T1261 2019

What is the T1261?

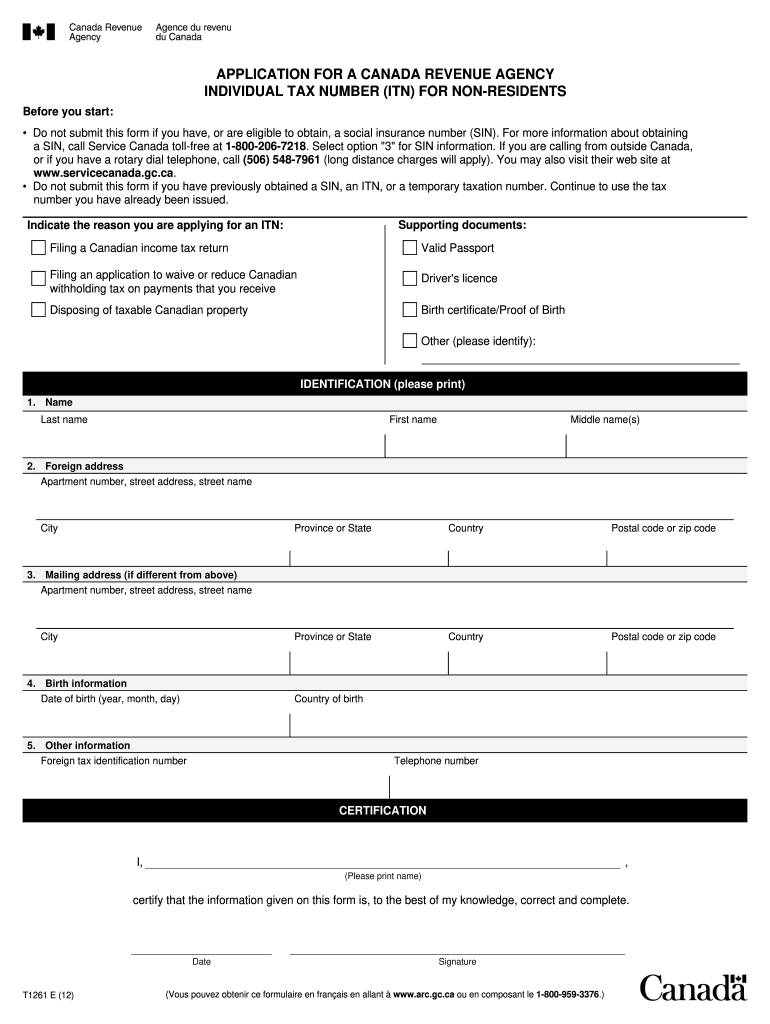

The T1261 form, also known as the Application for a Canada Revenue Agency Individual Tax Number (ITN), is a crucial document for individuals who need to file taxes in Canada but do not have a Social Insurance Number (SIN). This form is primarily used by non-residents and foreign nationals who wish to comply with Canadian tax regulations. Completing the T1261 allows individuals to obtain an ITN, which is necessary for processing tax returns and claiming refunds.

How to Use the T1261

To effectively use the T1261 form, individuals must first gather the necessary information and documents required for submission. This includes personal identification, proof of residency, and any relevant tax documents. Once the form is completed, it can be submitted to the Canada Revenue Agency either by mail or electronically, depending on the specific instructions provided. It is essential to ensure that all information is accurate to avoid delays in processing.

Steps to Complete the T1261

Completing the T1261 involves several key steps:

- Gather all required documents, including identification and proof of residency.

- Fill out the T1261 form accurately, ensuring all personal information is correct.

- Review the completed form for any errors or omissions.

- Submit the form to the Canada Revenue Agency through the designated method.

Following these steps carefully can help ensure a smooth application process for obtaining an ITN.

Legal Use of the T1261

The T1261 form is legally recognized by the Canada Revenue Agency as a valid means for individuals to obtain an ITN. Proper completion and submission of this form enable individuals to fulfill their tax obligations in Canada. It is important to adhere to all relevant tax laws and regulations to ensure compliance and avoid potential penalties.

Required Documents

When applying for an ITN using the T1261 form, applicants must provide specific documents to support their application. Required documents typically include:

- A valid form of identification, such as a passport or driver's license.

- Proof of residency, which may include utility bills or bank statements.

- Any additional tax documents that may be relevant to the application.

Having these documents ready can facilitate a smoother application process.

Eligibility Criteria

To be eligible for an ITN through the T1261 form, applicants must meet certain criteria. Generally, this includes:

- Being a non-resident or foreign national who needs to file taxes in Canada.

- Not having a Social Insurance Number (SIN).

- Intending to comply with Canadian tax laws.

Meeting these criteria is essential for a successful application.

Quick guide on how to complete t1261

Manage T1261 effortlessly on any device

Digital document administration has become widely accepted among companies and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle T1261 on any device utilizing airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to adjust and electronically sign T1261 without hassle

- Obtain T1261 and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign T1261 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1261

Create this form in 5 minutes!

How to create an eSignature for the t1261

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the purpose of the form itn in airSlate SignNow?

The form itn in airSlate SignNow helps streamline document management by allowing users to easily create, send, and eSign forms electronically. This saves time and reduces paperwork, making it ideal for businesses looking to enhance their processes.

-

How does airSlate SignNow handle form itn pricing?

airSlate SignNow offers a variety of pricing plans designed to accommodate businesses of all sizes. Depending on your needs, you can choose a plan that includes access to form itn features, ensuring you get the best value for your investment.

-

Can I integrate form itn with other applications?

Yes, airSlate SignNow allows seamless integration of form itn with various applications such as Google Drive, Dropbox, and CRM software. This ensures that you can streamline your workflow by easily managing your documents across multiple platforms.

-

What are the key features of form itn offered by airSlate SignNow?

Key features of form itn in airSlate SignNow include customizable templates, automated workflows, and real-time tracking of document status. These features simplify the signing process, making it more efficient and user-friendly.

-

Is there a mobile version for accessing form itn?

Absolutely! airSlate SignNow provides a mobile application that allows you to access form itn on the go. This means you can send and eSign documents anytime, anywhere, enhancing flexibility for busy professionals.

-

What are the benefits of using form itn with airSlate SignNow?

Using form itn with airSlate SignNow offers numerous benefits such as increased efficiency, reduced manual errors, and improved document security. Your team can collaborate effectively and focus on more important tasks while ensuring compliance.

-

How can form itn improve my business processes?

Form itn can signNowly streamline your business processes by reducing the time taken for document management. With airSlate SignNow, you can automate repetitive tasks, allowing your team to concentrate on strategic activities that drive growth.

Get more for T1261

- Virginia professional form

- Sample transmittal letter for articles of incorporation virginia form

- New resident guide virginia form

- Virginia cancellation form

- Satisfaction release or cancellation of deed of trust by individual virginia form

- Property deed trust 497428511 form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy virginia form

- Warranty deed for parents to child with reservation of life estate virginia form

Find out other T1261

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form