T1213 Oas 2018

What is the T1213 OAS?

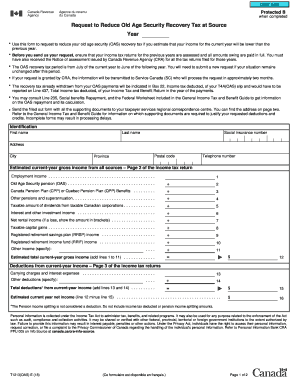

The T1213 OAS form, also known as the OAS tax form, is a document used by individuals in Canada to request a reduction in the amount of Old Age Security (OAS) recovery tax withheld from their benefits. This form is particularly relevant for seniors whose income exceeds a certain threshold, leading to a potential reduction in their OAS payments. By submitting the T1213 OAS, individuals can ensure that they are not overtaxed on their benefits, allowing for better financial planning and management of their retirement income.

How to use the T1213 OAS

Using the T1213 OAS form involves a straightforward process. First, individuals must accurately complete the form, providing necessary personal information, including their Social Insurance Number (SIN) and details about their income sources. Once completed, the form should be submitted to the Canada Revenue Agency (CRA) for review. Upon approval, the CRA will notify the individual and adjust the withholding tax on their OAS payments accordingly. This adjustment helps ensure that seniors receive the correct amount of benefits without excessive tax deductions.

Steps to complete the T1213 OAS

Completing the T1213 OAS form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including income statements and your SIN.

- Fill out the T1213 OAS form, ensuring all information is accurate.

- Double-check the form for any errors or omissions.

- Submit the completed form to the CRA by mail or online, if applicable.

- Await confirmation from the CRA regarding the approval of your request.

Legal use of the T1213 OAS

The T1213 OAS form is legally recognized as a valid request for adjusting the withholding tax on OAS benefits. It is essential to complete this form accurately and submit it in accordance with CRA guidelines to ensure compliance with tax regulations. Failure to use the form correctly may result in continued over-withholding of taxes, impacting an individual's financial situation. Understanding the legal implications of the T1213 OAS is crucial for seniors managing their retirement income.

Required Documents

To successfully complete the T1213 OAS form, individuals need to provide specific documents. These typically include:

- Social Insurance Number (SIN) documentation.

- Proof of income from various sources, such as pensions or investments.

- Any previous tax returns that may support the income claims made on the form.

Eligibility Criteria

Eligibility for using the T1213 OAS form generally includes being a senior receiving Old Age Security benefits and having an income that exceeds the specified threshold set by the CRA. Individuals must assess their financial situation to determine if they qualify for a reduction in the recovery tax. Meeting these criteria is essential for the successful approval of the form.

Quick guide on how to complete t1213 oas

Complete T1213 Oas effortlessly on any device

Managing online documents has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Handle T1213 Oas on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign T1213 Oas with ease

- Find T1213 Oas and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or black out sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and press the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or disorganized files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow takes care of all your documentation needs in just a few clicks from any device you prefer. Modify and eSign T1213 Oas to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1213 oas

Create this form in 5 minutes!

How to create an eSignature for the t1213 oas

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the oas tax form and who needs it?

The oas tax form is a document used for reporting Old Age Security benefits in Canada. It is essential for individuals receiving OAS payments to accurately declare their income and ensure compliance with tax regulations. Understanding this form is crucial for retirees looking to manage their finances efficiently.

-

How does airSlate SignNow facilitate the signing of the oas tax form?

airSlate SignNow enables users to easily upload and eSign the oas tax form electronically. This streamlines the process, making it quick and convenient to complete your tax documentation. With our solution, you can sign documents from anywhere, ensuring you don't miss important tax deadlines.

-

Are there any fees associated with using airSlate SignNow for the oas tax form?

Yes, airSlate SignNow offers various pricing plans, depending on your needs for signing the oas tax form. Our plans are competitively priced, ensuring that you have access to essential eSigning features without breaking the bank. You can choose the plan that best fits your requirements, whether for personal or business use.

-

Can airSlate SignNow integrate with other software for handling the oas tax form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms to enhance your document management process, including those used for filing the oas tax form. These integrations help streamline your workflow, making it easier to manage your documents all in one place.

-

What are the benefits of using airSlate SignNow for the oas tax form?

Using airSlate SignNow for your oas tax form provides several benefits, including ease of use, time savings, and enhanced security. Our platform allows for fast electronic signatures, so you can focus on more critical tasks without the hassle of paperwork. Additionally, all documents are securely stored, ensuring your information remains protected.

-

Is it safe to send the oas tax form using airSlate SignNow?

Yes, sending the oas tax form through airSlate SignNow is completely safe. We prioritize data security with advanced encryption protocols, ensuring that your sensitive information is handled with utmost care. You can sign and share your documents with confidence, knowing your data is secure.

-

How can I access my signed oas tax form after using airSlate SignNow?

After signing your oas tax form using airSlate SignNow, you can easily access it through your account dashboard. The platform provides you with a secure repository where all your signed documents are stored, allowing for easy retrieval whenever you need them. Plus, you can download or share them directly from your account.

Get more for T1213 Oas

Find out other T1213 Oas

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF