Kansas K 40 Form pdfFiller Comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank 2021

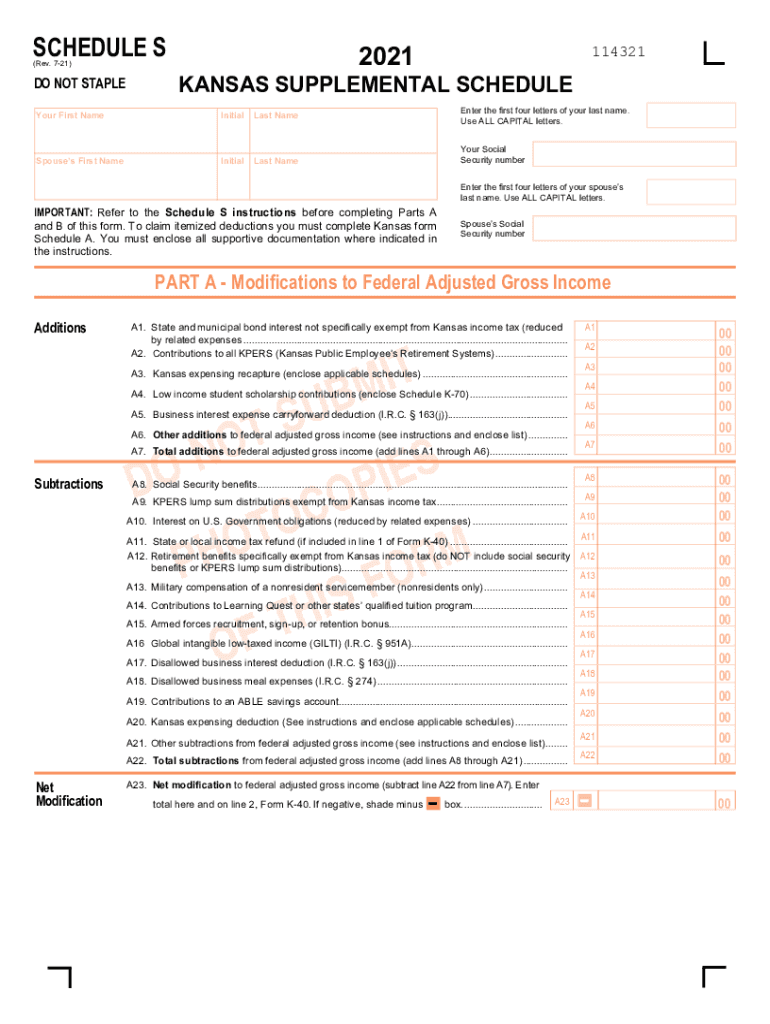

Understanding the Kansas Schedule S Form

The Kansas Schedule S form is a critical document used for reporting income and deductions for individuals who are filing their state taxes in Kansas. This form allows taxpayers to detail their income from various sources, including wages, dividends, and interest, as well as to claim deductions that may reduce their taxable income. Understanding the components of the Kansas Schedule S form is essential for accurate tax reporting and compliance with state regulations.

Key Elements of the Kansas Schedule S Form

The Kansas Schedule S form includes several key elements that taxpayers must complete. These elements typically encompass:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Sources: Taxpayers must report various income sources, including wages, business income, and investment earnings.

- Deductions: The form allows for specific deductions, such as those for retirement contributions and certain business expenses.

- Tax Calculation: The form guides users through calculating their total tax liability based on the reported income and deductions.

Steps to Complete the Kansas Schedule S Form

Completing the Kansas Schedule S form involves several straightforward steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and records of deductible expenses.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately list all income sources in the designated sections of the form.

- Claim Deductions: Include any applicable deductions to reduce your taxable income.

- Calculate Tax: Follow the instructions to compute your total tax liability based on the reported figures.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

Filing Deadlines for the Kansas Schedule S Form

It is important to be aware of the filing deadlines associated with the Kansas Schedule S form. Typically, the form must be submitted by April 15 of the tax year, aligning with the federal tax filing deadline. Taxpayers should also consider any extensions that may apply, ensuring that they adhere to state regulations to avoid penalties.

Legal Use of the Kansas Schedule S Form

The Kansas Schedule S form is legally recognized for state tax purposes. To ensure compliance, taxpayers must follow the guidelines set forth by the Kansas Department of Revenue. Accurate completion and timely submission of the form help avoid potential legal issues, including penalties for non-compliance. It is advisable to retain copies of submitted forms and supporting documents for future reference.

Digital vs. Paper Version of the Kansas Schedule S Form

Taxpayers have the option to complete the Kansas Schedule S form either digitally or on paper. The digital version offers the convenience of online filing, which can streamline the process and reduce the potential for errors. Conversely, some individuals may prefer the traditional paper method. Regardless of the chosen format, it is essential to ensure that all information is accurate and complete before submission.

Quick guide on how to complete kansas k 40 formpdffillercomenfeatures2020 form ks dor k 40 fill online printable fillable blank

Complete Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank effortlessly

- Obtain Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Select important portions of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas k 40 formpdffillercomenfeatures2020 form ks dor k 40 fill online printable fillable blank

Create this form in 5 minutes!

How to create an eSignature for the kansas k 40 formpdffillercomenfeatures2020 form ks dor k 40 fill online printable fillable blank

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an e-signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Kansas Schedule S form?

The Kansas Schedule S form is a tax document used by individuals who need to report income from pass-through entities in Kansas. It is essential for calculating the state income tax accurately, ensuring that you comply with Kansas tax regulations.

-

How can airSlate SignNow help with the Kansas Schedule S form?

airSlate SignNow provides a platform to easily fill out, sign, and send the Kansas Schedule S form electronically. This streamlines the process, making it more efficient and reducing the risk of errors commonly associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the Kansas Schedule S form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including personal and business plans. These plans provide access to features that simplify managing documents like the Kansas Schedule S form, ensuring you get the most value for your investment.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow provides features such as template creation, document tracking, eSignature, and secure cloud storage. These features ensure that your Kansas Schedule S form is not only completed accurately but also stored securely for easy access later.

-

Can I integrate airSlate SignNow with other software for managing the Kansas Schedule S form?

Absolutely! airSlate SignNow offers integration with various third-party applications like Google Drive, Salesforce, and more. This enables you to manage your Kansas Schedule S form and other documents seamlessly within your existing workflows.

-

Are there any benefits to using airSlate SignNow for my Kansas Schedule S form?

Using airSlate SignNow for your Kansas Schedule S form provides multiple benefits, including time savings, enhanced accuracy, and the convenience of electronic signatures. This results in a more streamlined process, allowing you to focus on other important tasks while ensuring compliance.

-

How secure is airSlate SignNow when handling sensitive tax documents like the Kansas Schedule S form?

airSlate SignNow prioritizes security with features like bank-level encryption and secure user authentication. Your Kansas Schedule S form and other sensitive documents are protected, ensuring confidentiality and compliance with regulations.

Get more for Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank

- Colorado violating form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497299932 form

- 3 day notice of termination of residential rental agreement due to violent criminal act or drug related felony colorado form

- 3 day termination notice due to repeated breach of specific provisions of residential rental agreement colorado form

- Limited liability company 497299936 form

- Request for satisfaction of lien by individual colorado form

- Request for satisfaction of lien by corporation or llc colorado form

- Colorado satisfaction form

Find out other Kansas k 40 form pdffiller comenfeatures2020 Form KS DoR K 40 Fill Online, Printable, Fillable, Blank

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast