Sch S Supplemental Sechedule Rev 7 20 If You Have Income that is Not Taxed or Included on Your Federal Return but is Taxable to 2020

Understanding the Kansas Schedule S Supplemental Form

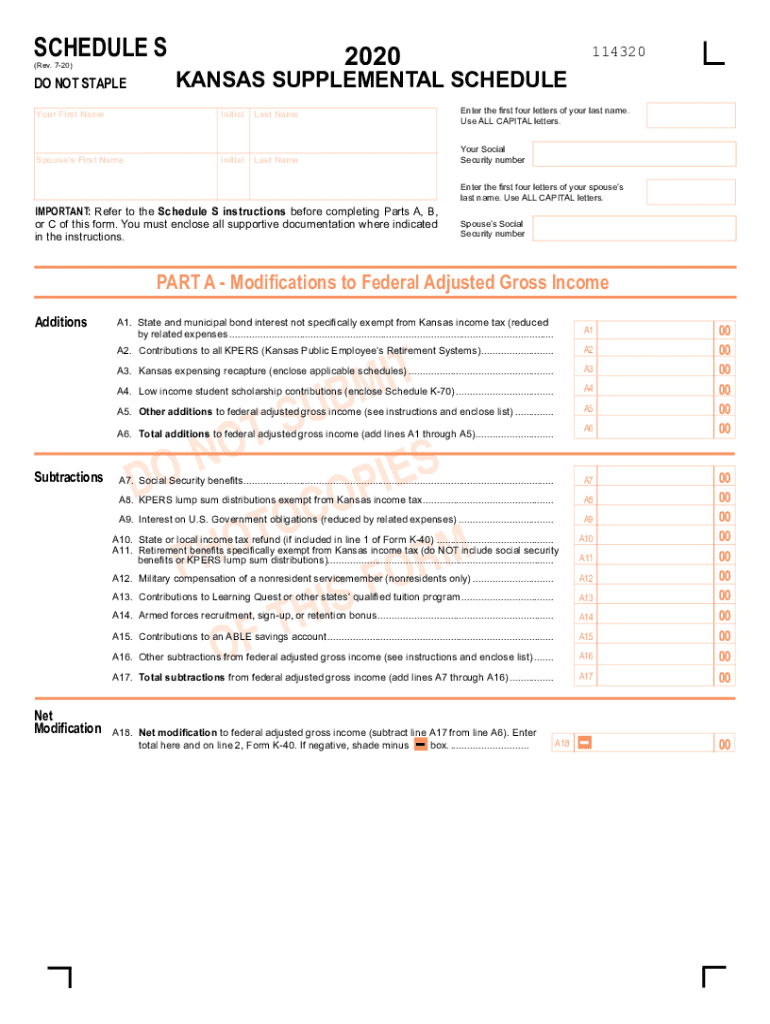

The Kansas Schedule S is a supplemental tax form used by individuals who have income not taxed or included on their federal return but is taxable to Kansas. This form is particularly relevant for those filing as nonresidents or part-year residents. Completing the Schedule S is essential to ensure accurate reporting of income and compliance with Kansas tax laws.

Steps to Complete the Kansas Schedule S

Completing the Kansas Schedule S involves several key steps:

- Gather all necessary documents, including your federal tax return and any records of income that is taxable to Kansas.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report any income that is not included on your federal return but is taxable in Kansas. This may include certain types of interest, dividends, or other income sources.

- Calculate your total taxable income for Kansas and ensure all figures are accurate.

- Review the completed form for any errors before submission.

Legal Use of the Kansas Schedule S

The Kansas Schedule S is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies may lead to penalties or audits. Using a reliable eSignature solution can further validate the submission process, ensuring compliance with legal standards.

Obtaining the Kansas Schedule S Form

The Kansas Schedule S form can be obtained from the Kansas Department of Revenue's website. It is available in a printable format, allowing taxpayers to fill it out by hand or electronically. Ensure you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines for the Kansas Schedule S

It is crucial to adhere to filing deadlines for the Kansas Schedule S to avoid penalties. Typically, the form is due on the same date as your federal tax return. For most individuals, this means the deadline is April 15. However, if you are filing as a nonresident or part-year resident, be sure to check for any specific deadlines that may apply to your situation.

Examples of Income Reported on the Kansas Schedule S

Common examples of income that may need to be reported on the Kansas Schedule S include:

- Interest income from municipal bonds not taxed federally.

- Income from partnerships or S corporations that is not included on the federal return.

- Certain types of capital gains that may be taxable to Kansas.

Quick guide on how to complete sch s supplemental sechedule rev 7 20 if you have income that is not taxed or included on your federal return but is taxable to

Effortlessly Prepare Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To on any device using airSlate SignNow's Android or iOS applications and enhance your document-centered workflow today.

Steps to Edit and eSign Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To with Ease

- Find Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To and click Get Form to begin.

- Utilize the tools we offer to complete your template.

- Emphasize critical sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to submit your document, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiring form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sch s supplemental sechedule rev 7 20 if you have income that is not taxed or included on your federal return but is taxable to

Create this form in 5 minutes!

How to create an eSignature for the sch s supplemental sechedule rev 7 20 if you have income that is not taxed or included on your federal return but is taxable to

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the Kansas Schedule S printable form?

The Kansas Schedule S printable form is a tax document used by businesses to report specific income and deductions in Kansas. It helps taxpayers calculate their eligibility for certain tax benefits. You can easily access and print the Kansas Schedule S form through our platform.

-

How can I download the Kansas Schedule S printable form?

You can download the Kansas Schedule S printable form directly from our airSlate SignNow platform. Simply search for 'Kansas Schedule S printable' and follow the prompts to download and print the form easily, ensuring you have the latest version.

-

Is there a cost associated with accessing the Kansas Schedule S printable form?

Accessing the Kansas Schedule S printable form through airSlate SignNow is free. Our platform allows you to download, fill out, and eSign documents without any fees, making it a cost-effective solution for managing your tax forms.

-

Can I eSign the Kansas Schedule S printable form on airSlate SignNow?

Yes! Our platform allows you to eSign the Kansas Schedule S printable form conveniently. After filling out the form, you can use our eSignature feature to sign it electronically, saving you time and hassle.

-

What features does airSlate SignNow offer for Kansas Schedule S printable forms?

airSlate SignNow offers several features for handling Kansas Schedule S printable forms, including document editing, eSigning, and secure sharing. These features facilitate quick and efficient document management, ensuring compliance with Kansas tax regulations.

-

Are there any integration options for using Kansas Schedule S printable forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to manage your Kansas Schedule S printable forms with your preferred software. This integration enhances workflow efficiency by linking your document management with other essential tools.

-

What are the benefits of using airSlate SignNow for Kansas Schedule S printable forms?

Using airSlate SignNow for your Kansas Schedule S printable forms streamlines the process of document management. It enhances accessibility, offers time-saving eSigning capabilities, and ensures compliance with state regulations, making tax filing simpler and more efficient.

Get more for Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To

- Quitclaim deed from an individual to a trust washington form

- Washington warranty deed 497429302 form

- Judgment summary washington form

- Washington affidavit form

- Agreement to provide renovation services to church washington form

- Quitclaim deed from husband and wife to two individuals washington form

- Washington special deed form

- Washington motion form

Find out other Sch S Supplemental Sechedule Rev 7 20 If You Have Income That Is Not Taxed Or Included On Your Federal Return But Is Taxable To

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later