Delaware Form 200 01 X 2019

What is the Delaware Form 200 01 X

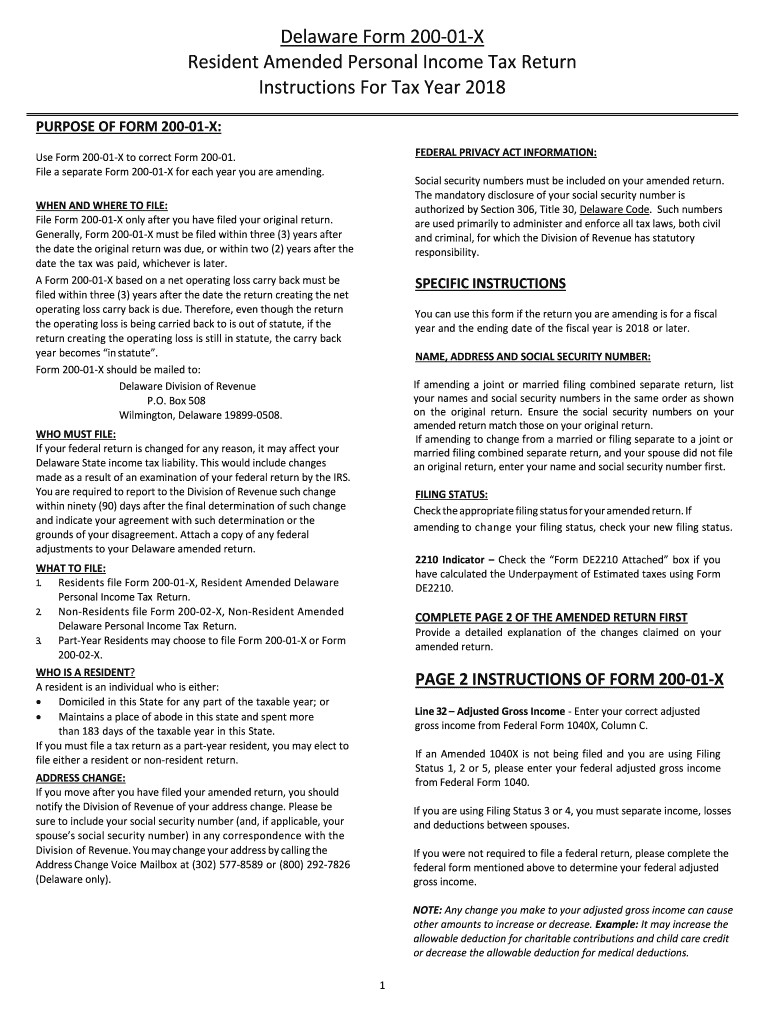

The Delaware Form 200 01 X is a tax form utilized by businesses and individuals to report specific financial information to the Delaware Division of Revenue. This form is essential for filing state income tax returns and is designed to ensure compliance with Delaware tax laws. It is primarily used for amended returns, allowing taxpayers to correct previously filed returns to reflect accurate information.

Steps to complete the Delaware Form 200 01 X

Completing the Delaware Form 200 01 X involves several key steps:

- Gather necessary documentation, including previous tax returns, income statements, and any relevant financial records.

- Fill out the form accurately, ensuring all sections are completed. Pay special attention to the areas that require corrections from the original return.

- Calculate any adjustments to your taxable income and determine the correct tax liability based on the amended information.

- Review the completed form for accuracy before submission to avoid delays or penalties.

How to obtain the Delaware Form 200 01 X

The Delaware Form 200 01 X can be obtained through the Delaware Division of Revenue's official website. It is available for download in a printable format, allowing taxpayers to fill it out manually or electronically. Additionally, forms may be available at local tax offices or through authorized tax professionals.

Legal use of the Delaware Form 200 01 X

To ensure the legal validity of the Delaware Form 200 01 X, it is crucial to follow specific guidelines. The form must be signed and dated by the taxpayer or an authorized representative. Electronic signatures are acceptable if the submission is made through a compliant eSignature platform, adhering to the requirements set forth by federal and state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Form 200 01 X typically align with the standard tax filing deadlines. Taxpayers should be aware of the specific dates for submitting amended returns to avoid penalties. Generally, the form must be filed within three years from the original due date of the return being amended.

Form Submission Methods (Online / Mail / In-Person)

The Delaware Form 200 01 X can be submitted through various methods:

- Online submission via the Delaware Division of Revenue's e-filing system, which provides a secure and efficient way to file.

- Mailing the completed form to the appropriate address designated by the Division of Revenue, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, where taxpayers can receive assistance if needed.

Quick guide on how to complete delaware form 200 01 x

Effortlessly prepare Delaware Form 200 01 X on any device

Online document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to acquire the correct form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and eSign your documents quickly without delays. Manage Delaware Form 200 01 X on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to edit and eSign Delaware Form 200 01 X with ease

- Obtain Delaware Form 200 01 X and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow efficiently addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Delaware Form 200 01 X to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware form 200 01 x

Create this form in 5 minutes!

How to create an eSignature for the delaware form 200 01 x

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Delaware Form 200 01 X?

Delaware Form 200 01 X is a crucial document for businesses operating in Delaware, allowing them to report certain tax liabilities. Understanding this form and its requirements is essential for compliance and is streamlined through platforms like airSlate SignNow.

-

How can airSlate SignNow help with completing Delaware Form 200 01 X?

airSlate SignNow provides an intuitive platform that simplifies the process of completing Delaware Form 200 01 X. You can easily fill out the form, eSign it, and securely store it, ensuring that all your documents are organized and accessible.

-

Are there any costs associated with using airSlate SignNow for Delaware Form 200 01 X?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solution provides features tailored for managing documents such as Delaware Form 200 01 X, allowing businesses to choose a plan that fits their budget.

-

What features does airSlate SignNow offer for Delaware Form 200 01 X?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and document tracking specifically designed for forms like the Delaware Form 200 01 X. These features enhance security and streamline the signing process, making compliance easier for your business.

-

Can I integrate airSlate SignNow with other tools for handling Delaware Form 200 01 X?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enabling smooth workflows for handling Delaware Form 200 01 X. This helps businesses to create a unified system for document management and eSigning.

-

What benefits does using airSlate SignNow provide for filing Delaware Form 200 01 X?

Using airSlate SignNow to file Delaware Form 200 01 X offers numerous benefits, including time savings, reduced errors, and enhanced compliance. The platform ensures that forms are accurately completed and securely signed, making it easier for businesses to meet their regulatory obligations.

-

Is it easy to navigate airSlate SignNow for managing Delaware Form 200 01 X?

Yes, airSlate SignNow is designed with user-friendliness in mind. Customers can easily navigate the platform to manage Delaware Form 200 01 X, allowing users to focus on completing and signing their documents without technical difficulties.

Get more for Delaware Form 200 01 X

- Quitclaim deed wife form

- Warranty deed from husband and wife to corporation washington form

- Washington case form

- Washington child support form

- Washington child support 497429379 form

- Petition legal separation form

- Wpf dr 010120 petition for declaration concerning validity ptin washington form

- Wpf dr 010250 return of service rts washington form

Find out other Delaware Form 200 01 X

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney