Form 50 767 Texas Comptroller of Public Accounts 2014

What is the Form 50 767 Texas Comptroller Of Public Accounts

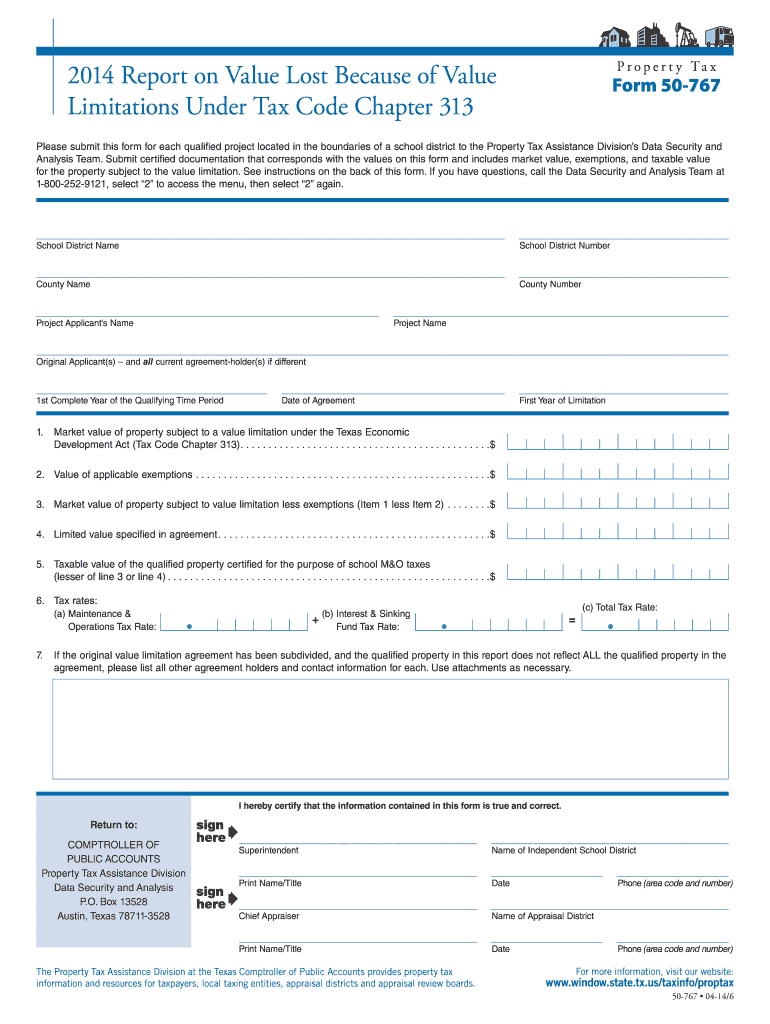

The Form 50 767 is a document issued by the Texas Comptroller of Public Accounts, primarily used for property tax exemption applications. This form is essential for individuals and businesses seeking to claim exemptions on their property taxes, ensuring compliance with state regulations. The form provides a structured way to present necessary information to qualify for various exemptions, such as those for charitable organizations or religious institutions.

How to use the Form 50 767 Texas Comptroller Of Public Accounts

Using the Form 50 767 involves several steps to ensure accurate completion and submission. First, gather all required information, including property details and the specific exemption being claimed. Next, fill out the form carefully, making sure to provide all requested data. After completing the form, review it for accuracy before submission. Once verified, the form can be submitted electronically or via mail, depending on the preferences outlined by the Texas Comptroller's office.

Steps to complete the Form 50 767 Texas Comptroller Of Public Accounts

Completing the Form 50 767 requires a systematic approach:

- Obtain the latest version of the form from the Texas Comptroller's website.

- Read the instructions thoroughly to understand the requirements.

- Fill in the property information, including the address and type of property.

- Provide details regarding the exemption being claimed, including supporting documentation.

- Sign and date the form to certify its accuracy.

- Submit the completed form by the specified deadline.

Legal use of the Form 50 767 Texas Comptroller Of Public Accounts

The legal use of the Form 50 767 is governed by Texas state law, which outlines the eligibility criteria for property tax exemptions. It is crucial for users to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or denial of the exemption. The form must be submitted within the designated time frame to be considered valid, and it is advisable to keep copies of all submitted documents for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 50 767 vary depending on the type of exemption being claimed. Generally, applications for property tax exemptions must be filed by April 30 of the tax year for which the exemption is sought. It is important to stay informed about any changes to deadlines, as these can impact eligibility for exemptions. Checking the Texas Comptroller's website regularly can provide updates on important dates related to property tax exemptions.

Form Submission Methods (Online / Mail / In-Person)

The Form 50 767 can be submitted through various methods, providing flexibility for users. Submissions can be made online via the Texas Comptroller's official website, which offers a streamlined process for electronic filing. Alternatively, completed forms can be mailed to the appropriate office or submitted in person at designated locations. Each submission method has specific guidelines, so it is essential to follow the instructions provided to ensure successful processing.

Quick guide on how to complete form 50 767 texas comptroller of public accounts

Your assistance manual on how to prepare your Form 50 767 Texas Comptroller Of Public Accounts

If you’re eager to learn how to generate and submit your Form 50 767 Texas Comptroller Of Public Accounts, here are some brief guidelines to simplify your tax filing process.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkbox selections, and eSignatures, and revisit to amend responses if required. Enhance your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Form 50 767 Texas Comptroller Of Public Accounts in just a few minutes:

- Establish your account and commence working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; traverse through variants and schedules.

- Select Get form to access your Form 50 767 Texas Comptroller Of Public Accounts in our editor.

- Complete the necessary fillable sections with your data (text entries, figures, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes online with airSlate SignNow. Keep in mind that filing on paper can lead to increased errors and delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 50 767 texas comptroller of public accounts

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How long does it take for Facebook to get back to you after you fill out your account form when you got locked out?

Up to 48 hrs.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the form 50 767 texas comptroller of public accounts

How to create an eSignature for your Form 50 767 Texas Comptroller Of Public Accounts online

How to create an electronic signature for the Form 50 767 Texas Comptroller Of Public Accounts in Chrome

How to generate an electronic signature for putting it on the Form 50 767 Texas Comptroller Of Public Accounts in Gmail

How to make an electronic signature for the Form 50 767 Texas Comptroller Of Public Accounts from your mobile device

How to make an eSignature for the Form 50 767 Texas Comptroller Of Public Accounts on iOS

How to make an electronic signature for the Form 50 767 Texas Comptroller Of Public Accounts on Android OS

People also ask

-

What is Form 50 767 Texas Comptroller Of Public Accounts?

Form 50 767 is a crucial document used by Texas property owners to request an exemption from property taxes. This form is managed by the Texas Comptroller of Public Accounts and helps in ensuring that eligible properties can benefit from tax exemptions. Understanding how to fill out Form 50 767 accurately can lead to signNow savings for property owners.

-

How can airSlate SignNow assist with Form 50 767 Texas Comptroller Of Public Accounts?

airSlate SignNow streamlines the process of completing and signing Form 50 767 Texas Comptroller Of Public Accounts. Our platform allows users to easily fill out the form, electronically sign it, and send it securely to the appropriate parties. This efficiency saves time and reduces the potential for errors in the application process.

-

Is airSlate SignNow cost-effective for processing Form 50 767 Texas Comptroller Of Public Accounts?

Yes, airSlate SignNow offers a cost-effective solution for processing Form 50 767 Texas Comptroller Of Public Accounts. With flexible pricing plans, users can choose an option that suits their budget while benefiting from our range of features. This can make the overall management of property tax exemptions simpler and more affordable.

-

What features does airSlate SignNow provide for Form 50 767 Texas Comptroller Of Public Accounts?

airSlate SignNow provides several features tailored for managing Form 50 767 Texas Comptroller Of Public Accounts, such as document templates, electronic signatures, and real-time tracking. Users can collaborate with others easily and ensure that all steps in the form submission process are followed. Our user-friendly interface makes it seamless for anyone to use.

-

Can airSlate SignNow integrate with other tools for Form 50 767 Texas Comptroller Of Public Accounts?

Yes, airSlate SignNow integrates with a variety of third-party applications that can enhance your experience with Form 50 767 Texas Comptroller Of Public Accounts. Whether you use CRM systems or cloud storage solutions, our integrations facilitate smoother workflows and keep your documentation organized. This ensures that you have a comprehensive toolset at your disposal.

-

What are the benefits of using airSlate SignNow for Form 50 767 Texas Comptroller Of Public Accounts?

Using airSlate SignNow for Form 50 767 Texas Comptroller Of Public Accounts offers numerous benefits, including faster processing times and improved accuracy. Our platform eliminates the need for printing and mailing documents, making the entire process digital and more efficient. Additionally, this helps in reducing the environmental footprint associated with paper documents.

-

Is it easy to learn how to use airSlate SignNow for Form 50 767 Texas Comptroller Of Public Accounts?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to navigate the system for Form 50 767 Texas Comptroller Of Public Accounts. We also provide resources, including tutorials and customer support, to assist users in maximizing their experience. This ensures a smooth onboarding process.

Get more for Form 50 767 Texas Comptroller Of Public Accounts

- 7 day notice to pay rent or lease terminated residential alaska form

- Assignment of deed of trust by individual mortgage holder alaska form

- 24 hours notice form

- Ak lease form

- 5 day notice to tenant of default for nonpayment of utilities residential from landlord to tenant alaska form

- Alaska notice 497293913 form

- 30 day notice to tenant of increase in rent for residential from landlord to tenant alaska form

- Notice to landlord to immediately remedy defect in essential services for residential from tenant to landlord alaska form

Find out other Form 50 767 Texas Comptroller Of Public Accounts

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed