Form 501 Annual Information Return Summary of Reports 2020

What is the Form 501 Annual Information Return

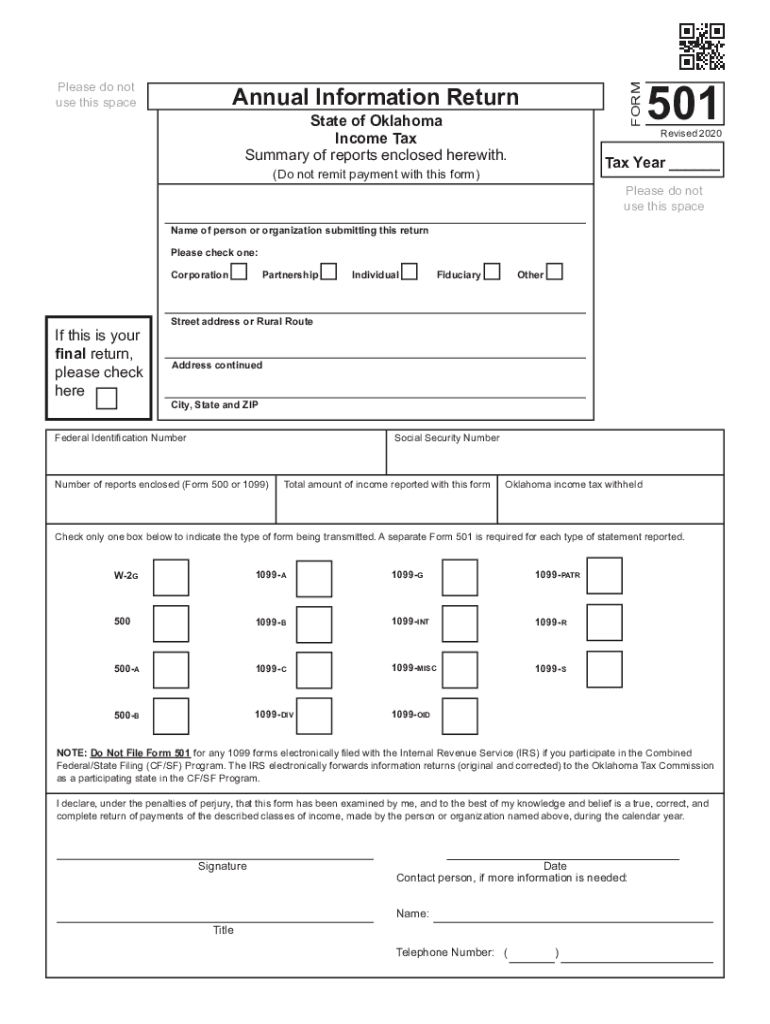

The 2017 Oklahoma Form 501 is an Annual Information Return that businesses in Oklahoma must file to report various financial details to the state. This form is essential for entities such as corporations, partnerships, and limited liability companies (LLCs) to disclose their income, deductions, and other pertinent financial information. The data collected through this form helps the state assess tax liabilities and maintain accurate records of business operations within Oklahoma.

Key Elements of the Form 501 Annual Information Return

The 2017 Oklahoma Form 501 includes several critical sections that must be completed accurately. Key elements typically consist of:

- Business Identification: Name, address, and taxpayer identification number of the business.

- Income Reporting: Total income earned during the reporting period.

- Deductions: Eligible deductions that reduce taxable income.

- Tax Calculation: Computation of the tax owed based on reported income and deductions.

- Signature: A declaration signed by an authorized representative of the business.

Steps to Complete the Form 501 Annual Information Return

Completing the 2017 Oklahoma Form 501 involves a series of steps to ensure accuracy and compliance:

- Gather necessary documents, including financial statements and previous tax returns.

- Fill out the business identification section with accurate details.

- Report total income and applicable deductions in the designated fields.

- Calculate the tax owed based on the provided information.

- Review the completed form for any errors or omissions.

- Obtain the signature of an authorized representative.

- Submit the form by the specified deadline.

Legal Use of the Form 501 Annual Information Return

The 2017 Oklahoma Form 501 is legally binding and must be filed in accordance with state regulations. Businesses are required to submit this form annually to remain compliant with Oklahoma tax laws. Failure to file or inaccuracies in reporting can result in penalties, interest, and potential audits. It is crucial for businesses to understand the legal implications of this form and ensure that all information is truthful and complete.

Filing Deadlines for the Form 501 Annual Information Return

Timely filing of the 2017 Oklahoma Form 501 is essential to avoid penalties. The deadline for submission is typically set for the 15th day of the fourth month following the end of the business's fiscal year. For most businesses operating on a calendar year, this means the form is due by April 15. It is advisable to confirm specific deadlines with the Oklahoma Tax Commission, as these may vary based on business structure or other factors.

Form Submission Methods

The 2017 Oklahoma Form 501 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many businesses choose to file electronically through the Oklahoma Tax Commission's online portal.

- Mail: Completed forms can be mailed to the appropriate address designated by the Oklahoma Tax Commission.

- In-Person: Businesses may also submit the form in person at designated tax offices.

Quick guide on how to complete form 501 annual information return summary of reports

Effortlessly Prepare Form 501 Annual Information Return Summary Of Reports on Any Device

Digital document organization has become increasingly favored among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can easily locate the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any holdups. Handle Form 501 Annual Information Return Summary Of Reports on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to Modify and eSign Form 501 Annual Information Return Summary Of Reports with Ease

- Find Form 501 Annual Information Return Summary Of Reports and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authentication as a conventional wet ink signature.

- Review all the details and click on the Done button to store your updates.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about missing or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Adjust and eSign Form 501 Annual Information Return Summary Of Reports and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 501 annual information return summary of reports

Create this form in 5 minutes!

How to create an eSignature for the form 501 annual information return summary of reports

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 2017 Oklahoma 501 form and how does airSlate SignNow help?

The 2017 Oklahoma 501 form is a tax form used for various reporting purposes in Oklahoma. airSlate SignNow simplifies the process of electronically signing and submitting this form by providing an easy-to-use platform for all your eSignature needs.

-

How much does it cost to use airSlate SignNow for the 2017 Oklahoma 501?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget when handling documents like the 2017 Oklahoma 501, ensuring you get an efficient and cost-effective solution.

-

Are there any special features for managing the 2017 Oklahoma 501 with airSlate SignNow?

Yes, airSlate SignNow provides features specifically designed to manage the 2017 Oklahoma 501 form efficiently. This includes templates for rapid form filling, secure eSignatures, and automatic reminders to streamline your workflow.

-

What are the benefits of using airSlate SignNow for the 2017 Oklahoma 501?

Using airSlate SignNow for the 2017 Oklahoma 501 form expedites the signing process, reduces paper clutter, and enhances document security. It also allows for easy tracking and management of your forms, improving organizational efficiency.

-

Can I integrate airSlate SignNow with other applications while handling the 2017 Oklahoma 501?

Absolutely, airSlate SignNow seamlessly integrates with numerous applications. This allows for an enhanced experience when managing the 2017 Oklahoma 501, enabling users to connect their existing tools for a smoother operation.

-

Is airSlate SignNow compliant with regulations regarding the 2017 Oklahoma 501?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document processing. This ensures that your handling of the 2017 Oklahoma 501 meets all necessary regulatory requirements.

-

How does airSlate SignNow enhance collaboration on the 2017 Oklahoma 501?

AirSlate SignNow offers collaborative features that allow multiple users to work on the 2017 Oklahoma 501 form simultaneously. This encourages teamwork and promotes quicker turnaround times for your document processes.

Get more for Form 501 Annual Information Return Summary Of Reports

Find out other Form 501 Annual Information Return Summary Of Reports

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney