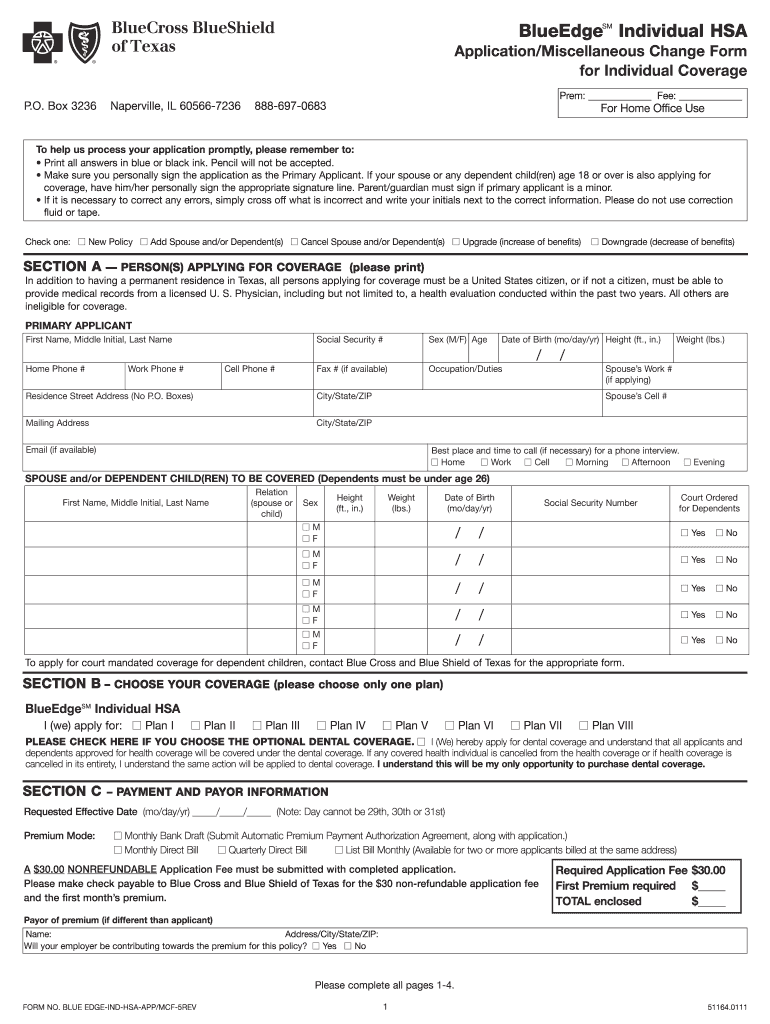

Blue Edge Individual Hsa Applicationmiscellaneou Change Form 2011-2026

Understanding Dependents Eligibility

Dependents eligibility refers to the criteria used to determine who qualifies as a dependent for tax purposes and other benefits. In the United States, the Internal Revenue Service (IRS) outlines specific guidelines that define dependents, which can include children, stepchildren, and qualifying relatives. Understanding these criteria is essential for individuals filing taxes or applying for benefits, as it can significantly impact tax deductions and credits.

To qualify as a dependent, the individual must meet certain conditions, including relationship, residency, age, and financial support tests. The relationship test ensures that the dependent is related to the taxpayer in a specified manner, while the residency test requires that the dependent lives with the taxpayer for more than half the year. The age test typically applies to children under the age of 19, or under 24 if they are full-time students. Lastly, the financial support test stipulates that the taxpayer must provide more than half of the dependent's financial support during the year.

Eligibility Criteria for Dependents

To determine dependents eligibility, specific criteria must be met. The IRS outlines two main categories of dependents: qualifying children and qualifying relatives. Each category has distinct requirements that must be satisfied.

- Qualifying Child: Must be the taxpayer's child, stepchild, foster child, sibling, or a descendant of any of these. The child must be under the age of 19, or under 24 if a full-time student, and must live with the taxpayer for more than half the year.

- Qualifying Relative: This category includes individuals who are not qualifying children but live with the taxpayer for the entire year and receive more than half of their support from the taxpayer. They must also meet specific income limits set by the IRS.

Application Process for Dependents Eligibility

To apply for dependents eligibility, taxpayers typically need to complete the appropriate tax forms during the filing process. The most common form is the IRS Form 1040, where taxpayers report their income and claim any dependents. When filling out this form, it is important to accurately list all qualifying dependents to ensure that the correct tax benefits are received.

In addition to the Form 1040, taxpayers may need to provide supporting documentation, such as birth certificates, Social Security numbers, and proof of residency, to substantiate their claims for dependents eligibility. Keeping organized records can facilitate the process and ensure compliance with IRS requirements.

Required Documents for Dependents Eligibility

When applying for dependents eligibility, several documents may be required to verify the relationship and residency of the dependent. These documents can include:

- Birth Certificates: To confirm the relationship between the taxpayer and the dependent.

- Social Security Cards: To provide proof of the dependent's identity and eligibility.

- Proof of Residency: Such as lease agreements or utility bills showing the dependent's address.

Gathering these documents in advance can streamline the application process and help avoid delays or complications during tax filing.

Filing Deadlines for Dependents Eligibility

Filing deadlines are critical for ensuring that dependents eligibility is recognized in a timely manner. For most taxpayers, the deadline to file federal income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers should be aware of any changes to deadlines, especially if they are applying for extensions or if they have special circumstances that may affect their filing status. It is advisable to file as early as possible to avoid any last-minute issues and ensure that all eligible dependents are accounted for in the tax return.

Penalties for Non-Compliance with Dependents Eligibility

Failing to accurately report dependents can lead to significant penalties and complications with the IRS. If a taxpayer incorrectly claims a dependent or fails to provide necessary documentation, they may face audits, fines, or denial of tax credits and deductions associated with dependents.

To avoid penalties, it is essential to understand the eligibility criteria fully and ensure that all information provided on tax forms is accurate and complete. Consulting with a tax professional can also provide guidance and help mitigate the risk of non-compliance.

Quick guide on how to complete blue edge individual hsa applicationmiscellaneou change form

The optimal method to discover and authorize Blue Edge Individual Hsa Applicationmiscellaneou Change Form

On a company-wide scale, inefficient procedures related to paper approvals can take up considerable work time. Signing documents such as Blue Edge Individual Hsa Applicationmiscellaneou Change Form is an inherent aspect of operations in any organization, which is why the efficiency of each agreement's lifecycle signNowly impacts the company's overall productivity. With airSlate SignNow, endorsing your Blue Edge Individual Hsa Applicationmiscellaneou Change Form is as straightforward and rapid as it can be. This platform provides you with the latest version of nearly any form. Even better, you can sign it right away without needing to install external applications on your device or printing physical copies.

How to obtain and approve your Blue Edge Individual Hsa Applicationmiscellaneou Change Form

- Explore our catalog by category or utilize the search bar to find the form you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Press Get form to start editing immediately.

- Fill out your form and include any required information using the toolbar.

- Once finished, click the Sign feature to endorse your Blue Edge Individual Hsa Applicationmiscellaneou Change Form.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to handle your documents effectively. You can discover, complete, edit, and even transmit your Blue Edge Individual Hsa Applicationmiscellaneou Change Form all within a single tab without any complications. Enhance your processes with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How can I change CA firms if I filled out an articleship form in February but did not submit it to the ICAI? Can the principal have restrictions in registration?

If the article ship registration has not been done, the principal can generally not restrict you.However, if there are any serious mis conduct on your end, then he can place his views to the Institute, so that the Institute can take appropriate action in such a way that you are not enrolled as an articled clerk under ICAI rules. But this is very rare, and exceptional circumstances.In general, and if you have conducted yourselves professionally, then there is no need to worry.

Create this form in 5 minutes!

How to create an eSignature for the blue edge individual hsa applicationmiscellaneou change form

How to create an electronic signature for the Blue Edge Individual Hsa Applicationmiscellaneou Change Form online

How to generate an eSignature for the Blue Edge Individual Hsa Applicationmiscellaneou Change Form in Google Chrome

How to make an electronic signature for putting it on the Blue Edge Individual Hsa Applicationmiscellaneou Change Form in Gmail

How to generate an electronic signature for the Blue Edge Individual Hsa Applicationmiscellaneou Change Form from your mobile device

How to create an electronic signature for the Blue Edge Individual Hsa Applicationmiscellaneou Change Form on iOS devices

How to create an electronic signature for the Blue Edge Individual Hsa Applicationmiscellaneou Change Form on Android OS

People also ask

-

What is dependents eligibility in relation to airSlate SignNow?

Dependents eligibility refers to the criteria that determine who qualifies as a dependent on your documents or forms sent via airSlate SignNow. This is crucial when signing or eSigning documents that require information about dependents. Understanding this ensures compliance with regulations and helps clarify responsibilities.

-

How can I manage dependents eligibility using airSlate SignNow?

With airSlate SignNow, you can easily manage dependents eligibility by customizing your documents to include fields for dependent information. This feature allows businesses to collect and maintain accurate records of eligible dependents, which can streamline processes such as benefits enrollment or dependent verification.

-

What are the pricing options for airSlate SignNow regarding dependents eligibility?

airSlate SignNow offers various pricing plans that cater to different business needs, including options that support processes involving dependents eligibility. By selecting a plan that suits your organization, you can ensure that you have access to all necessary features for managing documents related to dependents eligibility effectively.

-

Does airSlate SignNow offer features specifically for dependents eligibility?

Yes, airSlate SignNow includes features designed to help businesses accurately manage dependents eligibility through customizable templates and automated workflows. These tools facilitate the gathering of information related to dependents and ensure that your documents are compliant and up to date.

-

Can airSlate SignNow integrate with other systems related to dependents eligibility?

Absolutely! airSlate SignNow integrates seamlessly with various HR and management systems that help track dependents eligibility. This integration enhances efficiency by allowing for automatic updates and data sharing, thus reducing the manual workload involved in managing dependent information.

-

How does airSlate SignNow improve the process of verifying dependents eligibility?

airSlate SignNow streamlines the process of verifying dependents eligibility by allowing users to send, sign, and manage documents electronically. This reduces turnaround time and the potential for errors, making the verification process faster and more reliable for both businesses and employees.

-

What benefits does airSlate SignNow provide for managing dependents eligibility?

Using airSlate SignNow to manage dependents eligibility offers several benefits, including improved accuracy, reduced paper handling, and expedited processes for document signing. By automating these tasks, your business can focus more on strategic activities rather than administrative burdens.

Get more for Blue Edge Individual Hsa Applicationmiscellaneou Change Form

- Occupational therapy assistant associate degree application packet form

- Exome requisition for proband form

- Public history phdmiddle tennessee state university form

- Advising appointments seminole state college form

- Record evaluation for adjusted resident credit record evaluation for adjusted resident credit odu form

- Internships and co ops suny form

- 62817 medical student travel authorization form docx

- State medicaid recipients to get early prescription refills form

Find out other Blue Edge Individual Hsa Applicationmiscellaneou Change Form

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form