Special Fuel Tax Report and Schedules Special Fuel Tax Report and Schedules 2020

What is the ND SFN22942 Special Tax PDF?

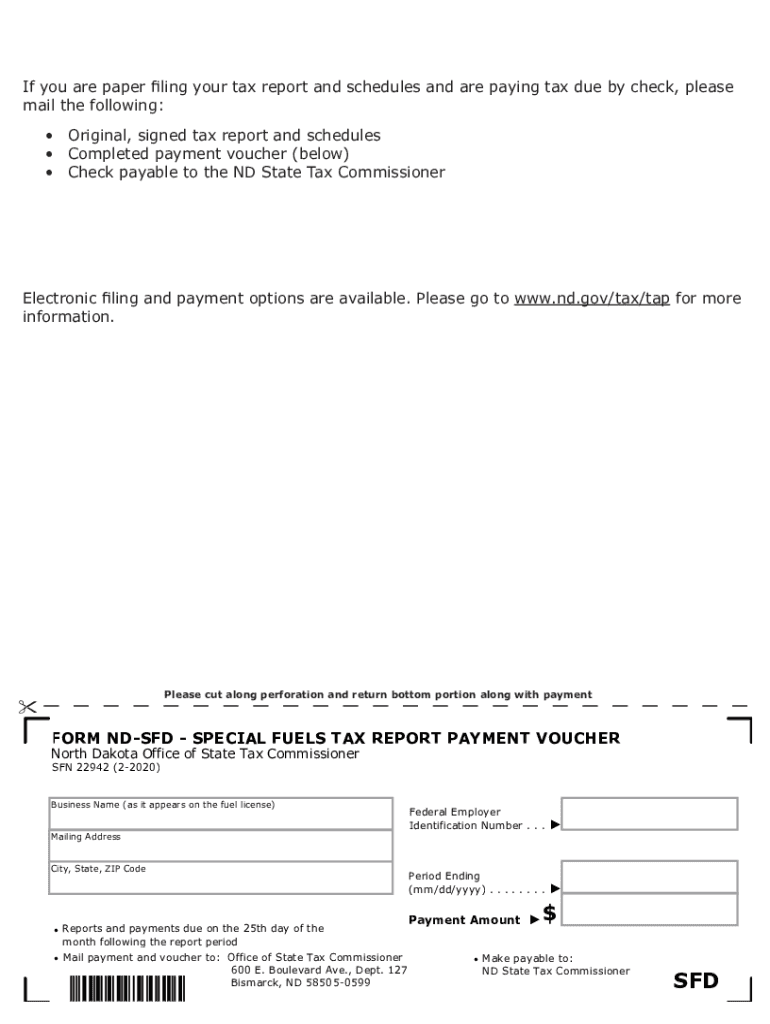

The ND SFN22942, also known as the Special Fuel Tax Report, is a crucial document used by businesses operating in North Dakota to report the use of special fuel. This form is essential for ensuring compliance with state tax regulations regarding the consumption of diesel and other special fuels. It provides a structured way for businesses to detail their fuel usage, which is vital for calculating applicable taxes. Understanding this form is important for maintaining legal compliance and avoiding potential penalties.

How to Use the ND SFN22942 Special Tax PDF

Using the ND SFN22942 Special Tax PDF involves several steps. First, businesses must accurately gather data on their fuel consumption and any relevant transactions. This includes information on the type of fuel used, the quantity consumed, and the purpose of the fuel usage. Once the data is collected, it should be entered into the appropriate sections of the form. It is advisable to review the completed form for accuracy before submission to ensure that all information is correct and complies with state requirements.

Steps to Complete the ND SFN22942 Special Tax PDF

Completing the ND SFN22942 Special Tax PDF requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation regarding fuel purchases and usage.

- Fill in the business information, including name, address, and tax identification number.

- Enter the details of fuel consumption, specifying the type of fuel and quantity.

- Calculate the total tax due based on the reported fuel usage.

- Review the form for any errors or omissions.

- Sign and date the form to validate the information provided.

Legal Use of the ND SFN22942 Special Tax PDF

The ND SFN22942 Special Tax PDF must be completed and submitted in accordance with North Dakota tax laws. To be considered legally binding, the form must be signed by an authorized representative of the business. Additionally, it is essential to ensure that all information provided is accurate and truthful to avoid penalties for non-compliance. Understanding the legal implications of this form can help businesses navigate their tax obligations effectively.

Filing Deadlines for the ND SFN22942 Special Tax PDF

Timely submission of the ND SFN22942 Special Tax PDF is critical to avoid penalties. The filing deadlines may vary based on the reporting period, so it is important for businesses to stay informed about specific due dates. Generally, forms must be submitted by the end of the month following the reporting period. Keeping a calendar of these deadlines can help ensure that submissions are made on time.

Form Submission Methods for the ND SFN22942 Special Tax PDF

The ND SFN22942 Special Tax PDF can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission through the North Dakota tax portal.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Quick guide on how to complete special fuel tax report and schedules special fuel tax report and schedules

Complete Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The most effective way to edit and electronically sign Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules effortlessly

- Obtain Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from your chosen device. Edit and electronically sign Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct special fuel tax report and schedules special fuel tax report and schedules

Create this form in 5 minutes!

How to create an eSignature for the special fuel tax report and schedules special fuel tax report and schedules

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the nd sfn22942 special tax pdf?

The nd sfn22942 special tax pdf is a specific tax form used for reporting certain tax information in North Dakota. It is essential for individuals and businesses to complete this form accurately to comply with state tax obligations. Using airSlate SignNow, you can easily prepare and eSign this document online.

-

How can I access the nd sfn22942 special tax pdf on airSlate SignNow?

You can access the nd sfn22942 special tax pdf directly through the airSlate SignNow platform. Once you log in, simply navigate to the document creation section, and you can either upload the PDF or create a new one using our templates. Streamlined access makes it easy to manage your tax forms.

-

What are the pricing options for using airSlate SignNow to handle the nd sfn22942 special tax pdf?

airSlate SignNow offers various pricing plans to cater to different business needs. You can choose from monthly or annual subscriptions, with options that include access to all essential features for managing documents like the nd sfn22942 special tax pdf. Visit our pricing page for more details on the available packages.

-

What features does airSlate SignNow provide for managing the nd sfn22942 special tax pdf?

airSlate SignNow provides multiple features to streamline the signing process of the nd sfn22942 special tax pdf, including templates, reminders, and team collaboration tools. These features simplify document management, ensuring that your tax forms are completed and signed promptly, saving you valuable time.

-

How does airSlate SignNow ensure the security of the nd sfn22942 special tax pdf?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the nd sfn22942 special tax pdf. We use advanced encryption protocols and secure data storage to protect your documents from unauthorized access. Additionally, our platform allows you to set permissions for different users.

-

Can I integrate airSlate SignNow with other software for handling the nd sfn22942 special tax pdf?

Yes, airSlate SignNow offers various integration options that allow you to link our platform with other software you may be using for tax management or business operations. These integrations help you streamline your processes, making it easier to handle the nd sfn22942 special tax pdf alongside your existing tools.

-

What are the benefits of using airSlate SignNow for the nd sfn22942 special tax pdf?

Using airSlate SignNow for the nd sfn22942 special tax pdf offers numerous benefits, including efficiency, ease of use, and cost-effectiveness. You can quickly send, sign, and store your tax documents all in one place, ensuring a smooth workflow that minimizes the hassle of traditional paper processes.

Get more for Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules

- Last will testament married form

- Legal last will and testament form for a domestic partner with no children washington

- Washington legal form

- Washington last will testament download form

- Codicil to will form for amending your will will changes or amendments washington

- Legal last will and testament form for married person with adult and minor children from prior marriage washington

- Legal last will and testament form for domestic partner with adult and minor children from prior marriage washington

- Legal last will and testament form for married person with adult and minor children washington

Find out other Special Fuel Tax Report And Schedules Special Fuel Tax Report And Schedules

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors