Report on Value Lost because of Value Limitations under Tax Code Chapter 313 Form 50 767 2020

What is the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

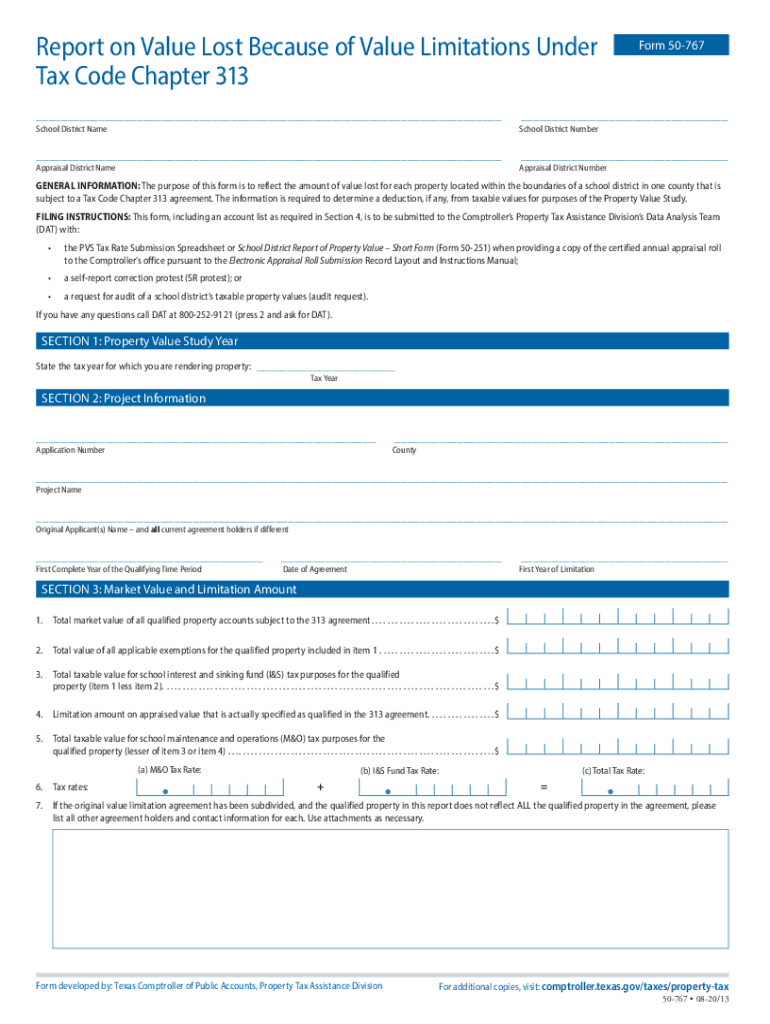

The Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 is a crucial document for property owners in Texas seeking tax relief. This form allows individuals and businesses to report the value lost due to limitations imposed by the Texas tax code. It is particularly relevant for those who have experienced a decrease in property value due to economic conditions or other factors. By completing this form, taxpayers can potentially receive tax benefits, helping to alleviate financial burdens associated with property ownership.

How to use the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

Using the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 involves several steps. First, gather all necessary documentation that supports your claim of lost value. This may include property appraisals, tax assessments, and any relevant financial statements. Next, accurately fill out the form, ensuring all information is complete and correct. Once completed, submit the form to the appropriate local tax authority by the specified deadline to ensure your claim is considered.

Steps to complete the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

Completing the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 requires careful attention to detail. Follow these steps:

- Collect supporting documents that demonstrate the loss in value.

- Obtain the latest version of Form 50 767 from your local tax authority.

- Fill out the form, providing accurate information regarding your property and the reasons for the value loss.

- Review the form for completeness and accuracy.

- Submit the form to the appropriate tax office before the deadline.

Key elements of the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

Several key elements must be included in the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767. These elements include:

- Property identification details, including the address and tax identification number.

- A detailed explanation of the circumstances leading to the value loss.

- Supporting documentation, such as appraisals and previous tax assessments.

- Signature of the property owner or authorized representative.

Legal use of the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

The legal use of the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 is essential for property owners seeking tax relief. This form must be completed in accordance with Texas tax laws to ensure its validity. Proper submission can lead to adjustments in property taxes based on the reported value loss, making it a vital tool for compliance and financial management.

Filing Deadlines / Important Dates

Filing deadlines for the Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 are critical to ensure timely processing of your claim. Typically, this form must be submitted by a specific date each year, often coinciding with property tax deadlines. It is essential to check with your local tax authority for the exact dates to avoid penalties or disqualification of your claim.

Quick guide on how to complete report on value lost because of value limitations under tax code chapter 313 form 50 767

Easily Prepare Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Effortlessly Edit and eSign Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

- Find Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which is quick and carries the same legal validity as a traditional handwritten signature.

- Review the details and then press the Done button to save your modifications.

- Choose how you wish to share your form, either via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767 and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct report on value lost because of value limitations under tax code chapter 313 form 50 767

Create this form in 5 minutes!

How to create an eSignature for the report on value lost because of value limitations under tax code chapter 313 form 50 767

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help my business?

airSlate SignNow is a user-friendly eSignature solution that empowers businesses to streamline their document signing process. Companies often find that they have 'texas lost because' of inefficiencies in manual paperwork, but with airSlate SignNow, you can easily send and sign documents electronically, improving your workflows signNowly.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow. The platform uses bank-level encryption and features such as two-factor authentication to protect your documents. Many businesses who mention 'texas lost because' of security bsignNowes have found peace of mind with airSlate SignNow’s robust security measures.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit different business needs. Users often determine that they 'texas lost because' they didn't choose an affordable eSignature solution sooner. Each tier provides unique features, ensuring companies can select an option that best suits their budget.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow offers seamless integration with a variety of third-party applications including Google Drive, Salesforce, and more. Businesses frequently experience 'texas lost because' of disjointed tools, but using airSlate SignNow can unify your document workflows across different platforms.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes equipped with features that enhance document management, including templates, collaborative editing, and real-time tracking. If you've ever thought 'texas lost because' of delayed approvals, these features can drastically speed up the signing process.

-

How can airSlate SignNow improve my team's productivity?

By eliminating the need for physical signatures and manual paperwork, airSlate SignNow can signNowly boost your team's productivity. Many users report feeling that they 'texas lost because' they haven’t implemented eSignatures earlier, as it allows for quicker turnaround times and less administrative burden.

-

Is there a mobile application for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application, allowing users to send and sign documents from anywhere at any time. This mobile functionality helps prevent scenarios where businesses feel like they 'texas lost because' they couldn't act quickly on urgent documents.

Get more for Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

- Vt tenant form

- 30 day notice to terminate written month to month lease where tenant has resided in premises two years or less residential form

- Vt month to month form

- Vt termination 497428846 form

- Vermont notice form

- Vermont verbal 497428848 form

- Relinquishment of minor to agency for adoption vermont form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property vermont form

Find out other Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 Form 50 767

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF