ACD 31015 STATE of NEW MEXICO TAXATION and RE Intuit 2005

What is the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

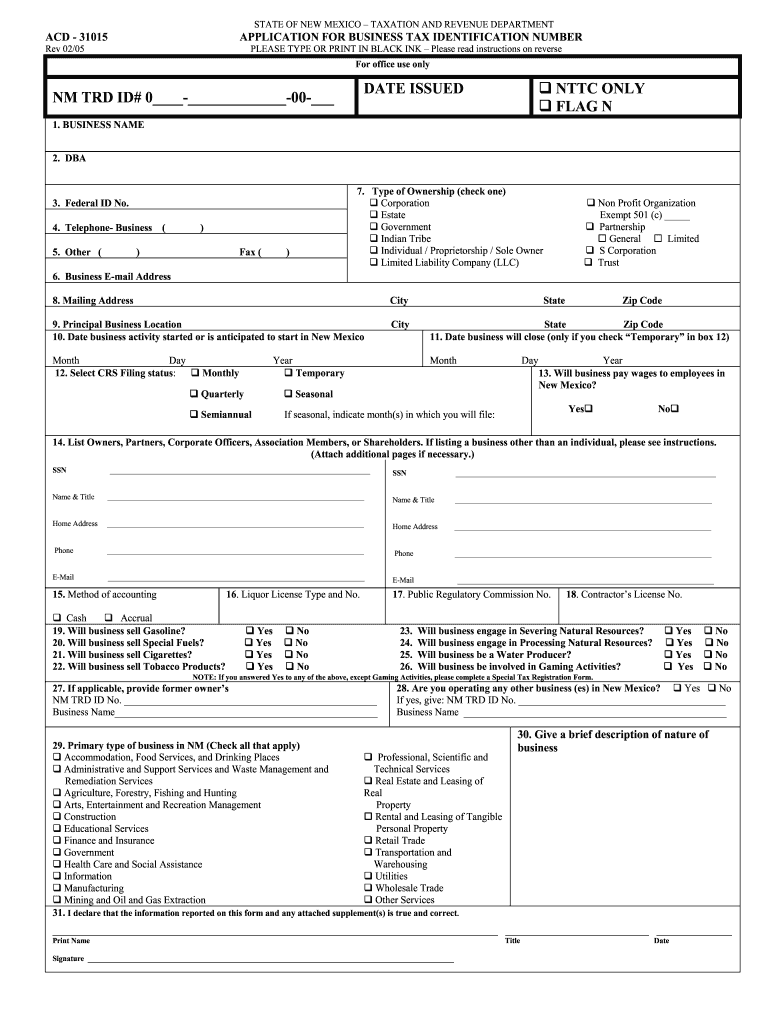

The ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form is a crucial document for taxpayers in New Mexico. It is designed to facilitate the reporting of various tax obligations specific to the state. This form plays an essential role in ensuring compliance with state tax laws and regulations, helping individuals and businesses accurately report their taxable income and deductions. Understanding this form is vital for those who wish to fulfill their tax responsibilities effectively.

Steps to complete the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

Completing the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form involves several important steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to avoid errors that could lead to penalties.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form either online, by mail, or in person, as per your preference.

Legal use of the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

The legal use of the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form is governed by state tax laws. This form must be completed truthfully and accurately to ensure compliance with legal requirements. Misrepresentation or failure to submit the form can result in penalties, including fines or legal action. It is essential for taxpayers to understand their obligations and ensure that the information provided is correct and complete.

Filing Deadlines / Important Dates

Filing deadlines for the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form are critical to avoid penalties. Typically, tax forms must be submitted by April 15 of each year, aligning with federal tax deadlines. However, specific deadlines may vary based on individual circumstances, such as extensions or specific tax situations. Taxpayers should be aware of any changes in deadlines announced by the New Mexico tax authorities to ensure timely filing.

Required Documents

To complete the ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form, several documents are required:

- Income statements, such as W-2s or 1099s, reflecting earnings for the tax year.

- Records of any deductions or credits you plan to claim.

- Previous tax returns for reference and consistency.

- Identification information, including Social Security numbers for all individuals listed on the form.

Form Submission Methods (Online / Mail / In-Person)

The ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New Mexico tax portal, which is often the fastest method.

- Mailing the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices for those who prefer face-to-face interaction.

Quick guide on how to complete acd 31015 state of new mexico taxation and re intuit

Your assistance manual on how to prepare your ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

If you’re curious about how to generate and submit your ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit, here are a few straightforward instructions on how to streamline tax processing.

To begin, you just need to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and revisit to edit responses as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-binding eSignature (if required).

- Double-check your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to return mistakes and delay refunds. Certainly, before e-filing your taxes, confirm the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct acd 31015 state of new mexico taxation and re intuit

FAQs

-

How has being incarcerated affected you? How has coming out of the prison system been, and how difficult has it been to re-enter into society? Do you feel that mass incarceration of African Americans is a new form of slavery?

While I have never been in prison, I have a background working in addictions and with parolees.First things first - Prison as a new form of slavery. Actually, the 14th Amendment constitutionally banning slavery SPECIFICALLY excludes prisoners when it bans ‘hard labor’ and ‘involuntary servitude’. it’s not a new form of slavery - constitutionally its always been there. To this day, there are states which require inmates to work, but don’t pay them. Other states who give inmates something like 60 cents/day for 8 hours of hard work. This is totally legal and consititional.When you ask specifically about African Americans - you may find books like ‘The Rich Get Richer: The Poor Get Prison’ or ‘The New Jim Crow’ contain enlightening information.As to transitioning back into society. The US has one of the highest recidivism rates for numerous reasons. However, this varies by state. Oregon has a fairly low recidivism rate (40% re-arrest rate) - while some states it’s as high as 90%. It all depends on the transitional and re-integration programs available in the state.For an individual, the transition back into society is all dependent on the support they have when they are released.

-

What’s the title of a person who can take a complex Excel spreadsheet and turn it into a user friendly, intuitive form that’s easy to fill out? How can I hire someone with those skills? It contains , financial, quoting & engineering data.

Look for an SaaS developer, someone with JavaScript, PHP, and MySQL skills to create Cloud-hosted browser-based forms and reports who also has a modicum of financial analysis background.Dumping obsolete Excel client server architecture as soon as you can will be the best thing you can do to bring your operation into the 21st Century.

-

If you were the President/PM and/or Senator that oversaw the United States of America and Japan combining to form a nation of 600+ million people, how would you ensure a good transition and how would you like the new culture to turn out?

As someone who has lived in both countries, I simply cannot begin to fatham how the U.S. and Japan would become a single united culture. U.S. and Japanese culture is so far apart in many ways.But, if I HAD to do it, here is how I would do it:First, the government would be modeled after the US government with the same constitution.Second, I would drastically…DRASTICALLY reduce the power of the federal government. Every administrative agency except those involved with law enforcement and tax collection would be gone and all responsibility would go to the states. Basically, we have the FBI, CIA, USCIS, IRS, and the like. We would still have the military as well. I would also etch in the Constitution that this is all the federal government will ever be responsible for: no growth in federal power. The federal government will only be responsible for protecting the God-given freedoms of its citizens (both internally and externally), and that’s it. All other powers will be the responsibility of the state.Third, Japan would be the 51st state.And that’s that. The Japanese will be able to maintain their cultural norms without government interference. At the same time, the rest of America can do the same.

Create this form in 5 minutes!

How to create an eSignature for the acd 31015 state of new mexico taxation and re intuit

How to create an eSignature for your Acd 31015 State Of New Mexico Taxation And Re Intuit in the online mode

How to create an eSignature for your Acd 31015 State Of New Mexico Taxation And Re Intuit in Google Chrome

How to create an eSignature for putting it on the Acd 31015 State Of New Mexico Taxation And Re Intuit in Gmail

How to make an eSignature for the Acd 31015 State Of New Mexico Taxation And Re Intuit straight from your mobile device

How to create an eSignature for the Acd 31015 State Of New Mexico Taxation And Re Intuit on iOS devices

How to create an electronic signature for the Acd 31015 State Of New Mexico Taxation And Re Intuit on Android

People also ask

-

What is ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit?

ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit refers to the regulations and guidelines set by the New Mexico Taxation and Revenue Department regarding electronic signatures and document submissions. Utilizing airSlate SignNow in conjunction with ACD 31015 ensures compliance with state requirements, making it easier for businesses to manage their documentation efficiently.

-

How can airSlate SignNow help with ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit compliance?

airSlate SignNow facilitates compliance with ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit by providing legally binding eSignatures and secure document storage. Our platform ensures that all documents are signed and stored according to state regulations, streamlining your tax-related processes.

-

What features does airSlate SignNow offer for managing ACD 31015 documents?

AirSlate SignNow offers a range of features tailored for ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit, including customizable templates, automated workflows, and real-time tracking of document status. These features make it easier for businesses to manage their tax documents efficiently and in compliance with state laws.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with ACD 31015?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to manage ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit documents. Our pricing plans are designed to fit various business sizes and needs, ensuring that you can access essential eSigning features without overspending.

-

Can airSlate SignNow integrate with other tools for ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit?

Absolutely, airSlate SignNow integrates seamlessly with various tools and software, enhancing your ability to manage ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit documents. Whether you use accounting software or CRM platforms, our integrations streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit?

Using airSlate SignNow for ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit provides numerous benefits, including faster document turnaround times, enhanced security through encrypted eSignatures, and improved compliance with state regulations. This means you can focus on your core business while we handle your documentation needs.

-

How secure is airSlate SignNow for handling ACD 31015 documents?

AirSlate SignNow prioritizes security by providing encryption, secure cloud storage, and compliance with data protection regulations. When managing ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit documents, you can trust that your sensitive information is protected against unauthorized access.

Get more for ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

Find out other ACD 31015 STATE OF NEW MEXICO TAXATION AND RE Intuit

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself