Form 50 767 2018

What is the Form 50 767

The Form 50 767 is a specific document utilized for certain tax-related purposes in the United States. This form is primarily used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). It is essential for ensuring compliance with federal tax regulations and may be required in various situations, such as when claiming deductions or reporting income. Understanding the purpose and requirements of Form 50 767 is crucial for accurate tax reporting.

How to use the Form 50 767

Using Form 50 767 involves several steps to ensure that all necessary information is accurately reported. First, gather all required financial documents, such as income statements and receipts. Next, fill out the form by entering the relevant data in the designated fields. It is important to double-check the information for accuracy before submission. Once completed, the form can be signed electronically or manually, depending on the submission method chosen. Familiarizing oneself with the specific instructions provided with the form can enhance the overall experience and ensure compliance with IRS guidelines.

Steps to complete the Form 50 767

Completing Form 50 767 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, including income statements and previous tax returns.

- Obtain the latest version of Form 50 767 from the IRS or authorized sources.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Enter financial information as required, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- Sign the form electronically or by hand, as applicable.

- Submit the form via the chosen method, whether online, by mail, or in person.

Legal use of the Form 50 767

The legal use of Form 50 767 is governed by IRS regulations and guidelines. It is important to ensure that the form is completed accurately and submitted within the designated timeframes to avoid penalties. The form serves as an official record of the financial information reported to the IRS, and any inaccuracies can lead to legal repercussions. Therefore, individuals and businesses should adhere to all legal requirements associated with the form, including maintaining proper documentation to support the information provided.

Filing Deadlines / Important Dates

Filing deadlines for Form 50 767 are critical to ensure compliance with IRS regulations. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of each year. However, specific circumstances may warrant different deadlines, such as extensions or special provisions for certain taxpayers. It is advisable to keep track of important dates related to tax filings to avoid late submissions, which can result in penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

Form 50 767 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Many taxpayers prefer to submit the form electronically through the IRS website or authorized e-filing services, which can expedite processing.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the instructions.

- In-Person: Some individuals may choose to deliver the form in person to their local IRS office, ensuring immediate confirmation of receipt.

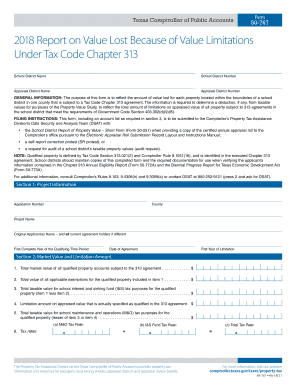

Quick guide on how to complete 2018 report on value lost because of value limitations under tax code chapter 313

Your assistance manual on how to prepare your Form 50 767

If you’re wondering how to create and submit your Form 50 767, here are some quick guidelines to simplify tax processing.

To begin, you simply need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document management solution that enables you to modify, draft, and finalize your tax documents seamlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, returning to edit information as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Form 50 767 in no time:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form 50 767 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in physical form may increase return mistakes and delay refunds. Moreover, before e-filing your taxes, consult the IRS website for declaration rules in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct 2018 report on value lost because of value limitations under tax code chapter 313

Create this form in 5 minutes!

How to create an eSignature for the 2018 report on value lost because of value limitations under tax code chapter 313

How to make an eSignature for the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 in the online mode

How to make an electronic signature for the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 in Chrome

How to generate an electronic signature for putting it on the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 in Gmail

How to create an eSignature for the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 from your smart phone

How to generate an eSignature for the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 on iOS devices

How to create an eSignature for the 2018 Report On Value Lost Because Of Value Limitations Under Tax Code Chapter 313 on Android

People also ask

-

What taxes do Texans not pay?

Taxes That Texas Does Not Levy Texas does not collect a state property tax. Property taxes are levied by local governmental entities, school districts and special purpose districts (see p. 20). Texans pay federal income taxes but not state or local income taxes.

-

What are the tax laws in Texas?

Texas Tax Rates, Collections, and Burdens Texas does not have corporate income tax but does levy a state gross receipts tax. Texas has a 6.25 percent state sales tax rate and an average combined state and local sales tax rate of 8.20 percent.

-

What taxes do I pay in Texas?

Taxes in Texas Income tax: None. Sales tax: 6.25% - 8/25% Property tax: 1.63% average effective rate. Gas tax: 20 cents per gallon of regular gasoline.

-

What are the tax rules in Texas?

Texas Tax Rates, Collections, and Burdens Texas does not have an individual income tax. Texas does not have corporate income tax but does levy a state gross receipts tax. Texas has a 6.25 percent state sales tax rate and an average combined state and local sales tax rate of 8.20 percent.

-

Is Texas a tax friendly state?

Which Are the Tax-Free States? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

-

What is Chapter 313 of the Texas Tax Code?

Texas Economic Development ActTax Code Chapter 313 The minimum limitation value varies by school district. The application for a limitation on the appraised value for M&O purposes is submitted directly to the school district and requires an application fee that is established by each school district.

Get more for Form 50 767

- Palm beach county building department form

- Tupperware party invitation templates form

- Chapter 18 section 1 the national judiciary form

- Form aesthetic intakedocx

- Client consent form for the non legal paternity test

- Dna test form

- Commission on retirement removal and discipline courts mo form

- Scope of service agreement template form

Find out other Form 50 767

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself