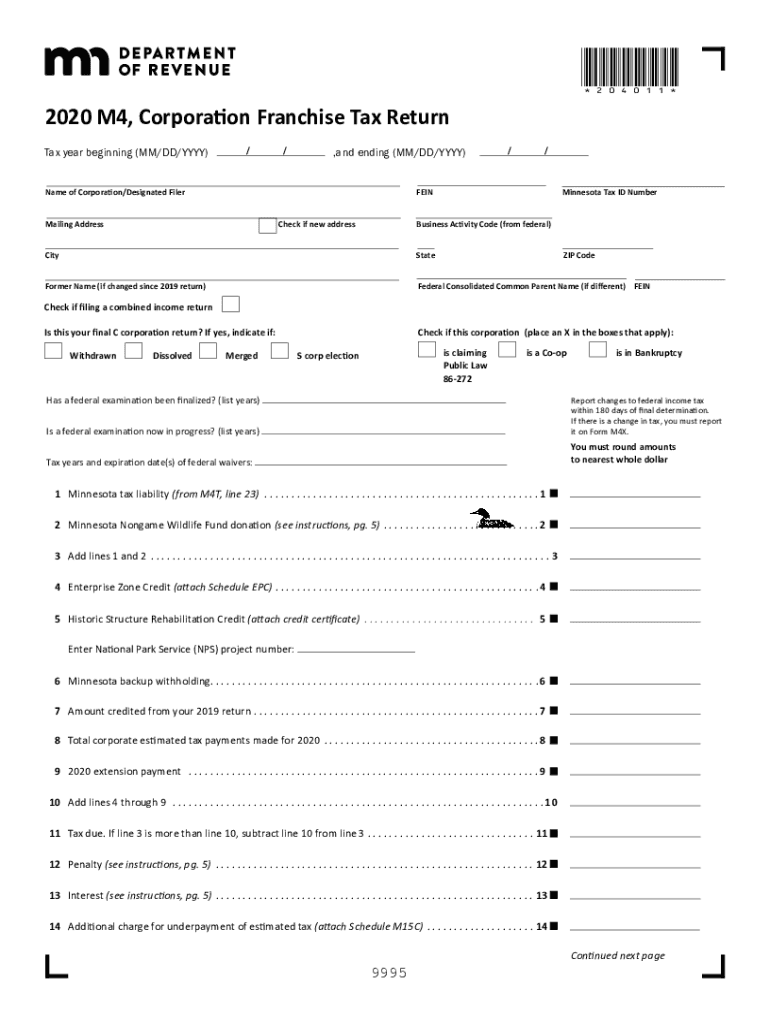

M4, Corporation Franchise Tax Return Corporation Franchise Tax Return 2020

What is the Minnesota M4 Tax?

The Minnesota M4 tax form, officially known as the Corporation Franchise Tax Return, is a crucial document for corporations operating in Minnesota. This form is used to report the corporation’s income, calculate the tax owed, and ensure compliance with state tax regulations. Corporations must file this form annually to maintain good standing with the Minnesota Department of Revenue. The M4 form is applicable to various business entities, including C corporations and S corporations, and it helps determine the franchise tax based on the corporation's net income.

Steps to Complete the Minnesota M4 Tax Form

Completing the Minnesota M4 tax form involves several important steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate total income and allowable deductions to determine net income.

- Refer to the Minnesota tax tables to find the applicable tax rate based on your net income.

- Fill out the M4 form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

Filing Deadlines for the Minnesota M4 Tax Form

Corporations must adhere to specific deadlines when filing the Minnesota M4 tax form. The standard due date is the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the form is due by April 15. It is important to file on time to avoid penalties and interest on any taxes owed.

Required Documents for the Minnesota M4 Tax Form

To complete the Minnesota M4 tax form accurately, several documents are required:

- Financial statements, including profit and loss statements and balance sheets.

- Records of any deductions or credits claimed.

- Prior year tax returns for reference.

- Any additional documentation required for specific adjustments or claims.

Legal Use of the Minnesota M4 Tax Form

The Minnesota M4 tax form must be used in accordance with state tax laws. It is essential for corporations to ensure that the information provided is truthful and accurate. Misrepresentation or failure to file can result in legal penalties, including fines and interest on unpaid taxes. Utilizing reliable digital tools for eSigning and submitting the M4 can enhance compliance and security.

Form Submission Methods for the Minnesota M4 Tax Form

Corporations have several options for submitting the Minnesota M4 tax form. The form can be filed electronically through the Minnesota Department of Revenue's online portal, which is often the most efficient method. Alternatively, corporations can mail the completed form to the appropriate address provided by the state. In-person submissions may also be possible at designated state offices.

Quick guide on how to complete 2020 m4 corporation franchise tax return corporation franchise tax return 2019

Complete M4, Corporation Franchise Tax Return Corporation Franchise Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct version and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage M4, Corporation Franchise Tax Return Corporation Franchise Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign M4, Corporation Franchise Tax Return Corporation Franchise Tax Return with ease

- Obtain M4, Corporation Franchise Tax Return Corporation Franchise Tax Return and then click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize crucial sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any chosen device. Modify and eSign M4, Corporation Franchise Tax Return Corporation Franchise Tax Return and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 m4 corporation franchise tax return corporation franchise tax return 2019

Create this form in 5 minutes!

How to create an eSignature for the 2020 m4 corporation franchise tax return corporation franchise tax return 2019

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the Minnesota M4 tax form and why is it important?

The Minnesota M4 tax form is used by employers to report the state income tax withholding for their employees. It's essential for compliance with Minnesota tax regulations and ensures that your employees' taxes are accurately withheld and reported.

-

How can airSlate SignNow help me manage the Minnesota M4 tax process?

airSlate SignNow simplifies the management of the Minnesota M4 tax process by allowing you to easily create, send, and eSign necessary documents. Our platform ensures secure storage and efficient tracking of all versions, helping you stay organized and compliant.

-

What features does airSlate SignNow offer for handling Minnesota M4 tax documents?

airSlate SignNow offers features like customizable templates, audit trails, and automated workflows specifically designed for Minnesota M4 tax documents. These features enhance document management, streamline signing processes, and reduce errors, making compliance easier for businesses.

-

Is airSlate SignNow cost-effective for managing Minnesota M4 tax compliance?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Minnesota M4 tax compliance. With flexible pricing plans, you can choose the option that best fits your business size and needs without compromising on crucial functionalities.

-

Can I integrate airSlate SignNow with my existing payroll software for Minnesota M4 tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with popular payroll software, streamlining the process of preparing and filing Minnesota M4 tax documents. This integration ensures that all relevant data is automatically updated and accessible.

-

What are the benefits of using airSlate SignNow for Minnesota M4 tax processing?

Using airSlate SignNow for Minnesota M4 tax processing offers several benefits, including enhanced efficiency, improved accuracy, and easy collaboration among team members. Our platform also allows for real-time tracking and notifications, keeping you informed throughout the process.

-

Is it easy to learn how to use airSlate SignNow for Minnesota M4 tax documents?

Yes, airSlate SignNow is user-friendly and designed for ease of use. With intuitive navigation and comprehensive support resources, you'll quickly learn how to manage your Minnesota M4 tax documents efficiently.

Get more for M4, Corporation Franchise Tax Return Corporation Franchise Tax Return

- Modification child wa form

- Wpf dr 060200 summons for modification of child support sm washington form

- Washington response petition form

- Wpf dr 060400 motion declaration for default child support modification mtdfl washington form

- Washington child support 497429405 form

- What do i write in my motion to enforce child support form

- Wpf dr 060520 response regarding oral testimony child support modification rsp washington form

- Wpf dr 060540 order regarding oral testimony child support modification orh washington form

Find out other M4, Corporation Franchise Tax Return Corporation Franchise Tax Return

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement