Ptax 324 2017

What is the Ptax 324

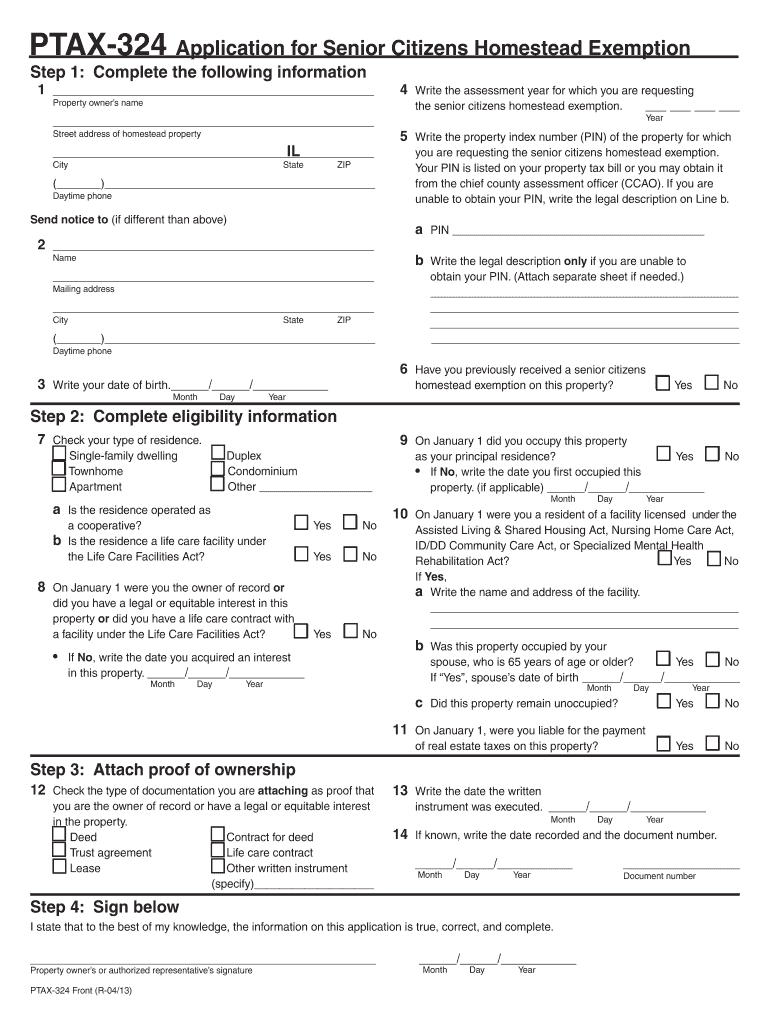

The Ptax 324 is an official form used in Illinois for applying for the senior citizen homestead exemption. This exemption provides property tax relief to eligible senior citizens, allowing them to reduce their property tax burden. By filing the Ptax 324, seniors can qualify for a reduction in the assessed value of their property, which can lead to significant savings on property taxes. Understanding the purpose and benefits of the Ptax 324 is essential for seniors looking to maximize their financial resources.

How to use the Ptax 324

Using the Ptax 324 involves several straightforward steps. First, seniors must ensure they meet the eligibility criteria, which typically include age requirements and residency status. Once eligibility is confirmed, seniors can obtain the form from their local county assessor's office or online. After filling out the form with accurate information regarding their property and personal details, they must submit it to the appropriate local authority. Utilizing digital tools, such as e-signature solutions, can simplify this process, ensuring that the form is completed and submitted securely.

Steps to complete the Ptax 324

Completing the Ptax 324 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including proof of age and residency.

- Obtain the Ptax 324 form from the local county assessor's office or online.

- Fill out the form, ensuring all information is accurate and complete.

- Sign the form electronically or in person, depending on submission method.

- Submit the completed form to the local assessor's office by the specified deadline.

Eligibility Criteria

To qualify for the senior citizen homestead exemption via the Ptax 324, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old and own the property they are claiming the exemption for. Additionally, they must occupy the property as their principal residence. It's important for seniors to verify these requirements with their local assessor's office, as they may vary slightly by county.

Required Documents

When applying for the Ptax 324, seniors will need to provide certain documents to support their application. These typically include:

- Proof of age, such as a driver's license or birth certificate.

- Documentation showing ownership of the property, like a deed.

- Evidence of residency, which may include utility bills or tax returns.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods

The Ptax 324 can be submitted through various methods, offering flexibility to applicants. Seniors have the option to:

- Submit the form online, utilizing e-signature tools for a secure and efficient process.

- Mail the completed form to their local county assessor's office.

- Deliver the form in person at the assessor's office, allowing for immediate confirmation of receipt.

Each method has its benefits, and seniors should choose the one that best fits their needs and comfort level.

Quick guide on how to complete ptax 324

Effortlessly Prepare Ptax 324 on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Ptax 324 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Ptax 324 with Ease

- Obtain Ptax 324 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ptax 324 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 324

Create this form in 5 minutes!

How to create an eSignature for the ptax 324

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is PTAX 324 for Tazewell County, IL?

The PTAX 324 form for Tazewell County, IL, is a property tax assessment form used by local authorities to evaluate property values. This form is essential for property owners to ensure their tax assessments are accurate and fair. Submitting the PTAX 324 helps maintain transparency in property taxation.

-

How can airSlate SignNow help with PTAX 324 in Tazewell County?

airSlate SignNow simplifies the process of completing and submitting the PTAX 324 form for Tazewell County, IL. With features like eSignature and document templates, users can complete their forms swiftly and securely. This streamlines compliance and reduces the time needed to manage property tax documentation.

-

What features does airSlate SignNow offer for PTAX 324 documentation?

airSlate SignNow offers several features that enhance the management of PTAX 324 documents, including customizable templates, secure cloud storage, and electronic signatures. This user-friendly platform ensures that your documentation meets local requirements while simplifying your workflow. These features can signNowly improve your efficiency in handling property tax assessments.

-

Is airSlate SignNow cost-effective for managing PTAX 324 in Tazewell County?

Yes, airSlate SignNow provides a cost-effective solution for managing PTAX 324 in Tazewell County, IL. With competitive pricing plans, businesses can leverage powerful features without breaking the budget. The savings on paper, printing, and postage can also help offset the cost of the software.

-

Can I integrate airSlate SignNow with other tools for PTAX 324 submissions?

Absolutely! airSlate SignNow can be easily integrated with various applications and tools that facilitate document management and submission for PTAX 324 in Tazewell County, IL. This flexibility allows users to create a seamless workflow, enhancing productivity and ensuring compliance with local tax regulations.

-

What are the benefits of using airSlate SignNow for PTAX 324 processing?

Using airSlate SignNow for PTAX 324 processing offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. By utilizing the eSignature feature, users can expedite the approval process and minimize errors associated with traditional document handling. Overall, it's a strategic choice for property owners in Tazewell County.

-

How secure is airSlate SignNow for handling PTAX 324 documents?

Security is a priority at airSlate SignNow. When handling PTAX 324 documents for Tazewell County, IL, users can benefit from robust encryption and compliance with data protection regulations. This ensures that sensitive information is safeguarded throughout the entire document signing and submission process.

Get more for Ptax 324

- Liability adult form

- Waiver and release from liability for minor child for scuba diving and skin diving form

- Release adult 497427126 form

- Waiver and release from liability for minor child for cultural or ethnic events form

- Waiver petting zoo 497427128 form

- Liability minor form

- Waiver release liability 497427130 form

- Waiver and release from liability for minor child for bowling alley form

Find out other Ptax 324

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors