Payments in Lieu of Taxes 2022-2026

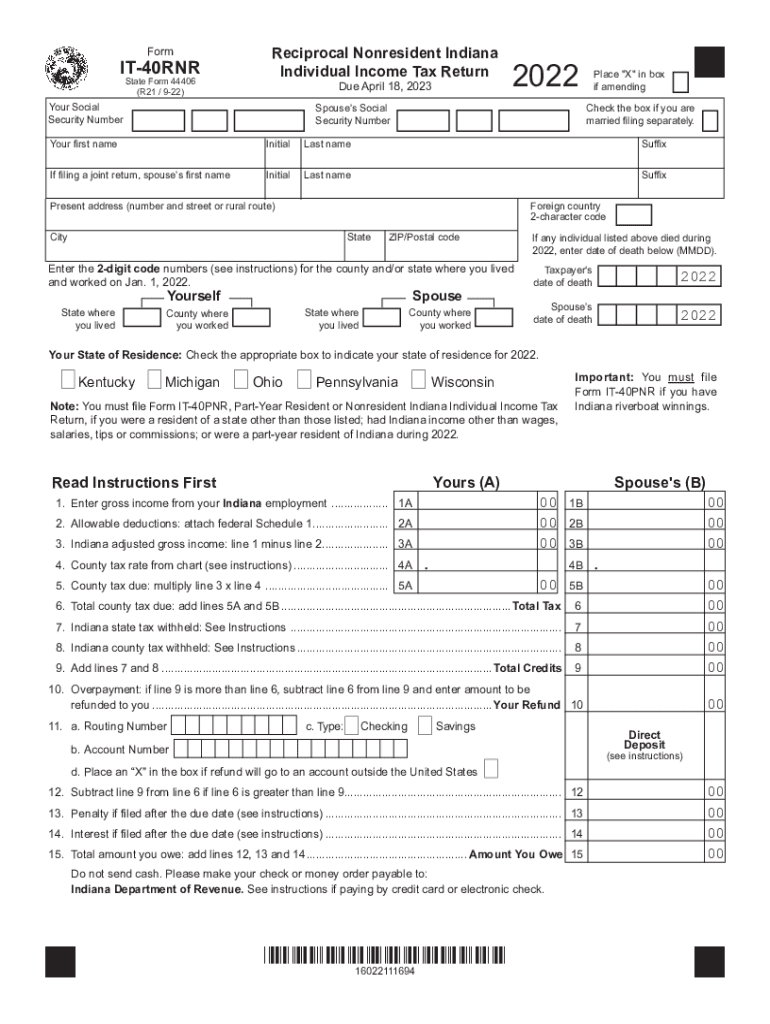

What is the IT-40RNR Form?

The IT-40RNR form is the Indiana nonresident tax return used by individuals who earn income in Indiana but do not reside in the state. This form allows nonresidents to report their income sourced from Indiana and calculate the appropriate tax liability. It is essential for ensuring compliance with Indiana state tax laws while providing a clear process for nonresidents to fulfill their tax obligations.

Steps to Complete the IT-40RNR Form

Completing the IT-40RNR form involves several key steps:

- Gather necessary documents, including W-2s and 1099s that report Indiana-sourced income.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned in Indiana on the appropriate lines of the form.

- Calculate your tax liability based on Indiana tax rates and any applicable credits.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IT-40RNR form to avoid penalties. Typically, the form must be filed by April 15 of the year following the tax year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates or changes to deadlines that may occur.

Required Documents for IT-40RNR Filing

When preparing to file the IT-40RNR form, ensure you have the following documents ready:

- W-2 forms from Indiana employers.

- 1099 forms for any freelance or contract work performed in Indiana.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return, if applicable, for reference.

Penalties for Non-Compliance

Failing to file the IT-40RNR form on time can result in penalties and interest on any unpaid tax. The state of Indiana imposes a late filing penalty, which can accumulate over time. It is important to file the form accurately and on time to avoid these financial consequences.

Digital vs. Paper Version of the IT-40RNR Form

The IT-40RNR form can be completed and submitted either digitally or via paper. The digital version offers the convenience of online filing, which can streamline the process and reduce the risk of errors. In contrast, the paper version requires mailing the completed form to the appropriate Indiana tax office. Consider your preferences and resources when choosing the method of submission.

Quick guide on how to complete payments in lieu of taxes

Complete Payments In Lieu Of Taxes seamlessly on any device

Online document management has gained signNow traction among companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without interruptions. Manage Payments In Lieu Of Taxes on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Payments In Lieu Of Taxes effortlessly

- Find Payments In Lieu Of Taxes and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere moments and holds the same legal authority as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Payments In Lieu Of Taxes and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payments in lieu of taxes

Create this form in 5 minutes!

How to create an eSignature for the payments in lieu of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 40rnr and how does it relate to airSlate SignNow?

The term 'it 40rnr' refers to a specific document management solution that can streamline your workflow. airSlate SignNow offers a comprehensive platform that enables businesses to easily send and eSign documents. By incorporating 'it 40rnr', users can enhance their efficiency in processing documents.

-

What are the pricing options for airSlate SignNow's it 40rnr features?

airSlate SignNow provides various pricing plans tailored to different business needs and usage levels of its 'it 40rnr' functionalities. These plans are designed to be cost-effective while ensuring that businesses have access to all the necessary features. You can choose a suitable plan based on your document management requirements.

-

What features does airSlate SignNow offer for it 40rnr users?

airSlate SignNow includes essential features for 'it 40rnr' users such as customizable templates, real-time tracking, and secure cloud storage. These features allow for a seamless document management experience, ensuring that users can efficiently eSign and send documents. Additionally, the platform supports a user-friendly interface to enhance productivity.

-

What benefits can businesses expect from using airSlate SignNow with it 40rnr?

Using airSlate SignNow in conjunction with 'it 40rnr' provides businesses with a range of benefits, including increased speed in document signing and improved collaboration among team members. This combination not only saves time but also reduces the likelihood of errors in document processing. Ultimately, it leads to more efficient business operations.

-

Can airSlate SignNow's it 40rnr functionalities integrate with other software?

Yes, airSlate SignNow's 'it 40rnr' functionalities can integrate seamlessly with various third-party applications like CRM systems, project management tools, and cloud storage solutions. This flexibility allows businesses to enhance their existing workflows without major disruptions. Integration helps in optimizing overall efficiency in document handling.

-

Is airSlate SignNow secure for managing sensitive documents in it 40rnr?

Absolutely, airSlate SignNow prioritizes the security of sensitive documents within its 'it 40rnr' features. The platform employs advanced encryption protocols to protect data at rest and in transit. Businesses can confidently use airSlate SignNow for signing and sending critical documents, knowing that their information is secure.

-

How can I get started with airSlate SignNow and it 40rnr?

Getting started with airSlate SignNow and utilizing its 'it 40rnr' capabilities is simple. You can sign up for a free trial on the website, which allows you to explore all features. After familiarizing yourself with the platform, you can choose a subscription plan that fits your business requirements.

Get more for Payments In Lieu Of Taxes

- Living trust for individual who is single divorced or widow or widower with children tennessee form

- Living trust for husband and wife with one child tennessee form

- Tennessee trust 497326936 form

- Amendment to living trust tennessee form

- Living trust property record tennessee form

- Financial account transfer to living trust tennessee form

- Assignment to living trust tennessee form

- Notice of assignment to living trust tennessee form

Find out other Payments In Lieu Of Taxes

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document