Special Fuel Tax Report and Schedules State of North Dakota 2014

What is the Special Fuel Tax Report and Schedules State of North Dakota

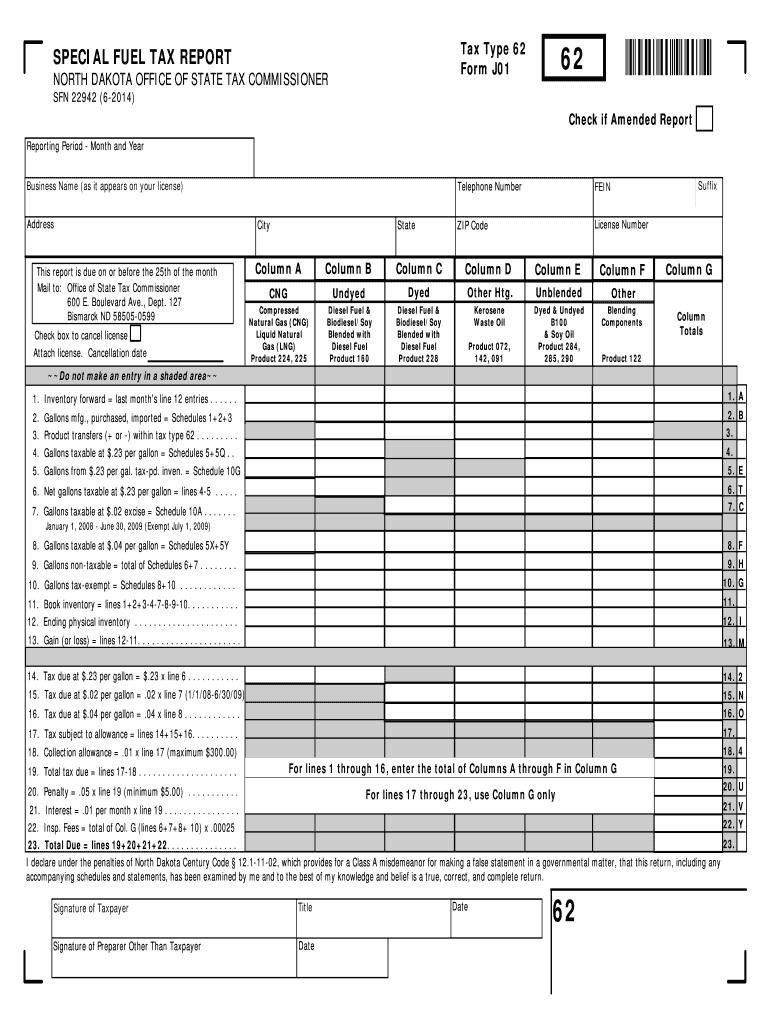

The Special Fuel Tax Report and Schedules State of North Dakota is a crucial document for businesses and individuals who use special fuels, such as diesel and gas, in the state. This report is designed to ensure compliance with state tax regulations related to the use and distribution of special fuels. It provides a detailed account of the amount of fuel consumed, the tax owed, and any exemptions that may apply. Properly completing this report is essential for maintaining legal compliance and avoiding penalties.

Steps to Complete the Special Fuel Tax Report and Schedules State of North Dakota

Completing the Special Fuel Tax Report requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documentation, including fuel purchase invoices and records of fuel usage.

- Fill out the report form accurately, ensuring all fields are completed as required.

- Calculate the total tax owed based on the fuel consumed during the reporting period.

- Review the report for accuracy before submission to avoid errors that could lead to penalties.

- Submit the completed report by the designated deadline, either electronically or by mail.

Legal Use of the Special Fuel Tax Report and Schedules State of North Dakota

The Special Fuel Tax Report is legally binding when completed and submitted according to state regulations. To ensure its legal standing, the report must be filled out truthfully and accurately. Any discrepancies or false information can lead to serious legal consequences, including fines and penalties. Utilizing a reliable digital signature solution can enhance the validity of the document, ensuring compliance with electronic signature laws.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is essential for compliance with the Special Fuel Tax Report. Typically, reports are due on a monthly or quarterly basis, depending on the volume of fuel used. Missing a deadline can result in penalties. It is advisable to check the North Dakota Department of Transportation's website or contact them directly for the most current deadlines and any changes to the filing schedule.

Required Documents

To complete the Special Fuel Tax Report, several documents are required:

- Invoices for fuel purchases

- Records of fuel consumption

- Any applicable exemption certificates

- Previous tax reports for reference

Having these documents readily available will streamline the reporting process and help ensure accuracy.

Form Submission Methods

The Special Fuel Tax Report can be submitted through various methods to accommodate different preferences:

- Online submission through the state’s tax portal

- Mailing a hard copy of the completed form

- In-person submission at designated state offices

Choosing the appropriate method can depend on your comfort level with technology and the urgency of your submission.

Quick guide on how to complete special fuel tax report and schedules state of north dakota

Effortlessly Prepare Special Fuel Tax Report And Schedules State Of North Dakota on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to efficiently create, modify, and eSign your documents without any delays. Manage Special Fuel Tax Report And Schedules State Of North Dakota on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Easily Edit and eSign Special Fuel Tax Report And Schedules State Of North Dakota Without Stress

- Locate Special Fuel Tax Report And Schedules State Of North Dakota and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searches, or mistakes that require reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Special Fuel Tax Report And Schedules State Of North Dakota while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct special fuel tax report and schedules state of north dakota

Create this form in 5 minutes!

How to create an eSignature for the special fuel tax report and schedules state of north dakota

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Special Fuel Tax Report And Schedules State Of North Dakota?

The Special Fuel Tax Report And Schedules State Of North Dakota is a required document for businesses that operate vehicles powered by special fuel within the state. This report helps ensure compliance with state tax regulations and provides a comprehensive overview of fuel usage. Completing this report accurately is crucial for avoiding penalties and maintaining good standing with state authorities.

-

How can airSlate SignNow help with the Special Fuel Tax Report And Schedules State Of North Dakota?

airSlate SignNow streamlines the process of preparing and submitting the Special Fuel Tax Report And Schedules State Of North Dakota. Our platform simplifies document creation and eSigning, allowing users to efficiently manage their reports. This ensures that all tax reports are accurate, timely, and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Special Fuel Tax Report And Schedules State Of North Dakota?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses looking to manage the Special Fuel Tax Report And Schedules State Of North Dakota. Our plans are designed to be cost-effective, ensuring you get the value you need without overextending your budget. You can choose a plan that fits your document needs and frequency of use.

-

What features does airSlate SignNow offer for the Special Fuel Tax Report And Schedules State Of North Dakota?

airSlate SignNow provides features such as customizable templates, document tracking, and legally binding eSignatures specifically for the Special Fuel Tax Report And Schedules State Of North Dakota. These features help businesses create accurate reports quickly and maintain a secure signing process. Additionally, our platform offers cloud storage for easy access to all documents.

-

How does airSlate SignNow ensure compliance for the Special Fuel Tax Report And Schedules State Of North Dakota?

airSlate SignNow ensures compliance by providing updated templates and guidelines for the Special Fuel Tax Report And Schedules State Of North Dakota. Our platform incorporates user-friendly prompts to help you fill out the reports accurately. Regular updates help keep your documents in line with the latest state requirements.

-

Can I integrate airSlate SignNow with other software for the Special Fuel Tax Report And Schedules State Of North Dakota?

Yes, airSlate SignNow offers integration capabilities with various accounting and business software to streamline the process of managing the Special Fuel Tax Report And Schedules State Of North Dakota. This ensures that your data flows smoothly between applications, reducing manual entry and the potential for errors. Integrating your systems enhances accuracy in your tax-related documentation.

-

What are the benefits of using airSlate SignNow for the Special Fuel Tax Report And Schedules State Of North Dakota?

Using airSlate SignNow for the Special Fuel Tax Report And Schedules State Of North Dakota provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform allows businesses to focus on core operations by simplifying document handling. Additionally, the ease of eSigning reduces turnaround times and helps maintain good compliance practices.

Get more for Special Fuel Tax Report And Schedules State Of North Dakota

- Account guardian conservator 497431016 form

- Modified annual account of married ward wisconsin form

- Notice of change of address wisconsin form

- Petition real estate 497431019 form

- Order for appraisal guardianship or conservatorship wisconsin form

- Order to authorize andor confirm salemortgagelease of real estate of individual under guardianship or conservatorship wisconsin form

- Mortgage real estate form

- Wisconsin rights additional form

Find out other Special Fuel Tax Report And Schedules State Of North Dakota

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT