DOR Tax Forms in Gov 2019

Understanding the DOR Tax Forms IN gov

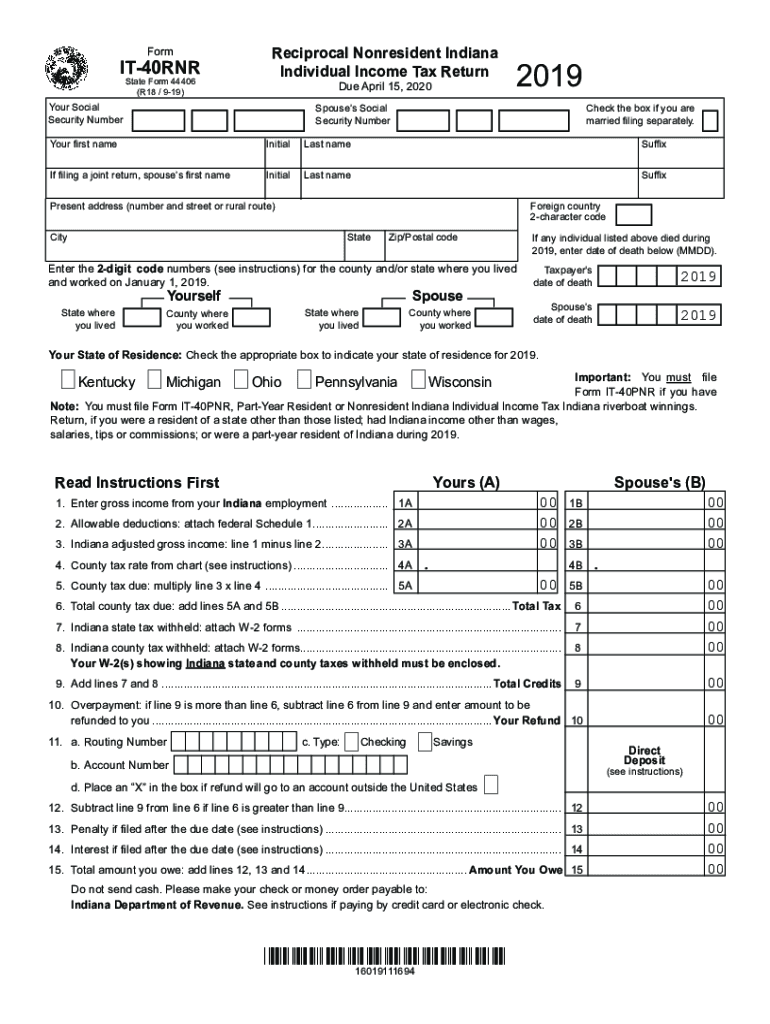

The Indiana Department of Revenue (DOR) provides various tax forms essential for residents and businesses in the state. These forms facilitate the reporting of income, property, and other tax obligations. The DOR tax forms are designed to ensure compliance with state tax laws and regulations, making them crucial for accurate tax filing. Familiarity with these forms helps taxpayers navigate their obligations efficiently.

Steps to Complete the DOR Tax Forms IN gov

Completing the DOR tax forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, download the appropriate form, such as the Indiana IT-40RNR, from the DOR website. Carefully read the instructions provided with the form, as they outline specific requirements for completion. Fill out the form accurately, ensuring all information is correct. Finally, review the completed form for any errors before submitting it.

Required Documents for DOR Tax Forms IN gov

When preparing to complete the DOR tax forms, certain documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of deductions and credits

- Previous year’s tax return

- Proof of residency, if applicable

Having these documents ready will streamline the process and help ensure that all required information is accurately reported.

Form Submission Methods for DOR Tax Forms IN gov

Taxpayers can submit the DOR tax forms through various methods. The most common submission methods include:

- Online: Many forms can be submitted electronically via the DOR's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate DOR address.

- In-Person: Taxpayers may also visit DOR offices to submit forms directly.

Choosing the right submission method depends on personal preference and the specific requirements of the form being filed.

Legal Use of the DOR Tax Forms IN gov

The DOR tax forms are legally binding documents used to report tax information to the state of Indiana. Proper completion and submission of these forms are essential to comply with state tax laws. Failure to submit the required forms can result in penalties, including fines or interest on unpaid taxes. Understanding the legal implications of these forms helps taxpayers fulfill their obligations while avoiding potential legal issues.

Filing Deadlines for DOR Tax Forms IN gov

Filing deadlines for DOR tax forms are crucial for compliance. Typically, individual income tax returns, including the Indiana IT-40RNR, are due on April 15. However, taxpayers should verify specific deadlines each year, as they may change or be extended in certain circumstances. Staying informed about these dates helps ensure timely submission and avoids penalties for late filing.

Quick guide on how to complete dor tax forms ingov

Complete DOR Tax Forms IN gov seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without any holdups. Manage DOR Tax Forms IN gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign DOR Tax Forms IN gov effortlessly

- Obtain DOR Tax Forms IN gov and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign DOR Tax Forms IN gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor tax forms ingov

Create this form in 5 minutes!

How to create an eSignature for the dor tax forms ingov

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the form it 40 rnr?

The form it 40 rnr is a tax document used by individuals seeking to report and reconcile certain refund claims. With airSlate SignNow, you can easily fill out and eSign your form it 40 rnr without any hassle, ensuring accuracy and compliance.

-

How does airSlate SignNow simplify the process of completing form it 40 rnr?

airSlate SignNow streamlines the completion of form it 40 rnr by providing a user-friendly interface. You can quickly upload, fill, and review the document from any device, making it easier than ever to manage your tax documentation.

-

Is airSlate SignNow cost-effective for handling the form it 40 rnr?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for businesses and individuals needing to manage documents like the form it 40 rnr. With affordable subscription options, you can enjoy a suite of features without breaking the bank.

-

What features of airSlate SignNow support the completion of form it 40 rnr?

airSlate SignNow offers several robust features to support the completion of form it 40 rnr, including eSignature capabilities, customizable templates, and compliance tracking. These features ensure that your tax documents are completed correctly and securely.

-

Can I integrate airSlate SignNow with other software for filing form it 40 rnr?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it convenient to manage and file your form it 40 rnr alongside other business tools. This integration enhances productivity by reducing the need to switch between multiple platforms.

-

What are the benefits of using airSlate SignNow for form it 40 rnr?

By using airSlate SignNow for your form it 40 rnr, you benefit from enhanced security, ease of use, and faster processing times. The platform's intuitive design helps you complete and submit your documents more efficiently, saving you time and reducing stress.

-

Is there customer support available for issues related to form it 40 rnr?

Yes, airSlate SignNow provides robust customer support to assist you with any issues related to form it 40 rnr. Their dedicated support team is available via chat, email, and phone to ensure you get the help you need quickly.

Get more for DOR Tax Forms IN gov

Find out other DOR Tax Forms IN gov

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast