MUNICIPAL TAX RETURN 2019-2026

What is the municipal tax return?

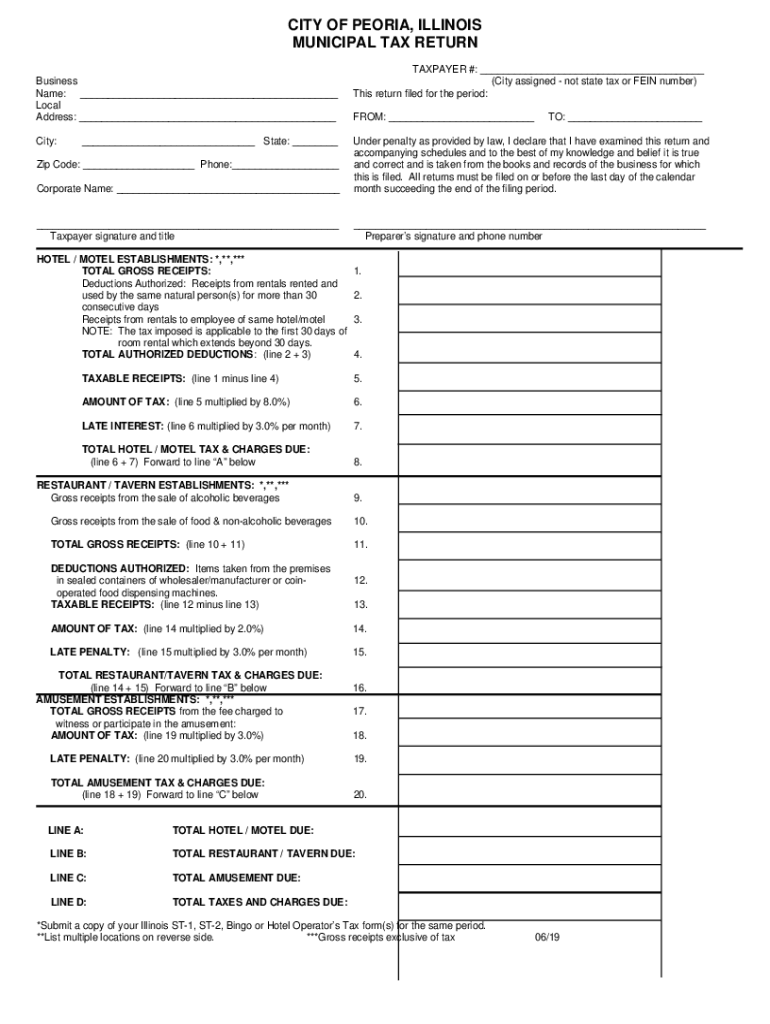

The municipal tax return is a form used by residents of Peoria, Illinois, to report their income and calculate their tax obligations to the local government. This form is essential for ensuring compliance with local tax laws and regulations. It typically requires information about the taxpayer's income, deductions, and any applicable credits. Understanding the municipal tax return is crucial for residents, as it directly impacts their financial responsibilities and potential refunds.

Steps to complete the municipal tax return

Completing the municipal tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, fill out the municipal tax return form with your personal information and income details. Be sure to include any deductions or credits you may qualify for, such as those available for individuals with disabilities. After completing the form, review it for accuracy before submitting it either online or by mail, depending on your preference.

Legal use of the municipal tax return

The municipal tax return is legally binding and must be completed accurately to avoid penalties. It is essential to adhere to local tax laws and regulations when filing this return. Falsifying information or failing to file can result in fines and other legal repercussions. Utilizing a reliable digital platform to complete and submit your municipal tax return can help ensure compliance with legal requirements while providing a secure way to manage your tax documents.

Filing deadlines / Important dates

Filing deadlines for the municipal tax return are critical to avoid penalties. Typically, the deadline for submitting your municipal tax return in Peoria is aligned with the federal tax deadlines, often falling on April 15. However, it is advisable to check for any local variations or extensions that may apply. Marking these important dates on your calendar can help ensure timely submission and compliance with local tax regulations.

Required documents

To successfully complete the municipal tax return, specific documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits

- Proof of residency in Peoria

- Any relevant financial statements

Having these documents ready will streamline the process and help ensure that your return is accurate and complete.

Form submission methods (Online / Mail / In-Person)

The municipal tax return can be submitted through various methods, providing flexibility for taxpayers. Residents can choose to file online using a secure digital platform, which offers convenience and immediate confirmation of receipt. Alternatively, the form can be mailed directly to the local tax office or submitted in person. Each method has its advantages, and choosing the right one depends on personal preference and the need for immediate processing.

Quick guide on how to complete municipal tax return

Complete MUNICIPAL TAX RETURN effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle MUNICIPAL TAX RETURN on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to modify and eSign MUNICIPAL TAX RETURN with ease

- Find MUNICIPAL TAX RETURN and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign MUNICIPAL TAX RETURN and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct municipal tax return

Create this form in 5 minutes!

How to create an eSignature for the municipal tax return

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the process for completing an il Peoria tax return using airSlate SignNow?

Completing an il Peoria tax return with airSlate SignNow involves uploading your tax documents to the platform, filling out the necessary information, and then eSigning the forms. Our user-friendly interface guides you step-by-step, ensuring that you have all required information for a successful submission. Additionally, you can easily share the completed forms with tax professionals if needed.

-

How much does it cost to eSign an il Peoria tax return with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different user needs, including options for individuals and businesses. The cost to eSign an il Peoria tax return is competitive, with options for monthly or annual subscriptions. This cost-effectiveness allows users to manage their tax documentation without breaking the bank.

-

What features does airSlate SignNow provide for managing il Peoria tax returns?

airSlate SignNow provides a range of features for managing il Peoria tax returns, including eSignature capabilities, secure document storage, and the ability to create templates for frequently used forms. These features streamline the tax return process, making it easy to organize and access your documents whenever needed. Additionally, users can track the status of their signatures in real-time.

-

Can I integrate airSlate SignNow with my accounting software for my il Peoria tax return?

Yes, airSlate SignNow offers integrations with a variety of accounting software to simplify the process of preparing your il Peoria tax return. This integration allows for seamless document transfer and collaboration between platforms, saving you time and reducing the risk of errors. Popular integrations include QuickBooks, Xero, and more.

-

What are the benefits of using airSlate SignNow for tax returns in Illinois?

Using airSlate SignNow for your il Peoria tax return offers numerous benefits, including convenience, security, and compliance with state requirements. The platform ensures that your documents are securely stored and that all signatures are legally binding. Additionally, the ability to eSign from anywhere helps you meet deadlines without the hassle of printing and mailing.

-

Is it safe to use airSlate SignNow for filing my il Peoria tax return?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your sensitive information while completing your il Peoria tax return. Our platform adheres to strict compliance regulations, ensuring that your documents are safe from unauthorized access. You can eSign your tax returns with peace of mind.

-

What types of documents can I eSign for my il Peoria tax return?

You can eSign a wide variety of documents for your il Peoria tax return using airSlate SignNow. This includes tax forms such as 1040, W-2, and various state-specific documents. The platform allows for easy uploading and signing of any required paperwork, ensuring all aspects of your tax return are handled efficiently.

Get more for MUNICIPAL TAX RETURN

- Dj contract pdf form

- Self employed animal exercise services contract form

- Speaker contract 497337262 form

- Self employed surveyor services contract form

- Journalist reporter agreement self employed independent contractor form

- Entertainment contract form

- Self employed tour guide services contract 497337266 form

- Aluminum form

Find out other MUNICIPAL TAX RETURN

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe