Pit It1040 Booklet PDF Ohio Department of Taxation 2022-2026

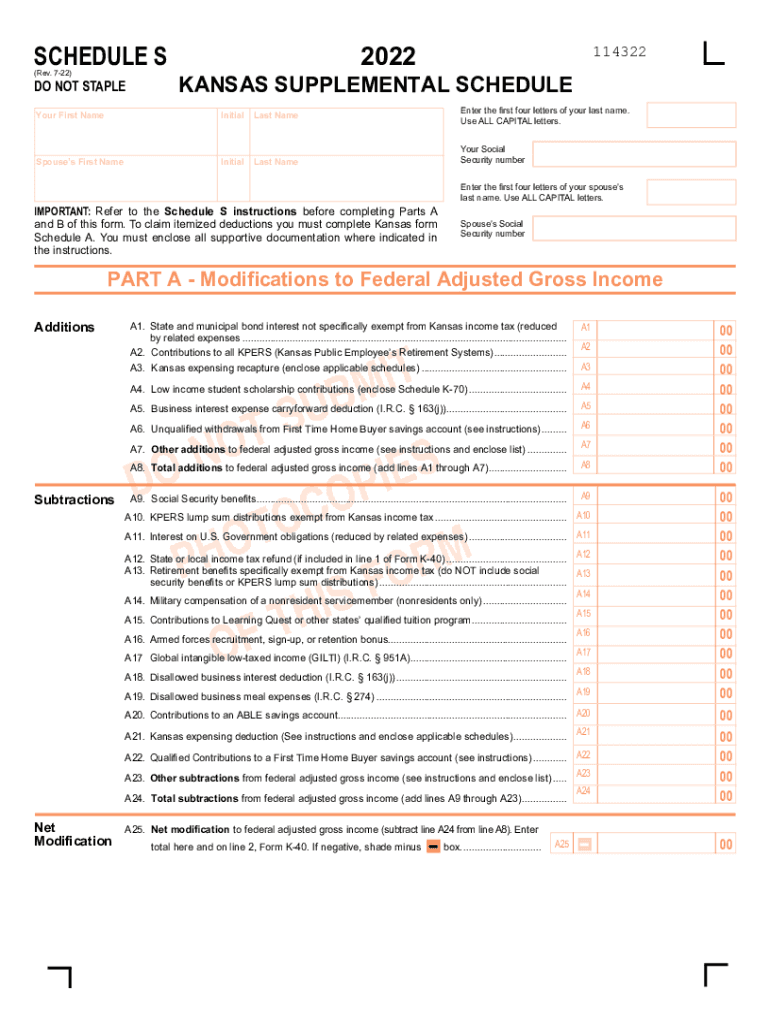

What is the Schedule S Form?

The Schedule S form is a supplemental tax form used primarily in Kansas. It allows taxpayers to report income, deductions, and credits that are not included on the standard tax return. This form is essential for individuals who have specific types of income or deductions that require additional detail. Understanding the purpose of the Schedule S form is crucial for accurate tax reporting and compliance with state tax laws.

Steps to Complete the Schedule S Form

Filling out the Schedule S form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Begin by entering your personal information at the top of the form, such as your name, address, and Social Security number.

- Report your income sources in the designated sections, ensuring that all amounts are accurate and properly categorized.

- Complete the deductions section, making sure to include any eligible expenses that can reduce your taxable income.

- Review your entries for accuracy before signing and dating the form.

Required Documents for the Schedule S Form

To accurately complete the Schedule S form, certain documents are necessary. These may include:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work, showing additional income.

- Receipts or documentation for any deductible expenses claimed.

- Previous year’s tax return for reference and consistency.

Filing Deadlines for the Schedule S Form

It is important to be aware of the filing deadlines associated with the Schedule S form. Typically, the due date aligns with the standard tax return deadline, which is April 15th for most taxpayers. However, if you require an extension, you may file for an extension to submit your tax return, including the Schedule S form. Always check for any updates or changes to deadlines each tax year.

Penalties for Non-Compliance with the Schedule S Form

Failure to file the Schedule S form or inaccuracies in reporting can lead to penalties. These may include:

- Fines for late filing or underreporting income.

- Interest on unpaid taxes, which accrues over time.

- Potential audits by the state tax authority if discrepancies are found.

Digital vs. Paper Version of the Schedule S Form

Taxpayers have the option to complete the Schedule S form either digitally or on paper. The digital version offers benefits such as automatic calculations and easier submission through e-filing platforms. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately reported.

Quick guide on how to complete pit it1040 bookletpdf ohio department of taxation

Effortlessly Prepare Pit it1040 booklet pdf Ohio Department Of Taxation on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, allowing you to acquire the necessary form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Pit it1040 booklet pdf Ohio Department Of Taxation on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Pit it1040 booklet pdf Ohio Department Of Taxation with Ease

- Locate Pit it1040 booklet pdf Ohio Department Of Taxation and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Pit it1040 booklet pdf Ohio Department Of Taxation and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pit it1040 bookletpdf ohio department of taxation

Create this form in 5 minutes!

How to create an eSignature for the pit it1040 bookletpdf ohio department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Kansas Schedule S Form?

The 2023 Kansas Schedule S Form is used by individuals and businesses in Kansas to report their income from partnerships and S corporations. This form is essential for accurately filing your state taxes and ensuring compliance with Kansas tax regulations.

-

How can airSlate SignNow help with the 2023 Kansas Schedule S Form?

airSlate SignNow provides an intuitive platform for preparing and sending the 2023 Kansas Schedule S Form. Our solution allows users to easily fill out, sign, and share the form electronically, simplifying the tax filing process for both individuals and businesses.

-

Is there a cost associated with using airSlate SignNow for the 2023 Kansas Schedule S Form?

Yes, while airSlate SignNow offers various pricing plans, we provide affordable options tailored for different user needs. Investing in our service to manage the 2023 Kansas Schedule S Form will save you time and enhance the accuracy of your tax filings.

-

What features does airSlate SignNow offer for handling the 2023 Kansas Schedule S Form?

Our platform includes features such as document templates, electronic signatures, and secure cloud storage, all of which are beneficial for filing the 2023 Kansas Schedule S Form. You can collaborate with others, track document status, and ensure compliance effortlessly.

-

Can I integrate airSlate SignNow with other tools for my 2023 Kansas Schedule S Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and many others, making it easier to manage your documents, including the 2023 Kansas Schedule S Form, within your preferred work environment.

-

How does airSlate SignNow ensure the security of my 2023 Kansas Schedule S Form?

We prioritize data security, implementing advanced encryption and compliance protocols to protect your information. Using airSlate SignNow for the 2023 Kansas Schedule S Form ensures that your sensitive data is handled securely throughout the signing and submission process.

-

What benefits will I experience when using airSlate SignNow for my 2023 Kansas Schedule S Form?

By using airSlate SignNow, you gain the benefit of a streamlined, user-friendly experience for managing your 2023 Kansas Schedule S Form. Our solution decreases the likelihood of errors, reduces the time spent on tax preparation, and provides convenience through electronic signatures.

Get more for Pit it1040 booklet pdf Ohio Department Of Taxation

- Executors deed of distribution individual executor to individual beneficiary texas form

- Texas homestead form

- Quitclaim deed from corporation to husband and wife texas form

- Warranty deed from corporation to husband and wife texas form

- Texas warranty form

- Oil gas and mineral deed from an individual to a corporation texas form

- Limited liability company corporation form

- Oil gas and mineral deed from trust to an individual sale of interest single trustee texas form

Find out other Pit it1040 booklet pdf Ohio Department Of Taxation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document