Do You Have Less Than or Equal to $100,000 2020

Understanding the Philadelphia BIR Tax Form 2018

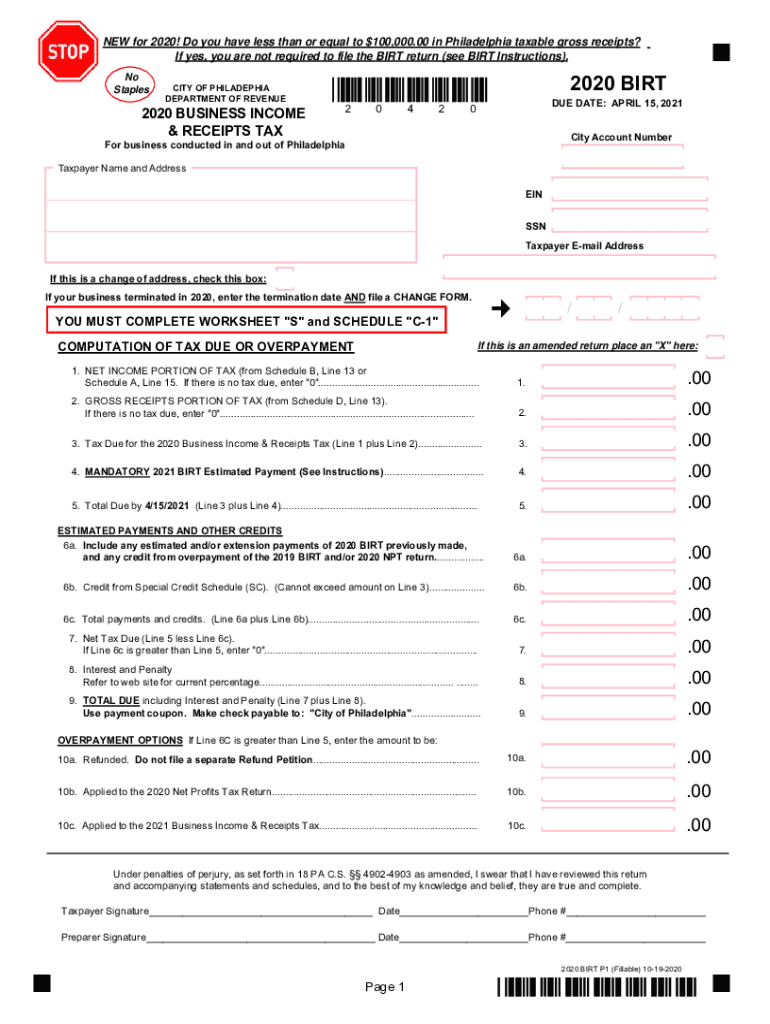

The Philadelphia BIR tax form 2018 is essential for businesses operating within the city. This form is primarily used for reporting business income and calculating the Business Income and Receipts Tax (BIRT). It is crucial for ensuring compliance with local tax regulations. The form collects information regarding gross receipts, taxable income, and other relevant financial data. Completing this form accurately is vital for avoiding penalties and ensuring that businesses meet their tax obligations.

Steps to Complete the Philadelphia BIR Tax Form 2018

Filling out the Philadelphia BIR tax form requires attention to detail. Here are the steps to ensure proper completion:

- Gather necessary financial documents, including income statements and receipts.

- Enter your business information, such as name, address, and federal employer identification number (EIN).

- Report your total gross receipts accurately in the designated section.

- Calculate your taxable income based on the guidelines provided.

- Complete any additional schedules or sections that apply to your business type.

- Review the form for accuracy before submitting it.

Required Documents for the Philadelphia BIR Tax Form 2018

To complete the Philadelphia BIR tax form 2018, certain documents are necessary. These include:

- Financial statements, including profit and loss statements.

- Copies of previous tax returns, if applicable.

- Receipts and records of all business income.

- Documentation for any deductions claimed.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Form Submission Methods for the Philadelphia BIR Tax Form 2018

The Philadelphia BIR tax form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Philadelphia Department of Revenue's website.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated city offices for direct assistance.

Choosing the right submission method can help businesses manage their filing efficiently.

Penalties for Non-Compliance with the Philadelphia BIR Tax Form 2018

Failure to comply with the requirements of the Philadelphia BIR tax form can lead to significant penalties. Common consequences include:

- Monetary fines for late submissions or underreporting income.

- Interest charges on unpaid taxes.

- Potential legal action for persistent non-compliance.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Eligibility Criteria for Filing the Philadelphia BIR Tax Form 2018

Eligibility to file the Philadelphia BIR tax form is determined by several factors, including:

- Business type: Corporations, partnerships, and sole proprietorships must all file.

- Gross receipts: Businesses with gross receipts above a certain threshold are required to file.

- Location: Only businesses operating within Philadelphia city limits need to submit this form.

Ensuring that your business meets these criteria is essential for compliance.

Quick guide on how to complete do you have less than or equal to 100000

Effortlessly Prepare Do You Have Less Than Or Equal To $100,000 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without unnecessary delays. Manage Do You Have Less Than Or Equal To $100,000 on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Do You Have Less Than Or Equal To $100,000 with Ease

- Locate Do You Have Less Than Or Equal To $100,000 and then select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Alter and eSign Do You Have Less Than Or Equal To $100,000 and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do you have less than or equal to 100000

Create this form in 5 minutes!

How to create an eSignature for the do you have less than or equal to 100000

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Philadelphia BIR tax form 2018 and what is its purpose?

The Philadelphia BIR tax form 2018 is a required document used by businesses to report and pay the Business Income and Receipts Tax in Philadelphia. This form helps ensure that businesses are compliant with local tax laws, making it essential for any company operating within the city.

-

How can airSlate SignNow assist in completing the Philadelphia BIR tax form 2018?

airSlate SignNow streamlines the process of completing the Philadelphia BIR tax form 2018 by allowing users to fill out and eSign the document electronically. Our user-friendly platform ensures that all necessary information is included, reducing the risk of errors and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the Philadelphia BIR tax form 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution enables businesses to eSign documents like the Philadelphia BIR tax form 2018 efficiently, making it a valuable investment for any organization.

-

What features does airSlate SignNow provide for handling the Philadelphia BIR tax form 2018?

With airSlate SignNow, users can easily create, edit, and send the Philadelphia BIR tax form 2018 for electronic signatures. Our platform provides customizable templates, workflow automation, and secure storage, all designed to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for the Philadelphia BIR tax form 2018?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools and software. This means you can easily manage the Philadelphia BIR tax form 2018 alongside your existing applications, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Philadelphia BIR tax form 2018?

Using airSlate SignNow for the Philadelphia BIR tax form 2018 provides multiple benefits, including time savings, increased accuracy, and improved compliance. The eSigning feature eliminates the need for paper forms, streamlining your filing process signNowly.

-

Is airSlate SignNow secure for sending sensitive documents like the Philadelphia BIR tax form 2018?

Yes, airSlate SignNow prioritizes security to protect your sensitive documents, including the Philadelphia BIR tax form 2018. Our platform includes industry-standard encryption and secure data storage, ensuring that your information remains safe and confidential.

Get more for Do You Have Less Than Or Equal To $100,000

- Federal monthly supervision report form

- Tennessee last will and testament form

- Water heater and smoke detector statement of compliance form

- Quebec back pain disability scale pdf form

- Department of justice complaint form

- Bbq dinner order form

- Anne healey scholarship form

- Parental consent and release form for field trips charlotte schools cms k12 nc

Find out other Do You Have Less Than Or Equal To $100,000

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney