Annual Information Return 2024-2026

What is the Annual Information Return

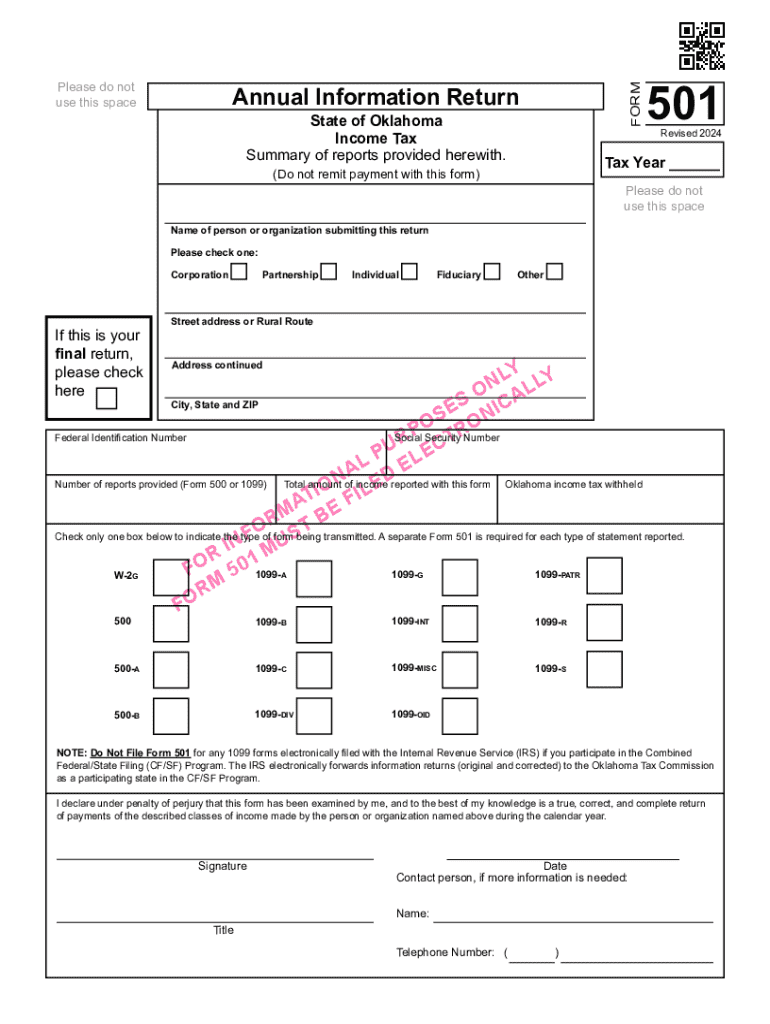

The Annual Information Return, specifically the Oklahoma Form 501, is a tax document required by the state of Oklahoma for various business entities. This form serves to report income, deductions, and other relevant financial information to ensure compliance with state tax regulations. It is essential for entities such as corporations, partnerships, and limited liability companies (LLCs) to accurately complete this form to maintain good standing with the state.

Steps to Complete the Annual Information Return

Completing the Oklahoma Form 501 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding your business's financial activities for the year.

- Ensure that all calculations are correct, particularly regarding income and deductions.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Oklahoma Form 501. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. Staying informed about these dates helps ensure timely submission and compliance with state tax laws.

Required Documents

To successfully complete the Oklahoma Form 501, certain documents are necessary. These include:

- Income statements detailing revenue generated during the year.

- Expense reports that outline all business-related expenditures.

- Previous year’s tax returns to provide a basis for comparison.

- Any additional documentation that supports claims made on the form.

Legal Use of the Annual Information Return

The Oklahoma Form 501 is legally binding and must be completed accurately to fulfill state tax obligations. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for all business entities operating in Oklahoma.

Who Issues the Form

The Oklahoma Form 501 is issued by the Oklahoma Tax Commission. This agency is responsible for overseeing tax collection and compliance within the state. Businesses can obtain the form directly from the Oklahoma Tax Commission’s website or through authorized tax professionals.

Create this form in 5 minutes or less

Find and fill out the correct annual information return

Create this form in 5 minutes!

How to create an eSignature for the annual information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Form 501?

The Oklahoma Form 501 is a crucial document used for various tax purposes in the state of Oklahoma. It is essential for businesses and individuals to understand its requirements to ensure compliance with state regulations. airSlate SignNow simplifies the process of completing and submitting the Oklahoma Form 501 electronically.

-

How can airSlate SignNow help with the Oklahoma Form 501?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the Oklahoma Form 501. With its intuitive interface, users can quickly complete the form and ensure that all necessary information is accurately captured. This streamlines the submission process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma Form 501?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that facilitate the completion and eSigning of the Oklahoma Form 501. Users can choose a plan that best fits their budget and requirements.

-

What features does airSlate SignNow offer for the Oklahoma Form 501?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Oklahoma Form 501. These features enhance the user experience by making it easier to manage documents and ensure timely submissions. Additionally, users can collaborate with others directly within the platform.

-

Can I integrate airSlate SignNow with other software for the Oklahoma Form 501?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to streamline their workflow when handling the Oklahoma Form 501. This means you can connect it with your existing tools for accounting, CRM, and more, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the Oklahoma Form 501?

Using airSlate SignNow for the Oklahoma Form 501 provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are stored securely and can be accessed anytime, anywhere. This convenience allows businesses to focus on their core operations while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing the Oklahoma Form 501?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Oklahoma Form 501. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively. This accessibility is a key advantage for businesses.

Get more for Annual Information Return

- Independent contractor waiver of workers compensation agreement form

- Printable monthly fire extinguisher inspection form template excel

- Neonatal transfer form

- Sw03_passpdf 537 kb florida high school athletic association form

- Canada school public service form

- 1244a form

- Affidavit of law form

- Trec financing form

Find out other Annual Information Return

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT