Lessor's Application for Personal Use Lease Automobile Exemption 50 286 Lessor's Application for Personal Use Lease Automobile E 2020

Understanding the Lessor's Application for Personal Use Lease Automobile Exemption 50-286

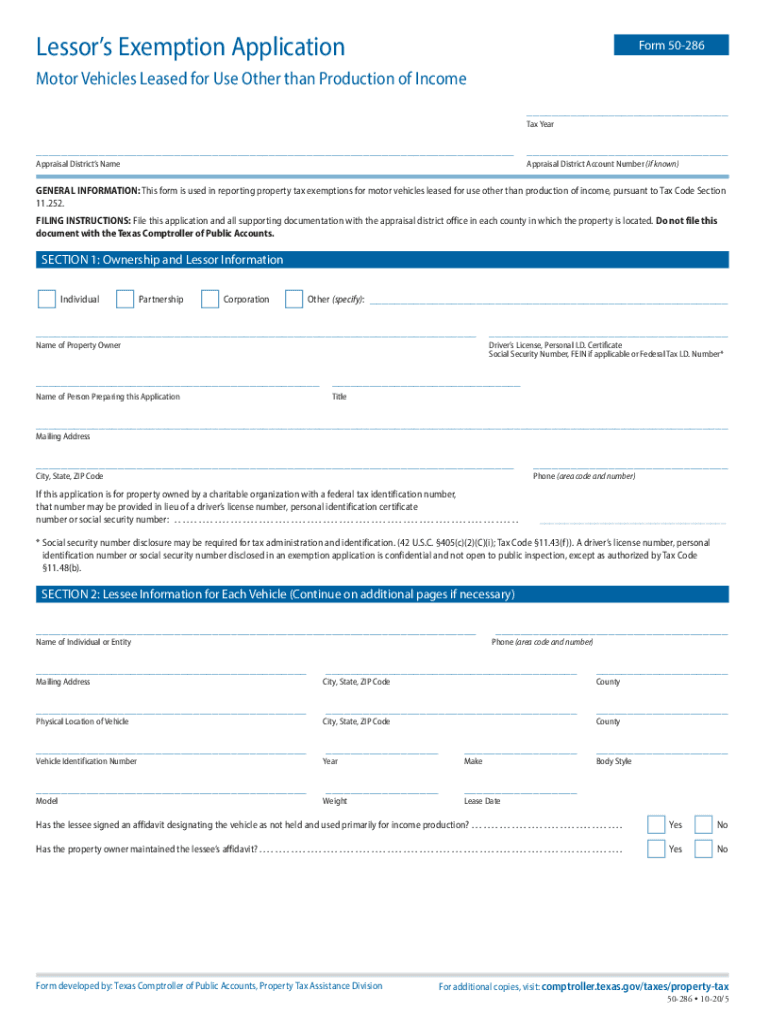

The Lessor's Application for Personal Use Lease Automobile Exemption 50-286 is a specific form used in the United States to apply for exemptions related to personal use lease automobiles. This form is particularly relevant for lessors who lease vehicles for personal use and wish to claim certain tax benefits. Understanding the purpose and requirements of this form is crucial for ensuring compliance with tax regulations.

This application allows lessors to document their eligibility for exemptions, which can lead to significant savings. It is essential to accurately complete the form, as any discrepancies may result in delays or denials in processing the exemption.

Steps to Complete the Lessor's Application for Personal Use Lease Automobile Exemption 50-286

Completing the Lessor's Application for Personal Use Lease Automobile Exemption 50-286 involves several important steps. First, gather all necessary documentation, including details about the leased vehicle and the leasing agreement. This information is vital for accurately filling out the form.

Next, carefully fill in the required fields on the application. Ensure that all information is correct and complete to avoid any issues during processing. Once completed, review the form to confirm accuracy before submission. Finally, submit the form according to the guidelines provided by the relevant tax authority.

Eligibility Criteria for the Lessor's Application for Personal Use Lease Automobile Exemption 50-286

To qualify for the Lessor's Application for Personal Use Lease Automobile Exemption 50-286, certain eligibility criteria must be met. Generally, the lessor must be the legal owner of the vehicle and must have leased it for personal use. Additionally, the vehicle should meet specific requirements set forth by tax regulations.

It is important to review the criteria carefully to ensure compliance. If the lessor does not meet these eligibility requirements, the application may be denied, and the associated tax benefits will not be granted.

Required Documents for the Lessor's Application for Personal Use Lease Automobile Exemption 50-286

When applying for the Lessor's Application for Personal Use Lease Automobile Exemption 50-286, certain documents are required to support the application. These typically include:

- A copy of the lease agreement for the vehicle.

- Proof of ownership of the vehicle.

- Documentation showing the vehicle is used for personal purposes.

Having these documents ready will facilitate a smoother application process and help ensure that all necessary information is provided to the tax authority.

Legal Use of the Lessor's Application for Personal Use Lease Automobile Exemption 50-286

The Lessor's Application for Personal Use Lease Automobile Exemption 50-286 must be used in accordance with applicable laws and regulations. Understanding the legal framework surrounding this exemption is essential for compliance. The form is designed to ensure that lessors can claim legitimate tax benefits while adhering to tax laws.

Failure to comply with legal requirements may result in penalties or loss of the exemption. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding the legal use of this form.

Quick guide on how to complete lessors application for personal use lease automobile exemption 50 286 lessors application for personal use lease automobile

Effortlessly Prepare Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E with Ease

- Locate Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lessors application for personal use lease automobile exemption 50 286 lessors application for personal use lease automobile

Create this form in 5 minutes!

How to create an eSignature for the lessors application for personal use lease automobile exemption 50 286 lessors application for personal use lease automobile

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 286 exemption and how does it impact businesses?

The 286 exemption refers to certain tax benefits available for businesses, allowing them to reduce their tax liability under specific conditions. Understanding the 286 exemption can signNowly impact a company's financial strategy and overall profitability. It's crucial for businesses to consult a tax professional to explore eligibility and maximize potential savings.

-

How does airSlate SignNow support the 286 exemption process?

airSlate SignNow facilitates the management of documents related to the 286 exemption through its efficient eSignature capabilities. By streamlining the signing process, airSlate SignNow helps businesses ensure compliance with tax regulations while minimizing administrative burdens. This makes it easier to manage paperwork associated with the 286 exemption.

-

What features does airSlate SignNow offer that relate to the 286 exemption?

airSlate SignNow provides various features such as document templates, automated workflows, and secure storage that can simplify the compliance process relevant to the 286 exemption. These tools help businesses create, send, and track documents seamlessly, ensuring that all 286 exemption-related information is handled efficiently. By leveraging these features, businesses can focus on their core activities while ensuring tax compliance.

-

Are there any costs associated with using airSlate SignNow for managing the 286 exemption?

Yes, airSlate SignNow has various pricing plans tailored to different business needs, including those managing the 286 exemption. The plans are designed to be cost-effective, providing value through features that support document management and eSigning processes. Businesses should evaluate their requirements to select the plan that best fits their budget and compliance needs.

-

Can airSlate SignNow integrate with other software to help with 286 exemption documentation?

Absolutely, airSlate SignNow integrates seamlessly with multiple CRM and business management software to help streamline the documentation process associated with the 286 exemption. Integrations with platforms like Salesforce, Google Drive, and others enhance productivity by allowing users to consolidate their workflows efficiently. This connectivity aids in managing all pertinent documents in one centralized location.

-

What are the benefits of using airSlate SignNow for 286 exemption-related documents?

Using airSlate SignNow for 286 exemption-related documents provides several benefits, including increased efficiency, better organization, and enhanced security. The platform allows instant tracking of document status, which can streamline tax compliance efforts signNowly. By automating the signing process, businesses can reduce turnaround time and focus on strategic initiatives.

-

Does airSlate SignNow provide support for businesses dealing with the 286 exemption?

Yes, airSlate SignNow offers extensive support to businesses navigating the complexities of the 286 exemption. Their customer support team is available to assist with any questions or troubleshooting needs, ensuring smooth usage of their tools. Additionally, airSlate SignNow provides resources and guides that can help businesses understand how to manage the 286 exemption effectively.

Get more for Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E

- Vermont change name form

- Certificate of service vermont form

- Vermont emancipation form

- Month to month lease 497428838 form

- 14 day notice to pay rent or lease terminates for residential property vermont form

- Terminate material form

- 7 day notice to terminate week to week lease including shared space in landlords personal residence residential vermont form

- Vermont month to month form

Find out other Lessor's Application For Personal Use Lease Automobile Exemption 50 286 Lessor's Application For Personal Use Lease Automobile E

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free