Azumio Inc App Check 2019-2026

Understanding the Revenue Form T2 Sch 125 E

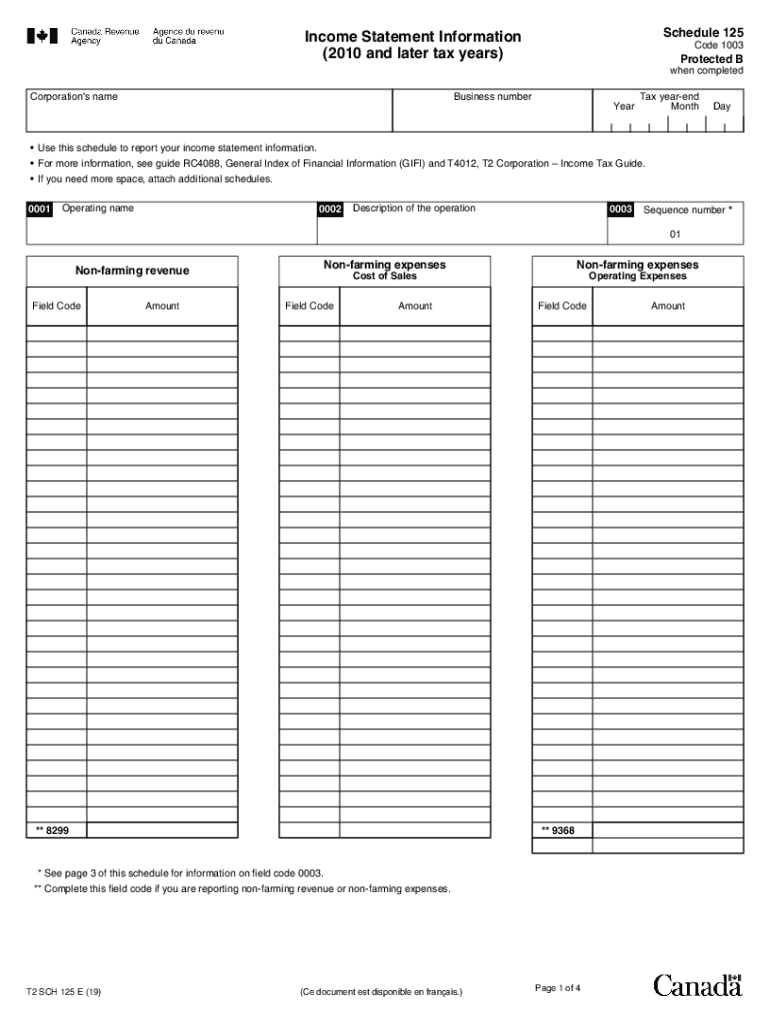

The revenue form T2 Sch 125 E is a crucial document for businesses in the United States, particularly for corporations that need to report their income and expenses accurately. This form is specifically designed to provide detailed information about a corporation's revenue, allowing for a comprehensive overview of financial performance. It is essential for ensuring compliance with tax regulations and for the accurate calculation of corporate taxes.

Steps to Complete the T2 Sch 125 E

Completing the T2 Sch 125 E involves several important steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill in the required fields, ensuring that all revenue sources are accurately reported.

- Double-check calculations to ensure accuracy in reported figures.

- Sign and date the form, confirming that the information provided is complete and accurate.

Filing Deadlines for the T2 Sch 125 E

It is important to be aware of the filing deadlines associated with the T2 Sch 125 E. Typically, the form must be submitted by the due date of the corporation's tax return. Late submissions can result in penalties, so timely filing is crucial for compliance.

Required Documents for the T2 Sch 125 E

When preparing to fill out the T2 Sch 125 E, certain documents are essential:

- Income statement detailing all revenue streams.

- Expense reports to substantiate deductions.

- Previous tax returns for reference.

- Any supporting documentation for claimed deductions.

IRS Guidelines for the T2 Sch 125 E

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting the T2 Sch 125 E. These guidelines ensure that all necessary information is included and that the form meets legal requirements. Familiarizing yourself with these guidelines can help avoid errors and facilitate a smoother filing process.

Penalties for Non-Compliance with the T2 Sch 125 E

Failing to comply with the requirements associated with the T2 Sch 125 E can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. Understanding the importance of timely and accurate submissions can help mitigate these risks.

Quick guide on how to complete azumio inc app check

Effortlessly Prepare Azumio Inc App Check on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Azumio Inc App Check on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Edit and eSign Azumio Inc App Check with Ease

- Locate Azumio Inc App Check and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you'd like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, and errors that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Azumio Inc App Check to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azumio inc app check

Create this form in 5 minutes!

How to create an eSignature for the azumio inc app check

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the revenue form T2 Sch 125 E?

The revenue form T2 Sch 125 E is a document used by Canadian corporations to report their income and expenses for tax purposes. It is essential for ensuring compliance with the Canada Revenue Agency and accurately calculating corporate taxes.

-

How can airSlate SignNow help with filling out the revenue form T2 Sch 125 E?

airSlate SignNow simplifies the process of completing the revenue form T2 Sch 125 E by allowing users to fill out, sign, and send documents securely. Our easy-to-use platform ensures that all required fields are completed accurately, saving you time and reducing errors.

-

Is airSlate SignNow a cost-effective solution for managing the revenue form T2 Sch 125 E?

Yes, airSlate SignNow offers a cost-effective solution for managing the revenue form T2 Sch 125 E. With flexible pricing plans, businesses can choose the option that best fits their needs without sacrificing quality or functionality.

-

What features does airSlate SignNow offer for the revenue form T2 Sch 125 E?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSigning options specifically useful for the revenue form T2 Sch 125 E. These features streamline the process, ensuring both accuracy and compliance.

-

Can I integrate airSlate SignNow with other software to manage the revenue form T2 Sch 125 E?

Absolutely! airSlate SignNow integrates with a variety of popular business applications, allowing for seamless management of the revenue form T2 Sch 125 E within your existing workflows. This makes it easier to automate processes and keep everything organized.

-

What are the benefits of using airSlate SignNow for the revenue form T2 Sch 125 E?

Using airSlate SignNow for the revenue form T2 Sch 125 E provides numerous benefits, including faster turnaround times for signatures, improved document security, and enhanced collaboration among team members. This ensures a hassle-free experience when handling essential business documents.

-

Is technical support available for airSlate SignNow users dealing with the revenue form T2 Sch 125 E?

Yes, airSlate SignNow offers comprehensive technical support for all users, including those dealing with the revenue form T2 Sch 125 E. Our support team is available to assist you with any questions or issues that may arise during the document processing.

Get more for Azumio Inc App Check

- Assignment of lease and rent from borrower to lender virginia form

- Assignment of lease from lessor with notice of assignment virginia form

- Virginia tenant property form

- Va complaint with form

- Guaranty or guarantee of payment of rent virginia form

- Financial information sheet virginia

- Virginia child support guidelines form

- Tenus hearing form

Find out other Azumio Inc App Check

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document