T1135 Fill Out and Auto Calculatecomplete Form Online 2019-2026

What is the T1135 form?

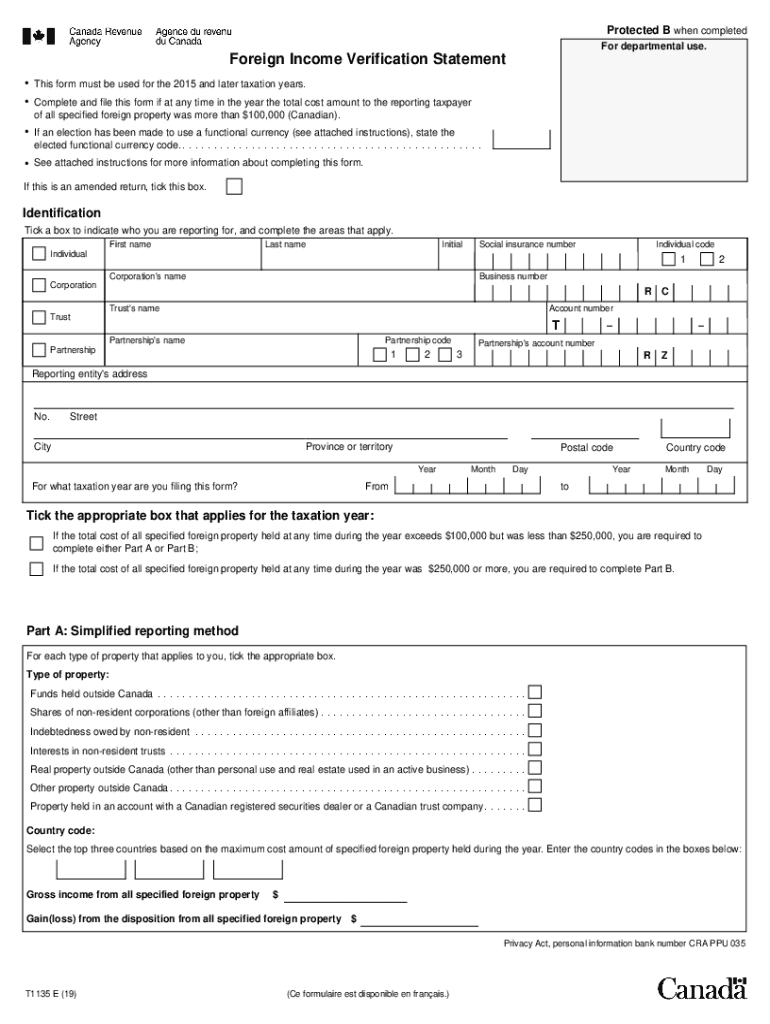

The T1135 form, officially known as the T1135 Foreign Income Verification Statement, is a tax document required by the Canada Revenue Agency (CRA) for Canadian residents who hold specified foreign property with a total cost exceeding $100,000 CAD. This form is essential for reporting foreign investments, including stocks, bonds, and real estate, ensuring compliance with Canadian tax laws. The T1135 form helps the CRA monitor foreign income and assets, contributing to the prevention of tax evasion.

How to fill out the T1135 form online

Filling out the T1135 form online can streamline the process and reduce errors. Users can access a fillable PDF version of the T1135 form, allowing them to input their information directly. Key steps include:

- Download the T1135 form PDF from a reliable source.

- Open the form using a compatible PDF reader.

- Enter your personal information, including your name, address, and tax identification number.

- List your foreign properties, providing details such as the type of property, its location, and the cost amount.

- Review your entries for accuracy before saving the completed form.

Filing deadlines for the T1135 form

It is crucial to adhere to the filing deadlines for the T1135 form to avoid penalties. The T1135 must be submitted by the due date of your income tax return, which is typically April 30 for individuals. For self-employed individuals, the deadline is June 15, but any taxes owed must still be paid by April 30. Late submissions may result in significant penalties, so timely filing is essential.

Required documents for the T1135 form

When completing the T1135 form, it is important to gather all necessary documents to ensure accurate reporting. Required documents may include:

- Records of foreign property ownership, such as purchase agreements or statements.

- Bank statements or investment account statements detailing foreign assets.

- Documentation of income generated from foreign properties, including dividends or rental income.

Legal use of the T1135 form

The T1135 form serves a legal purpose in ensuring compliance with Canadian tax regulations. By accurately reporting foreign income and assets, individuals can avoid potential legal issues related to tax evasion. The form must be completed truthfully, as any discrepancies or omissions could lead to audits or penalties from the CRA.

Penalties for non-compliance with the T1135 form

Failure to file the T1135 form or inaccuracies in reporting can result in severe penalties. The CRA imposes a penalty of $25 per day for each day the form is late, up to a maximum of $2,500. Additionally, if the form is filed late or incorrectly, the CRA may impose further penalties or initiate an audit, which can lead to additional financial consequences.

Quick guide on how to complete t1135 fill out and auto calculatecomplete form online

Fill out T1135 Fill Out And Auto Calculatecomplete Form Online effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage T1135 Fill Out And Auto Calculatecomplete Form Online on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign T1135 Fill Out And Auto Calculatecomplete Form Online without hassle

- Obtain T1135 Fill Out And Auto Calculatecomplete Form Online and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign T1135 Fill Out And Auto Calculatecomplete Form Online and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1135 fill out and auto calculatecomplete form online

Create this form in 5 minutes!

How to create an eSignature for the t1135 fill out and auto calculatecomplete form online

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the t1135 form?

The t1135 form is a Canadian tax form used to report foreign income and assets held by residents. It is essential for compliance with the Income Tax Act, ensuring that Canadians report their foreign holdings accurately. Completing the t1135 form correctly can help avoid penalties and ensure proper tax management.

-

How can airSlate SignNow help with the t1135 form?

airSlate SignNow provides a streamlined platform for eSigning documents, including the t1135 form. Its easy-to-use interface allows you to fill out, sign, and send the form quickly, helping to simplify your filing process. This efficiency reduces errors and ensures timely submissions to tax authorities.

-

Is airSlate SignNow suitable for businesses requiring the t1135 form?

Yes, airSlate SignNow is an excellent choice for businesses needing to manage the t1135 form. Its robust features allow for multi-user access, making it ideal for teams involved in tax reporting. With airSlate SignNow, collaboration is simplified while ensuring compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for the t1135 form?

airSlate SignNow offers various pricing plans to suit different business needs, including options suitable for users who frequently complete forms like the t1135 form. Prices are competitive and include features tailored for document management and eSigning. You can choose from monthly or annual subscriptions, depending on your volume of document handling.

-

Are there any integrations available for processing the t1135 form?

airSlate SignNow integrates seamlessly with a range of productivity tools that can aid in processing the t1135 form. Whether you use accounting software, cloud storage solutions, or project management tools, you can easily incorporate SignNow into your existing workflow. This integration enhances efficiency, allowing for easier document management and collaboration.

-

What are the benefits of using airSlate SignNow for the t1135 form?

Using airSlate SignNow for the t1135 form offers numerous benefits, including time savings and error reduction. The platform allows for cloud storage and easy retrieval of your completed forms, ensuring you always have access to essential documents. Additionally, you can enhance the security of your submissions with encrypted eSignatures.

-

Can I track the status of my t1135 form submissions with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all document submissions, including the t1135 form. You can see when your form has been sent, viewed, and signed, allowing for better management of your filing deadlines. This feature ensures that you are always updated on the progress of your important tax documents.

Get more for T1135 Fill Out And Auto Calculatecomplete Form Online

- Parenting plan form

- Wpf ps 160100 petition for establishment of parentage pursuant to rcw 2626 washington form

- Wpf ps 160200 summons petition for establishment of parentage pursuant to rcw 2626 washington form

- Washington law form

- Washington parentage form

- Parenting plan form

- Wpf ps 150650 residential schedule washington form

- Wpf ps 150700 order of child support washington form

Find out other T1135 Fill Out And Auto Calculatecomplete Form Online

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF