50 286 2017

What is the 50 286

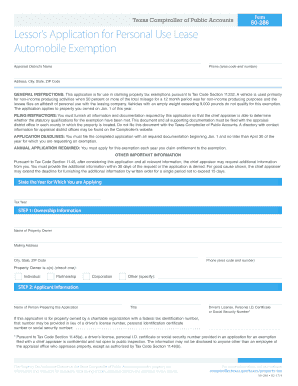

The 50 286 form, commonly referred to as the 286 exemption, is a specific document used in the United States to apply for certain tax exemptions. This form is essential for individuals or entities seeking to establish eligibility for exemptions related to federal taxes. Understanding the purpose and implications of the 50 286 is crucial for ensuring compliance with tax regulations and maximizing potential benefits.

How to use the 50 286

Using the 50 286 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and any supporting documentation required for the exemption. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission or mailing it to the appropriate tax authority.

Key elements of the 50 286

The 50 286 form contains several key elements that are critical for its validity. These include the applicant's personal information, the specific exemption being requested, and any relevant supporting documentation. Additionally, the form may require signatures from authorized individuals, confirming the accuracy of the information provided. Understanding these elements is essential for ensuring that the form meets all legal requirements and is processed without delays.

Eligibility Criteria

Eligibility for the 50 286 exemption is determined by specific criteria set forth by the IRS. Generally, applicants must demonstrate that they meet certain conditions related to their tax status or the nature of their business. This may include factors such as income level, type of business entity, or specific activities that qualify for exemption. It is important for applicants to review these criteria carefully to ensure they qualify before submitting the form.

Steps to complete the 50 286

Completing the 50 286 form involves a systematic approach to ensure accuracy and compliance. Begin by reading the instructions thoroughly to understand the requirements. Next, fill out the form section by section, providing all requested information. It is advisable to double-check each entry for accuracy. After completing the form, attach any necessary supporting documents that validate the exemption request. Finally, ensure that the form is signed and dated before submission to avoid any processing issues.

Legal use of the 50 286

The legal use of the 50 286 form is governed by federal tax laws and regulations. To be considered valid, the form must be completed in accordance with these laws, ensuring that all information is truthful and accurate. Additionally, the form must be submitted within the specified deadlines to avoid penalties or denial of the exemption. Understanding the legal framework surrounding the 50 286 is essential for applicants to protect their rights and ensure compliance with tax obligations.

Quick guide on how to complete 50 286

Effortlessly Prepare 50 286 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your files quickly without delays. Manage 50 286 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign 50 286 with Ease

- Find 50 286 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and electronically sign 50 286 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 50 286

Create this form in 5 minutes!

How to create an eSignature for the 50 286

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 286 exemption in the context of document signing?

The 286 exemption refers to a specific provision that may apply to certain businesses regarding document signing and electronic signatures. Understanding this exemption can help businesses streamline their document management processes. By leveraging the 286 exemption with airSlate SignNow, companies can efficiently comply with legal requirements.

-

How does airSlate SignNow support the 286 exemption?

airSlate SignNow offers features that ensure compliance with the 286 exemption, making electronic signatures legally binding. Our platform is designed to meet regulatory standards, allowing businesses to harness the benefits of the exemption confidently. This ensures that your signed documents hold up in legal contexts.

-

What are the pricing options for using airSlate SignNow with a focus on the 286 exemption?

airSlate SignNow offers flexible pricing plans designed to meet various business needs while ensuring compliance with the 286 exemption. Businesses can choose from different tiers depending on their volume of documents and specific features required. Our competitive pricing enables companies to adopt our solution cost-effectively.

-

What features does airSlate SignNow provide to facilitate the 286 exemption?

airSlate SignNow includes robust features like template creation, automated workflows, and secure storage to support the 286 exemption. These features help businesses accelerate the signing process while maintaining compliance with legal standards. Additionally, our user-friendly interface ensures that anyone can utilize these features effectively.

-

Are there any benefits of using airSlate SignNow related to the 286 exemption?

Yes, using airSlate SignNow in relation to the 286 exemption provides several benefits, including enhanced efficiency, reduced paperwork, and improved compliance. By adopting eSigning solutions, businesses can save time and reduce costs associated with traditional document signing. Moreover, this electronic solution helps in better record management.

-

Can airSlate SignNow integrate with other tools while addressing the 286 exemption?

Absolutely, airSlate SignNow seamlessly integrates with various CRM and document management tools to enhance the utility of the 286 exemption. These integrations facilitate a smoother workflow, allowing users to manage documents and signatures efficiently. This means businesses can maintain existing software setups while reaping the benefits of compliance and efficiency.

-

Is airSlate SignNow user-friendly for those implementing the 286 exemption?

Yes, airSlate SignNow is designed to be user-friendly, allowing anyone to implement the 286 exemption with ease. Our intuitive interface simplifies the signing process, making it accessible for all team members. This ensures that businesses can quickly adopt eSigning practices without extensive training.

Get more for 50 286

- Wpf drpscu 010260 motion declaration for service of summons by publication dclr washington form

- Wpf drpscu 010265 order for service of summons by publication orpub washington form

- Wpf ps 010280 motion and declaration to serve by mail mt washington form

- Washington service mail 497429445 form

- Wpf ps 010290 summons by mail parentage sm washington form

- Wpf ps 010300 response to petition for establishment of parentage rsp washington form

- Wpf ps 010310 acceptance of service parentage acsr washington form

- Washington notice appearance form

Find out other 50 286

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer