Place 'X' in Box 2020

What is the Place 'X' In Box

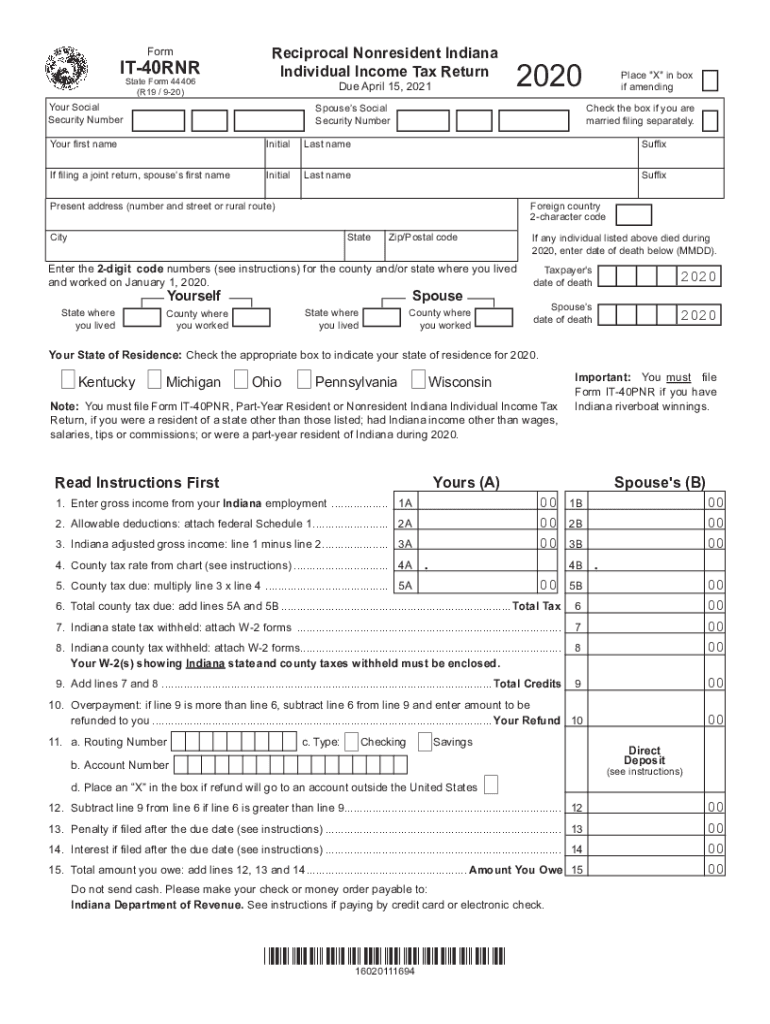

The Place 'X' In Box refers to a specific section on the Indiana IT-40 RNR form where taxpayers must indicate their residency status. This designation is crucial for determining the correct tax obligations. The box typically requires taxpayers to mark whether they are a full-year resident, part-year resident, or non-resident of Indiana for the tax year in question.

How to use the Place 'X' In Box

To properly utilize the Place 'X' In Box on the Indiana IT-40 RNR form, taxpayers should carefully read the instructions provided alongside the form. Mark the appropriate box that corresponds to your residency status. Ensure that this selection aligns with your actual residency during the tax year, as incorrect information can lead to complications or penalties.

Key elements of the Place 'X' In Box

Several key elements are associated with the Place 'X' In Box on the Indiana IT-40 RNR form:

- Residency Status: This determines whether you are liable for state taxes based on your residency.

- Tax Year: Ensure that the residency status corresponds to the tax year for which you are filing.

- Accuracy: Correctly marking this box is essential to avoid potential audits or penalties.

Steps to complete the Place 'X' In Box

Completing the Place 'X' In Box involves a few straightforward steps:

- Review your residency status for the tax year.

- Locate the Place 'X' In Box on the Indiana IT-40 RNR form.

- Mark the box that accurately reflects your residency status.

- Double-check your selection to ensure accuracy before submitting the form.

Legal use of the Place 'X' In Box

The legal use of the Place 'X' In Box is governed by Indiana tax regulations. Accurate completion of this section is necessary for compliance with state tax laws. Misrepresentation of residency status can result in legal repercussions, including fines or penalties, making it essential for taxpayers to provide truthful information.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana IT-40 RNR form are typically aligned with federal tax deadlines. Generally, the deadline for submitting your state tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to avoid late filing penalties.

Quick guide on how to complete place quotxquot in box

Effortlessly Prepare Place 'X' In Box on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly solution to conventional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Place 'X' In Box on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Modify and Electronically Sign Place 'X' In Box with Ease

- Locate Place 'X' In Box and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Place 'X' In Box and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct place quotxquot in box

Create this form in 5 minutes!

How to create an eSignature for the place quotxquot in box

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the form it 40 rnr and how does it work?

The form it 40 rnr is a specialized document used for reporting certain tax-related information. With airSlate SignNow, you can easily fill out, send, and eSign the form it 40 rnr, making the process efficient and straightforward for your business.

-

How much does it cost to use airSlate SignNow for the form it 40 rnr?

airSlate SignNow offers flexible pricing plans that can accommodate businesses of all sizes. The cost to use airSlate SignNow for the form it 40 rnr is competitive and provides excellent value, especially considering the time and resources saved by streamlining your document workflows.

-

What are the key features of airSlate SignNow for processing form it 40 rnr?

Key features include easy document editing, secure eSigning, and customizable templates specifically for the form it 40 rnr. Additionally, airSlate SignNow provides tracking and notification features, ensuring you stay updated on document status from start to finish.

-

How can airSlate SignNow benefit my business when handling form it 40 rnr?

Using airSlate SignNow for the form it 40 rnr can signNowly reduce bottlenecks in your document management process. The platform increases efficiency in completing and submitting forms, ultimately saving you time and resources while ensuring compliance with regulations.

-

Does airSlate SignNow integrate with other software for the form it 40 rnr?

Yes, airSlate SignNow integrates seamlessly with various business applications, streamlining the completion of the form it 40 rnr. This enhances collaboration and ensures that all necessary data is accurately gathered and processed for efficient document management.

-

Is airSlate SignNow secure for submitting sensitive documents like form it 40 rnr?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive documents like the form it 40 rnr. This ensures that your data remains confidential and is safe from unauthorized access.

-

Can I track the status of my form it 40 rnr submissions with airSlate SignNow?

Yes, airSlate SignNow provides a tracking feature that allows you to monitor the status of your form it 40 rnr submissions. You will receive notifications and updates, ensuring you are informed every step of the way, leading to better management of your documentation.

Get more for Place 'X' In Box

Find out other Place 'X' In Box

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien