T1213OAS Request to Reduce Old Age Security Recovery 2020-2026

What is the T1213OAS Request To Reduce Old Age Security Recovery

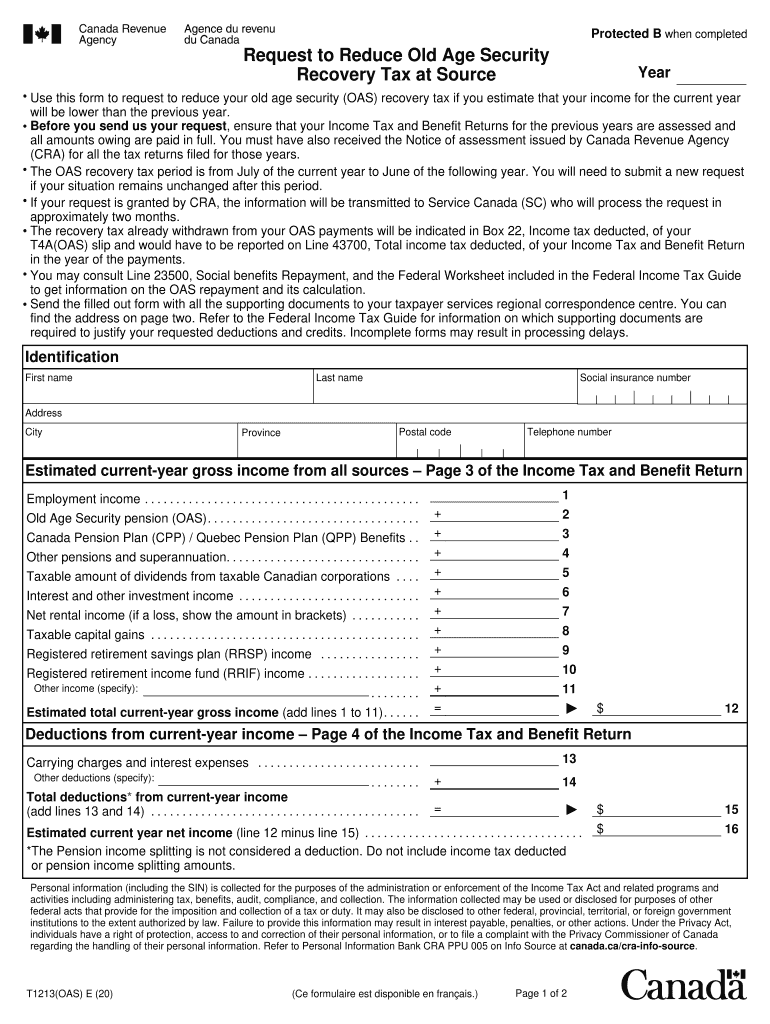

The T1213OAS is a form used to request a reduction in the recovery of Old Age Security (OAS) benefits. This form is particularly relevant for individuals whose income may exceed the threshold for full OAS benefits, leading to a clawback situation. By submitting the T1213OAS, taxpayers can provide the Canada Revenue Agency (CRA) with information about their estimated income for the year, allowing for a potential adjustment in the amount recovered from their OAS payments.

How to use the T1213OAS Request To Reduce Old Age Security Recovery

Using the T1213OAS involves several key steps. First, gather all necessary documentation related to your income and any deductions you may be eligible for. This information will help you accurately complete the form. After filling out the form with your details, submit it to the CRA. It is advisable to keep a copy of the submitted form for your records. Once the CRA processes your request, they will inform you of any adjustments to your OAS recovery amount.

Steps to complete the T1213OAS Request To Reduce Old Age Security Recovery

Completing the T1213OAS form requires careful attention to detail. Here are the steps to follow:

- Obtain the T1213OAS form from the CRA website or through other official channels.

- Fill out your personal information, including your name, address, and Social Insurance Number (SIN).

- Provide an estimate of your income for the year, along with any relevant deductions.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the CRA, either online or by mail.

Required Documents

When completing the T1213OAS, certain documents may be necessary to support your request. These documents can include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of any deductions or credits you plan to claim.

- Any correspondence from the CRA regarding your OAS benefits.

Eligibility Criteria

To be eligible to use the T1213OAS form, you must meet specific criteria. You should be receiving Old Age Security benefits and anticipate that your income will exceed the threshold set by the CRA for the current year. This form is particularly useful for individuals who may experience fluctuations in income, such as retirees with variable income sources or those working part-time.

Form Submission Methods

The T1213OAS can be submitted through various methods, ensuring flexibility for users. You can submit the form online through the CRA's secure portal, by mail to the appropriate CRA office, or in-person at designated locations. Each method has its own processing times, so consider your needs when choosing how to submit.

Quick guide on how to complete t1213oas request to reduce old age security recovery

Prepare T1213OAS Request To Reduce Old Age Security Recovery with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage T1213OAS Request To Reduce Old Age Security Recovery on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign T1213OAS Request To Reduce Old Age Security Recovery effortlessly

- Locate T1213OAS Request To Reduce Old Age Security Recovery and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important paragraphs of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form—via email, SMS, or an invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign T1213OAS Request To Reduce Old Age Security Recovery while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1213oas request to reduce old age security recovery

Create this form in 5 minutes!

How to create an eSignature for the t1213oas request to reduce old age security recovery

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is t1213oas and how does it benefit my business?

The t1213oas is a key feature of airSlate SignNow that streamlines the document signing process. It empowers businesses to efficiently send and eSign documents, reducing turnaround time and improving productivity. By leveraging t1213oas, you can ensure your agreements are signed accurately and securely.

-

How does airSlate SignNow's t1213oas feature compare in pricing to other eSignature solutions?

AirSlate SignNow offers competitive pricing for its t1213oas feature, making it an affordable choice for businesses of all sizes. Unlike many other eSignature solutions, airSlate SignNow provides a cost-effective platform without sacrificing quality or features. This ensures that you can access powerful tools like t1213oas within a budget-friendly plan.

-

What features are included with the t1213oas functionality?

The t1213oas functionality includes robust features such as templates, automated workflows, and integration capabilities with various platforms. These features enhance your document management process and enable seamless collaboration. With t1213oas, you gain access to user-friendly tools designed to facilitate faster document turnaround.

-

Can I integrate the t1213oas feature with other software I use?

Yes, airSlate SignNow's t1213oas integrates easily with numerous software platforms, including CRM and document management systems. This flexibility allows you to incorporate t1213oas into your existing workflows effortlessly. By doing so, you can streamline your operations and enhance your productivity.

-

Is the t1213oas feature secure for my sensitive documents?

Absolutely, the t1213oas feature is designed with security in mind. AirSlate SignNow employs advanced encryption and compliance measures to protect your sensitive documents during the signing process. You can confidently use t1213oas, knowing that your data is secure and meets industry standards.

-

What are the key benefits of using t1213oas for document signing?

The primary benefits of using t1213oas include increased efficiency, reduced paper usage, and improved document accuracy. By adopting t1213oas, businesses can shorten the time it takes to get documents signed, which ultimately leads to faster deal closures. Furthermore, the environmental impact of reduced paper usage is a bonus.

-

How can I get started with t1213oas on airSlate SignNow?

Getting started with t1213oas on airSlate SignNow is simple. Just sign up for a free trial or choose a plan that suits your business needs. Once you’re on board, you can quickly access and utilize the t1213oas features to enhance your document signing experience.

Get more for T1213OAS Request To Reduce Old Age Security Recovery

Find out other T1213OAS Request To Reduce Old Age Security Recovery

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors