of

Create this form in 5 minutes!

People also ask

-

What is the PA BIR P1 receipts tax form make?

The PA BIR P1 receipts tax form make is a document required by the Pennsylvania Department of Revenue for reporting and paying various taxes. It allows businesses to accurately declare their receipts and ensure compliance with state tax regulations. Using airSlate SignNow makes completing and submitting this form both quick and straightforward.

-

How can airSlate SignNow help in creating the PA BIR P1 receipts tax form make?

airSlate SignNow streamlines the process of creating the PA BIR P1 receipts tax form make by providing customizable templates and an intuitive interface. Users can fill out the required fields quickly, ensuring accuracy and efficiency in document preparation. This eliminates the stress of manual processing and potential errors.

-

Is there a cost associated with using airSlate SignNow for the PA BIR P1 receipts tax form make?

Yes, there are various pricing plans available for airSlate SignNow based on your business needs. With a cost-effective solution, you can access features that simplify the creation of the PA BIR P1 receipts tax form make. It's an investment in efficiency that can save time and reduce errors in your tax documentation.

-

Can I integrate airSlate SignNow with other accounting software for the PA BIR P1 receipts tax form make?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to manage your PA BIR P1 receipts tax form make within your existing workflow. This integration ensures that your financial data is synchronized, simplifying the overall process of tax preparation.

-

What features does airSlate SignNow provide for document signing related to the PA BIR P1 receipts tax form make?

airSlate SignNow provides robust eSignature features that allow you to securely sign your PA BIR P1 receipts tax form make online. This functionality complies with legal standards, ensuring that your signed documents are valid. Plus, you can track and manage the signing process in real-time, enhancing efficiency.

-

How does airSlate SignNow ensure the security of the PA BIR P1 receipts tax form make?

Security is a top priority for airSlate SignNow, which employs industry-standard encryption and secure storage to protect your documents, including the PA BIR P1 receipts tax form make. Your data is safe from unauthorized access, ensuring compliance and confidentiality during the entire process.

-

What are the benefits of using airSlate SignNow for tax documentation like the PA BIR P1 receipts tax form make?

Using airSlate SignNow enhances the efficiency, accuracy, and security of handling tax documentation like the PA BIR P1 receipts tax form make. It reduces the time spent on paperwork and enables easy digital access. Additionally, you gain greater control over the signing process and document management.

Get more for Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of

- Motion filing fees form

- Motion for deferral of various fees oregon form

- Motion for deferral of filing fees oregon form

- Order for deferral of filing fee oregon form

- Order for deferral of various fees oregon form

- Parenting time enforcement instructions oregon form

- Oregon support form

- Status quo application instructions oregon form

Find out other Koosylvia myftp infohost https wwwBusiness Income & Receipts Tax BIRTServicesCity Of

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy