New Mexico Form ACD 31015 Application for Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD 2022-2026

What is the New Mexico Form ACD 31015?

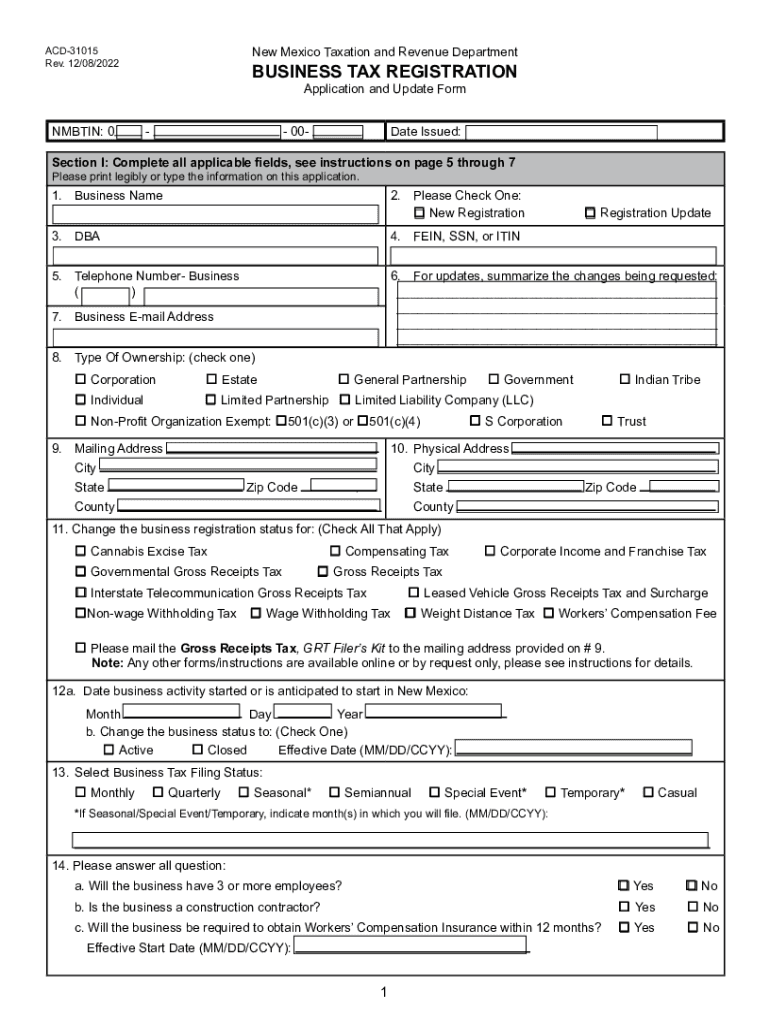

The New Mexico Form ACD 31015 is an application for a business tax identification number, also known as a tax ID. This form is essential for businesses operating in New Mexico as it allows them to comply with state tax regulations. The tax ID is necessary for various business activities, including filing taxes, opening bank accounts, and applying for business licenses. By obtaining this identification number, businesses can ensure they meet the legal requirements set forth by the state of New Mexico.

Steps to Complete the New Mexico Form ACD 31015

Completing the New Mexico Form ACD 31015 involves several straightforward steps:

- Gather necessary information, including your business name, address, and ownership details.

- Provide the type of business entity, such as LLC, corporation, or partnership.

- Fill out the form accurately, ensuring all sections are completed.

- Review the information for any errors or omissions.

- Submit the form through the appropriate method, whether online or by mail.

Following these steps will help ensure a smooth application process for your business tax ID.

Legal Use of the New Mexico Form ACD 31015

The New Mexico Form ACD 31015 is legally binding once completed and submitted. It serves as an official request for a business tax identification number, which is required for compliance with state tax laws. This form must be filled out accurately to avoid any legal issues or delays in processing. Proper use of this form ensures that businesses can operate legally and fulfill their tax obligations in New Mexico.

Eligibility Criteria for the New Mexico Form ACD 31015

To be eligible to submit the New Mexico Form ACD 31015, applicants must meet specific criteria:

- The applicant must be a business entity operating or planning to operate in New Mexico.

- Applicants must provide accurate information regarding their business structure and ownership.

- Businesses must comply with state regulations and be prepared to meet tax obligations.

Ensuring eligibility before submitting the form can help streamline the application process.

Required Documents for the New Mexico Form ACD 31015

When completing the New Mexico Form ACD 31015, specific documents may be required to support your application:

- Proof of business registration, if applicable.

- Identification information for all business owners.

- Any relevant permits or licenses required for your business type.

Having these documents ready can facilitate a smoother application process and help avoid delays.

Form Submission Methods for the New Mexico Form ACD 31015

The New Mexico Form ACD 31015 can be submitted through various methods:

- Online submission via the New Mexico Taxation and Revenue Department website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices, if necessary.

Choosing the right submission method can depend on your business needs and preferences.

Quick guide on how to complete new mexico form acd 31015 application for business tax idnew mexico form acd 31075 business tax registrationnew mexico form acd

Complete New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD with ease

- Find New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD and then click Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD and guarantee clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form acd 31015 application for business tax idnew mexico form acd 31075 business tax registrationnew mexico form acd

Create this form in 5 minutes!

People also ask

-

What is acd 31015 and how does it relate to airSlate SignNow?

The term acd 31015 refers to a specific aspect of our software that enhances document signing functionality. airSlate SignNow incorporates acd 31015 technology to ensure secure and efficient e-signatures. This feature aids businesses in streamlining their document workflows and increasing overall productivity.

-

What are the pricing options for airSlate SignNow with acd 31015 features?

airSlate SignNow offers flexible pricing plans that include features supported by acd 31015. Our plans cater to various business sizes and needs, starting with a basic option for small teams to enterprise-level solutions. Visit our pricing page for detailed information on how each plan incorporates the benefits of acd 31015.

-

What features does airSlate SignNow provide with acd 31015 technology?

With acd 31015, airSlate SignNow includes features such as template creation, in-person signing, and automated workflows. These tools help simplify document management and improve compliance. Additional features such as integrations with popular apps enhance user experience.

-

How does acd 31015 improve the signing process in airSlate SignNow?

acd 31015 improves the signing process by optimizing document handling, ensuring fast and secure e-signatures. This feature minimizes the time spent on paperwork and enhances accuracy. Ultimately, it leads to a more efficient workflow and happier clients.

-

Can airSlate SignNow with acd 31015 integrate with other applications?

Yes, airSlate SignNow fully supports integrations with various applications, enhancing the capabilities of acd 31015. Connect it with CRM platforms, accounting software, and productivity tools for seamless workflow management. These integrations help unite your tools and optimize the signing process.

-

What benefits does the acd 31015 feature bring to businesses?

The acd 31015 feature of airSlate SignNow brings signNow benefits such as cost savings, increased efficiency, and improved customer satisfaction. By automating document processes, businesses can allocate resources more effectively. This leads to higher conversion rates and lower operational costs.

-

Is airSlate SignNow secure when utilizing acd 31015?

Absolutely! airSlate SignNow, powered by acd 31015 technology, prioritizes data security and compliance. We utilize advanced encryption and rigorous security measures to protect your documents, ensuring that signing and storing documents is safe and compliant with industry regulations.

Get more for New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings nevada form

- Nevada letter demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles nevada form

- Nevada repairs 497320651 form

- Nevada notice rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession nevada form

- Letter from tenant to landlord about illegal entry by landlord nevada form

- Letter from landlord to tenant about time of intent to enter premises nevada form

Find out other New Mexico Form ACD 31015 Application For Business Tax IDNew Mexico Form ACD 31075 Business Tax RegistrationNew Mexico Form ACD

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe