I 030 Wisconsin Schedule CC, Request for a Closing 2020

What is the I 030 Wisconsin Schedule CC, Request For A Closing

The I 030 Wisconsin Schedule CC is a form issued by the Wisconsin Department of Revenue. It serves as a request for a closing certificate for fiduciaries. This form is essential for individuals or entities acting in a fiduciary capacity, such as executors or administrators of estates, who need to demonstrate that all tax obligations have been satisfied before the distribution of assets. The Schedule CC provides a formal mechanism for ensuring compliance with state tax laws, thus protecting both the fiduciary and the beneficiaries involved.

Steps to complete the I 030 Wisconsin Schedule CC, Request For A Closing

Completing the I 030 Wisconsin Schedule CC involves several key steps. First, gather all necessary information related to the estate or trust, including financial records, tax returns, and any relevant documentation that supports the request. Next, accurately fill out the form, ensuring all sections are completed, including details about the fiduciary and the estate. It is crucial to review the form for any errors or omissions before submission. Finally, submit the completed form to the Wisconsin Department of Revenue through the appropriate method, whether online, by mail, or in person.

Key elements of the I 030 Wisconsin Schedule CC, Request For A Closing

The I 030 Wisconsin Schedule CC includes several key elements that must be addressed. These elements typically consist of the fiduciary's contact information, the estate or trust name, and a detailed account of the assets and liabilities. Additionally, the form requires a declaration of compliance with all applicable tax obligations. This declaration is vital as it assures the state that all taxes have been paid or arrangements made for payment. Completing these elements accurately is essential for the successful processing of the closing certificate request.

Legal use of the I 030 Wisconsin Schedule CC, Request For A Closing

The legal use of the I 030 Wisconsin Schedule CC is primarily to facilitate the distribution of an estate or trust's assets. By obtaining a closing certificate, fiduciaries can ensure that they are not held liable for any outstanding tax obligations that may arise after the distribution. This form serves as a safeguard, providing legal protection to the fiduciary by confirming that all necessary tax filings have been completed and that any taxes owed have been settled. Understanding the legal implications of this form is crucial for fiduciaries to fulfill their responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

The I 030 Wisconsin Schedule CC can be submitted through various methods, providing flexibility for fiduciaries. The form can be completed and submitted online via the Wisconsin Department of Revenue's e-filing system, which offers a convenient and efficient way to process requests. Alternatively, fiduciaries may choose to print the completed form and submit it by mail to the appropriate address. In-person submissions are also accepted at designated Department of Revenue offices. Each method has its own processing times, so fiduciaries should consider their needs when choosing a submission method.

Filing Deadlines / Important Dates

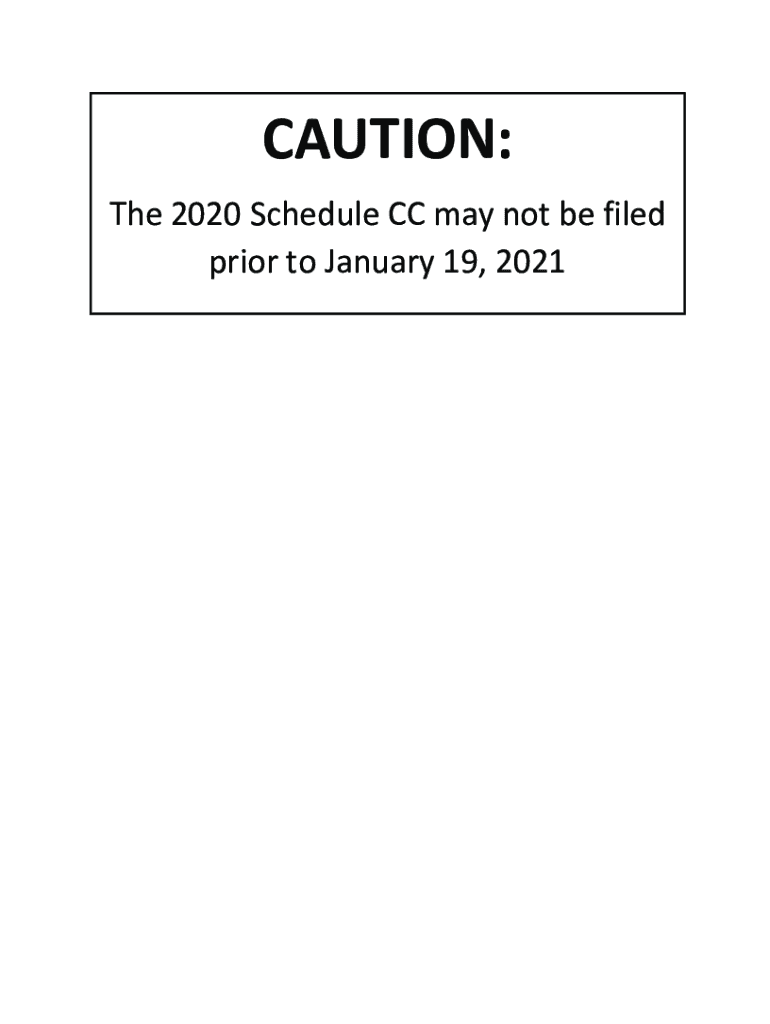

Filing deadlines for the I 030 Wisconsin Schedule CC are critical for fiduciaries to observe. Generally, the request for a closing certificate should be submitted as soon as all tax obligations are met, particularly before the final distribution of assets. While specific deadlines may vary based on individual circumstances, it is advisable to check for any updates from the Wisconsin Department of Revenue regarding important dates related to estate and trust filings. Timely submission helps avoid potential penalties or complications in the distribution process.

Quick guide on how to complete 2020 i 030 wisconsin schedule cc request for a closing

Effortlessly prepare I 030 Wisconsin Schedule CC, Request For A Closing on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage I 030 Wisconsin Schedule CC, Request For A Closing on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign I 030 Wisconsin Schedule CC, Request For A Closing with ease

- Find I 030 Wisconsin Schedule CC, Request For A Closing and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from a device of your preference. Edit and eSign I 030 Wisconsin Schedule CC, Request For A Closing and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 i 030 wisconsin schedule cc request for a closing

Create this form in 5 minutes!

How to create an eSignature for the 2020 i 030 wisconsin schedule cc request for a closing

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Wisconsin Department of Revenue Schedule CC?

The Wisconsin Department of Revenue Schedule CC is a form required for certain tax filers in Wisconsin to report their capital gains and losses. This schedule helps in determining the taxable income from the sale of capital assets. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the Wisconsin Department of Revenue Schedule CC?

airSlate SignNow simplifies the process of eSigning essential documents like the Wisconsin Department of Revenue Schedule CC. Our platform ensures secure and fast document handling, allowing you to focus more on completing your filings rather than getting bogged down with paperwork.

-

Is there a cost involved in using airSlate SignNow for the Wisconsin Department of Revenue Schedule CC?

While using airSlate SignNow for managing your documents associated with the Wisconsin Department of Revenue Schedule CC involves a subscription fee, it remains a cost-effective solution. Our pricing plans offer great value with comprehensive features tailored to meet your business needs.

-

What are the features of airSlate SignNow related to the Wisconsin Department of Revenue Schedule CC?

Key features include secure eSigning, document templates, automated workflows, and integration capabilities. These features enhance the efficiency of handling the Wisconsin Department of Revenue Schedule CC and other essential tax documents.

-

Can I track the status of my Wisconsin Department of Revenue Schedule CC submissions using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Wisconsin Department of Revenue Schedule CC submissions. You’ll receive notifications when your documents are signed and completed, ensuring peace of mind.

-

Are integrations available with airSlate SignNow for the Wisconsin Department of Revenue Schedule CC?

Absolutely! airSlate SignNow offers a range of integrations with popular applications that can enhance your experience while managing the Wisconsin Department of Revenue Schedule CC. This makes it seamless to incorporate eSigning into your existing workflow.

-

What benefits does airSlate SignNow offer for filing the Wisconsin Department of Revenue Schedule CC?

Using airSlate SignNow provides numerous benefits such as enhanced efficiency, reduced paper waste, and improved compliance with state regulations. It streamlines the filing process for the Wisconsin Department of Revenue Schedule CC, ensuring you meet deadlines without hassle.

Get more for I 030 Wisconsin Schedule CC, Request For A Closing

- Satisfaction release or cancellation of mortgage by corporation vermont form

- Satisfaction release or cancellation of mortgage by individual vermont form

- Partial release of property from mortgage for corporation vermont form

- Partial release of property from mortgage by individual holder vermont form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy vermont form

- Warranty deed for parents to child with reservation of life estate vermont form

- Warranty deed for separate or joint property to joint tenancy vermont form

- Warranty deed for separate property of one spouse to both as joint tenants vermont form

Find out other I 030 Wisconsin Schedule CC, Request For A Closing

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy