Www Revenue State Mn Uscorporation Franchise TaxCorporation Franchise TaxMinnesota Department of Revenue 2021

Understanding the Minnesota M4 Franchise Tax

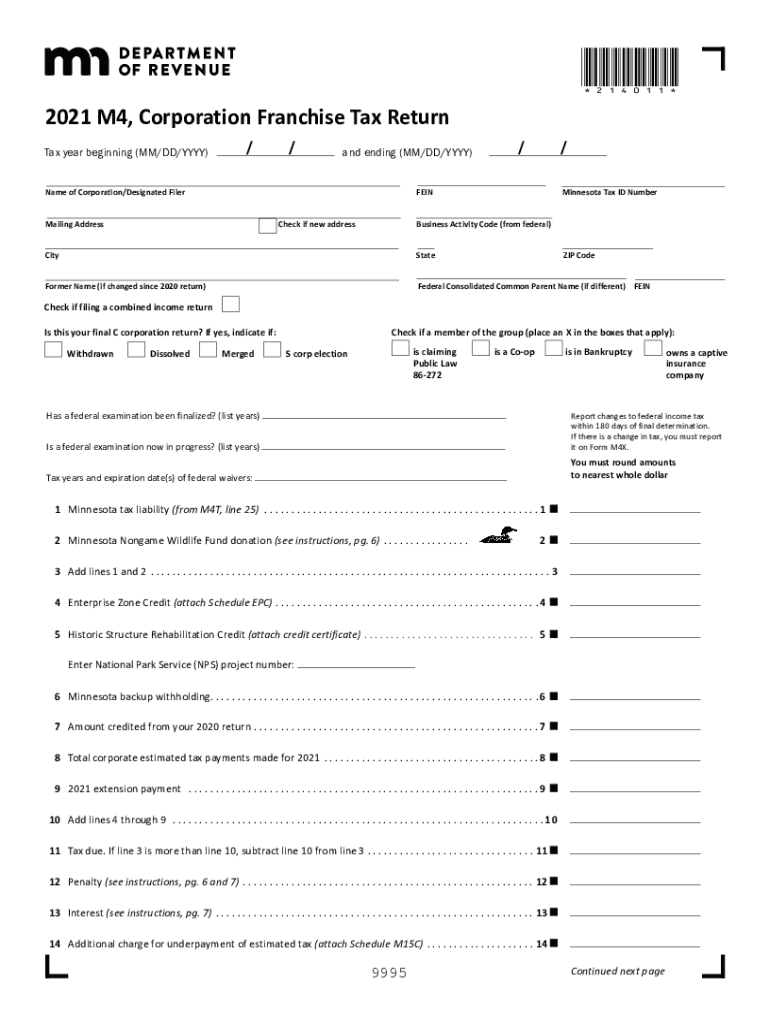

The Minnesota M4 form, also known as the Minnesota franchise return, is essential for corporations operating in Minnesota. This form is used to report the income and calculate the franchise tax owed to the state. The Minnesota Department of Revenue requires this form to ensure compliance with state tax laws and to facilitate the proper assessment of corporate taxes. Understanding the nuances of the M4 form is crucial for businesses to avoid penalties and ensure accurate tax reporting.

Steps to Complete the Minnesota M4 Form

Filling out the Minnesota M4 form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine your business structure, as this will affect the tax calculation.

- Calculate your taxable income based on federal tax returns and state-specific adjustments.

- Fill out the M4 form accurately, ensuring all income and deductions are reported.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail to the Minnesota Department of Revenue.

Legal Use of the Minnesota M4 Franchise Tax Form

The Minnesota M4 form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information is accurate and that the form is signed by an authorized representative of the corporation. The legal implications of submitting this form include potential audits and penalties for non-compliance. Therefore, businesses should maintain thorough records and consult with tax professionals if needed.

Filing Deadlines for the Minnesota M4 Form

Corporations must be aware of the filing deadlines associated with the Minnesota M4 form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the deadline is April 15. Missing this deadline can result in penalties and interest on unpaid taxes, making timely submission critical for compliance.

Required Documents for the Minnesota M4 Form

To complete the Minnesota M4 form, several documents are required:

- Federal tax return (Form 1120 or 1120-S)

- Financial statements, including profit and loss statements

- Records of any tax credits or deductions claimed

- Documentation supporting any adjustments made to income

Having these documents ready will streamline the filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance with the Minnesota M4 Form

Failure to file the Minnesota M4 form on time or submitting inaccurate information can lead to significant penalties. These may include:

- Late filing penalties, which can be a percentage of the unpaid tax amount.

- Interest on unpaid taxes, accruing from the original due date.

- Potential audits by the Minnesota Department of Revenue, which can lead to further financial scrutiny.

It is vital for corporations to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete wwwrevenuestatemnuscorporation franchise taxcorporation franchise taxminnesota department of revenue

Complete Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue without any hassle

- Obtain Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuestatemnuscorporation franchise taxcorporation franchise taxminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuestatemnuscorporation franchise taxcorporation franchise taxminnesota department of revenue

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is mn m 4 and how does airSlate SignNow utilize it?

Mn m 4 is a key feature in airSlate SignNow that enhances the document signing process. It allows users to easily manage and track their document workflows, ensuring that every step is documented and accessible. This streamlined approach saves time and increases efficiency for businesses of all sizes.

-

How does the pricing structure for airSlate SignNow work?

AirSlate SignNow offers a competitive pricing structure that caters to various business needs. The mn m 4 tool is included in all plans, each designed to provide businesses with the best value for their e-signature and document management needs. Users can explore different tiers to find the one that suits their requirements without overspending.

-

What features does airSlate SignNow offer that incorporate mn m 4?

The mn m 4 feature in airSlate SignNow includes enhanced documentation management, automatic reminders, and secure signing capabilities. Customers benefit from a user-friendly interface that simplifies the process of sending and signing documents. Additionally, the platform is designed to ensure compliance with industry regulations.

-

Can airSlate SignNow integrate with other applications using mn m 4?

Yes, airSlate SignNow integrates seamlessly with various applications, leveraging the capabilities of mn m 4. This includes popular CRM and project management tools, allowing users to streamline their workflows and maximize productivity. Integrations help businesses create a more cohesive system for document management and e-signatures.

-

What are the benefits of using airSlate SignNow's mn m 4 feature?

Using airSlate SignNow with the mn m 4 feature delivers signNow benefits, such as improved document tracking and enhanced security. Businesses can expedite the signing process while maintaining oversight on all transactions. This leads to faster turnaround times and greater customer satisfaction.

-

Is training available for using mn m 4 in airSlate SignNow?

Absolutely! AirSlate SignNow provides comprehensive training resources for users to fully utilize mn m 4. These resources include video tutorials, webinars, and customer support to assist users in maximizing the platform's capabilities. This ensures businesses can implement the solution effectively and efficiently.

-

What types of documents can be signed using airSlate SignNow's mn m 4 feature?

AirSlate SignNow allows users to sign a wide variety of documents using the mn m 4 feature, including contracts, agreements, and forms. Whether it’s legal documents or simple forms, the platform supports them all efficiently. This versatility makes airSlate SignNow suitable for various industries.

Get more for Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue

- Individual credit application florida form

- Interrogatories to plaintiff for motor vehicle occurrence florida form

- Interrogatories to defendant for motor vehicle accident florida form

- Fl llc form

- Florida estate form

- Notice of dishonored check civil keywords bad check bounced check florida form

- Check bad form

- Mutual wills containing last will and testaments for unmarried persons living together with no children florida form

Find out other Www revenue state mn uscorporation franchise taxCorporation Franchise TaxMinnesota Department Of Revenue

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now