PTAX 324 Application for Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County 2017-2026

What is the PTAX 324 Application for Senior Citizens Homestead Exemption?

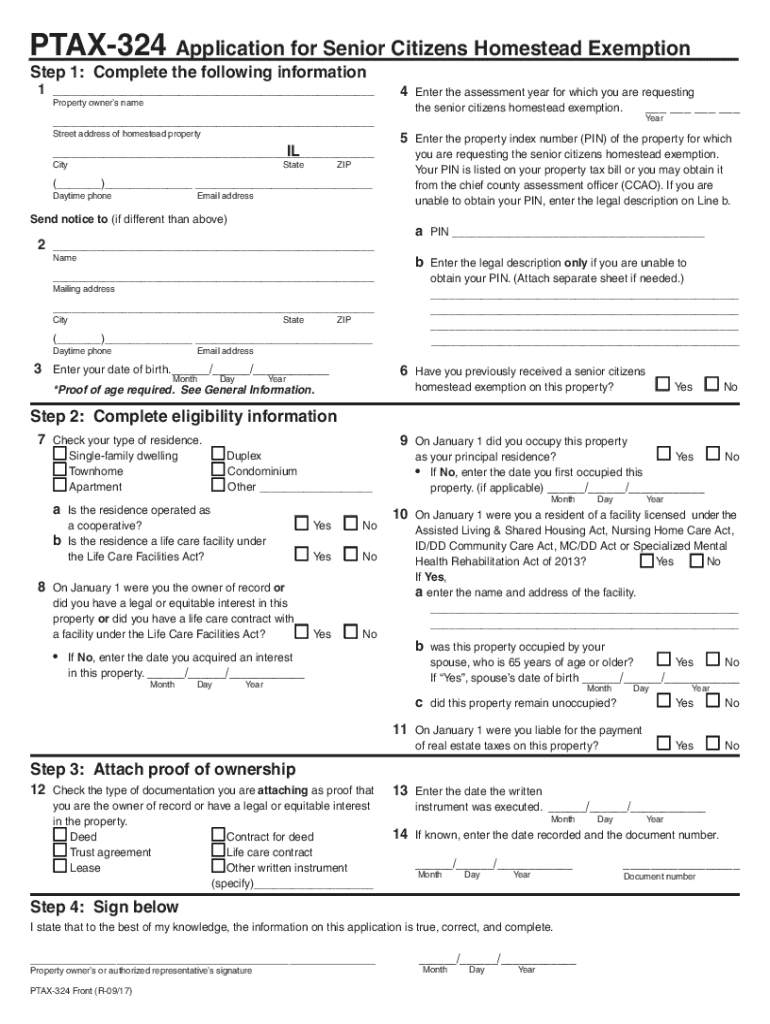

The PTAX 324 application is designed for senior citizens in the United States seeking a homestead exemption on their property taxes. This exemption can significantly reduce the amount of property tax owed, providing financial relief to eligible seniors. The application is specific to various counties, including Stephenson County, and requires proof of age and residency. It is important for applicants to understand the criteria and benefits associated with this exemption to ensure they receive the appropriate tax relief.

Eligibility Criteria for the PTAX 324 Application

To qualify for the PTAX 324 application, seniors must meet certain eligibility criteria. Typically, applicants need to be at least sixty-five years old and must own and occupy the property as their primary residence. Additionally, there may be income limits that determine eligibility for the exemption. It is crucial for applicants to review their local county regulations, as these can vary significantly across different regions.

Steps to Complete the PTAX 324 Application

Completing the PTAX 324 application involves several key steps:

- Gather necessary documentation, including proof of age, residency, and income.

- Obtain the PTAX 324 application form, which can often be found online or at local government offices.

- Fill out the application accurately, ensuring all required information is provided.

- Submit the application by the specified deadline, either online or via mail, depending on local procedures.

Taking care to follow these steps will help ensure a smooth application process.

Required Documents for the PTAX 324 Application

Applicants must provide specific documents when submitting the PTAX 324 application. Commonly required documents include:

- Proof of age, such as a birth certificate or driver's license.

- Documentation of property ownership, like a deed or tax bill.

- Income verification, which may include tax returns or income statements.

Having these documents ready will facilitate the application process and help avoid delays.

Form Submission Methods

The PTAX 324 application can typically be submitted through various methods. Applicants may have the option to:

- Submit the application online through the local county's tax assessor's website.

- Mail the completed application to the appropriate county office.

- Deliver the application in person at the county tax office.

Choosing the most convenient submission method can help ensure timely processing of the application.

Filing Deadlines for the PTAX 324 Application

Filing deadlines for the PTAX 324 application can vary by county. It is essential for applicants to be aware of these deadlines to ensure their applications are submitted on time. Generally, applications must be filed by a specific date each year to qualify for the exemption for that tax year. Checking with local tax authorities will provide the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete ptax 324 application for senior citizens homestead exemption senior citizens homestead exemption stephenson county

Easy Preparation of PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to find the necessary form and securely keep it in the cloud. airSlate SignNow equips you with everything needed to create, edit, and electronically sign your documents quickly and efficiently. Work on PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County from any device using the airSlate SignNow apps for Android or iOS and simplify your document-based tasks today.

Effortlessly Edit and eSign PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County

- Find PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County to ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 324 application for senior citizens homestead exemption senior citizens homestead exemption stephenson county

Create this form in 5 minutes!

How to create an eSignature for the ptax 324 application for senior citizens homestead exemption senior citizens homestead exemption stephenson county

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 2007 homestead form, and why do I need it?

The 2007 homestead form is essential for homeowners seeking to claim property tax exemptions based on their primary residence. It helps reduce the amount of taxable value of your home, thereby lowering your property taxes. Completing this form accurately is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with submitting the 2007 homestead application?

airSlate SignNow streamlines the submission of the 2007 homestead application by offering electronic signatures and document management. With its user-friendly interface, you can quickly fill out, sign, and send your application online, ensuring a faster processing time. This makes handling your homestead petitions seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for the 2007 homestead process?

Yes, while airSlate SignNow offers competitive pricing plans, the specific costs can vary based on the features you choose. However, the cost is often outweighed by the savings on property taxes you could achieve by properly filing your 2007 homestead form. Consider it an investment in your financial well-being.

-

What features does airSlate SignNow offer for handling the 2007 homestead documentation?

airSlate SignNow provides features like e-signatures, document templates, and real-time collaboration, specifically tailored for the 2007 homestead documentation. These tools not only save you time but ensure accuracy in your filing process. You can also track the status of your submission easily.

-

Can I integrate airSlate SignNow with other software for managing my 2007 homestead documents?

Absolutely! airSlate SignNow offers integration capabilities with various platforms, enhancing your workflow for managing the 2007 homestead documents. You can connect it with document storage services and CRM tools to keep all related information organized and accessible at your fingertips.

-

What are the benefits of using airSlate SignNow for my 2007 homestead application?

Using airSlate SignNow for your 2007 homestead application simplifies the process and reduces paperwork hassle. Its secure e-signature feature ensures compliance and safety while saving you time. Additionally, the platform's accessibility means you can manage your documents from anywhere.

-

How secure is airSlate SignNow when dealing with my 2007 homestead application?

airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect your 2007 homestead application data. Your personal and financial information remains confidential and secure throughout the signing process. Trust the platform to handle sensitive documents with care.

Get more for PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential washington form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property washington form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497429705 form

- Wa lease tenant form

- Washington arrangements form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497429710 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497429711 form

- Washington violating form

Find out other PTAX 324 Application For Senior Citizens Homestead Exemption Senior Citizens Homestead Exemption Stephenson County

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now