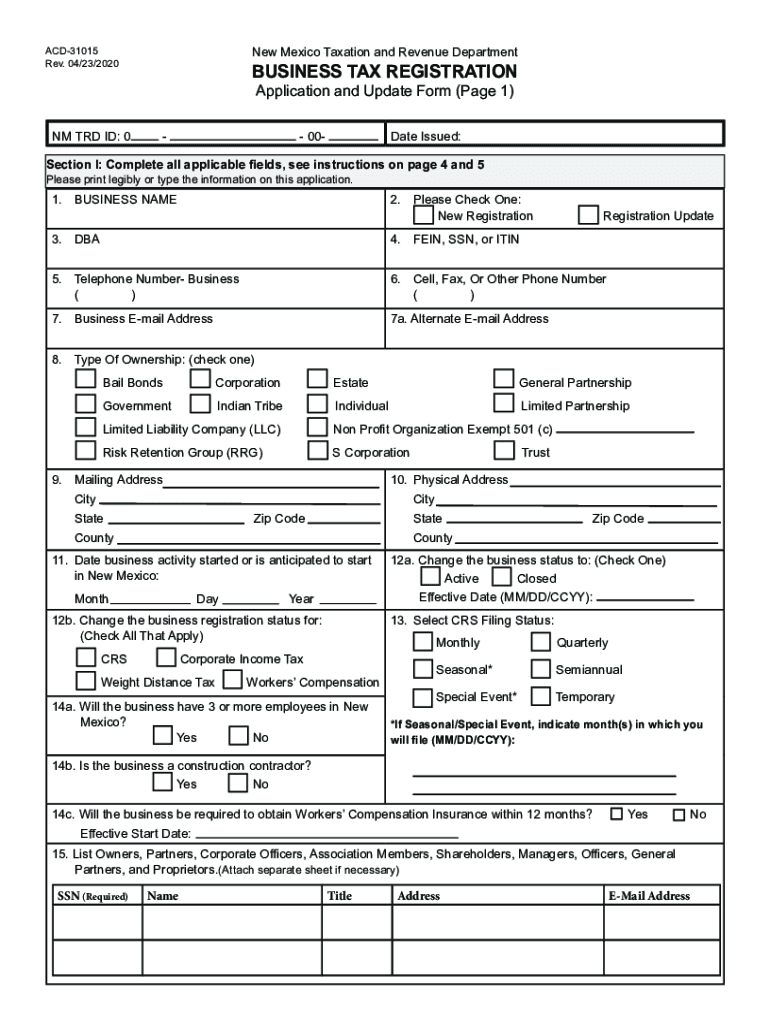

Register Your Business NM Taxation and Revenue Department 2020

What is the Register Your Business NM Taxation And Revenue Department

The Register Your Business form is a crucial document managed by the New Mexico Taxation and Revenue Department. It serves as a formal registration for businesses operating within the state, ensuring compliance with local laws and regulations. This form is essential for various business types, including sole proprietorships, partnerships, and corporations, as it helps establish a legal framework for business operations in New Mexico.

Steps to complete the Register Your Business NM Taxation And Revenue Department

Completing the Register Your Business form requires several key steps to ensure accuracy and compliance. First, gather necessary information about your business, including its legal structure, ownership details, and business address. Next, fill out the form with precise information, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form either online, by mail, or in person at a designated location.

Required Documents

When registering your business with the New Mexico Taxation and Revenue Department, specific documents are required to support your application. These typically include proof of identity, such as a driver's license or passport, and any necessary permits or licenses relevant to your business type. Additionally, if your business is a corporation or LLC, you may need to provide articles of incorporation or organization. Ensuring that all required documents are included will facilitate a smoother registration process.

Form Submission Methods (Online / Mail / In-Person)

The Register Your Business form can be submitted through multiple methods, providing flexibility for business owners. You can complete the registration online through the New Mexico Taxation and Revenue Department's website, which is often the fastest option. Alternatively, you may choose to mail the completed form to the appropriate office or deliver it in person to ensure immediate processing. Each method has its own processing times, so selecting the one that best suits your needs is essential.

Penalties for Non-Compliance

Failure to register your business with the New Mexico Taxation and Revenue Department can lead to significant penalties. Non-compliance may result in fines, back taxes, and potential legal action against the business owner. It is crucial to adhere to registration deadlines and maintain compliance with state regulations to avoid these consequences. Understanding the importance of timely registration can help protect your business from unnecessary complications.

Eligibility Criteria

To register your business in New Mexico, specific eligibility criteria must be met. Generally, any individual or entity planning to conduct business within the state can apply. This includes residents and non-residents alike. However, certain business types may have additional requirements, such as obtaining specific licenses or permits. It is advisable to review the criteria relevant to your business type to ensure successful registration.

Quick guide on how to complete register your business nm taxation and revenue department

Effortlessly Prepare Register Your Business NM Taxation And Revenue Department on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Register Your Business NM Taxation And Revenue Department on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The Easiest Way to Modify and eSign Register Your Business NM Taxation And Revenue Department Seamlessly

- Obtain Register Your Business NM Taxation And Revenue Department and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and is legally equivalent to a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Register Your Business NM Taxation And Revenue Department to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct register your business nm taxation and revenue department

Create this form in 5 minutes!

How to create an eSignature for the register your business nm taxation and revenue department

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is acd 31015 and how does it relate to airSlate SignNow?

The acd 31015 is a specific model number associated with airSlate SignNow's robust eSigning solution. It reflects the platform's focus on delivering easy-to-use, cost-effective document signing features. By utilizing acd 31015, businesses can streamline their document workflows while adhering to compliance standards.

-

What pricing plans are available for acd 31015 users?

airSlate SignNow offers flexible pricing plans tailored for different business needs. Users of acd 31015 can choose from various options, including monthly and annual subscriptions. Each plan is designed to provide essential features while ensuring maximum value for businesses of all sizes.

-

What key features does acd 31015 include?

The acd 31015 model encompasses a variety of essential features such as customizable templates, automated workflows, and real-time document tracking. These tools enable users to complete transactions faster and enhance productivity. The versatility of acd 31015 makes it suitable for various industries.

-

How does acd 31015 benefit businesses?

By implementing the acd 31015 model, businesses can signNowly reduce paper usage and improve document turnaround times. This cost-effective solution not only enhances efficiency but also supports eco-friendly practices. Additionally, the acd 31015 promotes compliance and security in electronic signatures.

-

Can acd 31015 integrate with other software applications?

Yes, the acd 31015 model is designed to seamlessly integrate with a variety of popular software applications such as CRM systems and project management tools. This integration capability allows teams to maintain their existing workflows while benefiting from airSlate SignNow's eSigning features. Enhanced integration options improve overall productivity and collaboration.

-

Is it easy to set up and use acd 31015?

Certainly! The acd 31015 model is user-friendly and easy to set up, requiring minimal technical expertise. The intuitive interface guides users through the document preparation and signing process. This ensures that businesses can quickly adopt and leverage the benefits of airSlate SignNow without extensive training.

-

What types of documents can be signed using acd 31015?

With the acd 31015 solution, businesses can electronically sign a wide range of documents, including contracts, agreements, and forms. The flexibility of airSlate SignNow allows users to customize their document templates for various purposes. This versatility ensures that businesses can meet diverse signing needs efficiently.

Get more for Register Your Business NM Taxation And Revenue Department

- Lead based paint disclosure for rental transaction vermont form

- Notice of lease for recording vermont form

- Vt cover form

- Supplemental residential lease forms package vermont

- Residential landlord tenant rental lease forms and agreements package vermont

- Name change instructions and forms package for an adult vermont

- Vermont name change instructions and forms package for a minor vermont

- Name change instructions and forms package for a family vermont

Find out other Register Your Business NM Taxation And Revenue Department

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application