PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK Gov 2020

What is the Oklahoma Form OW-8ES for 2019?

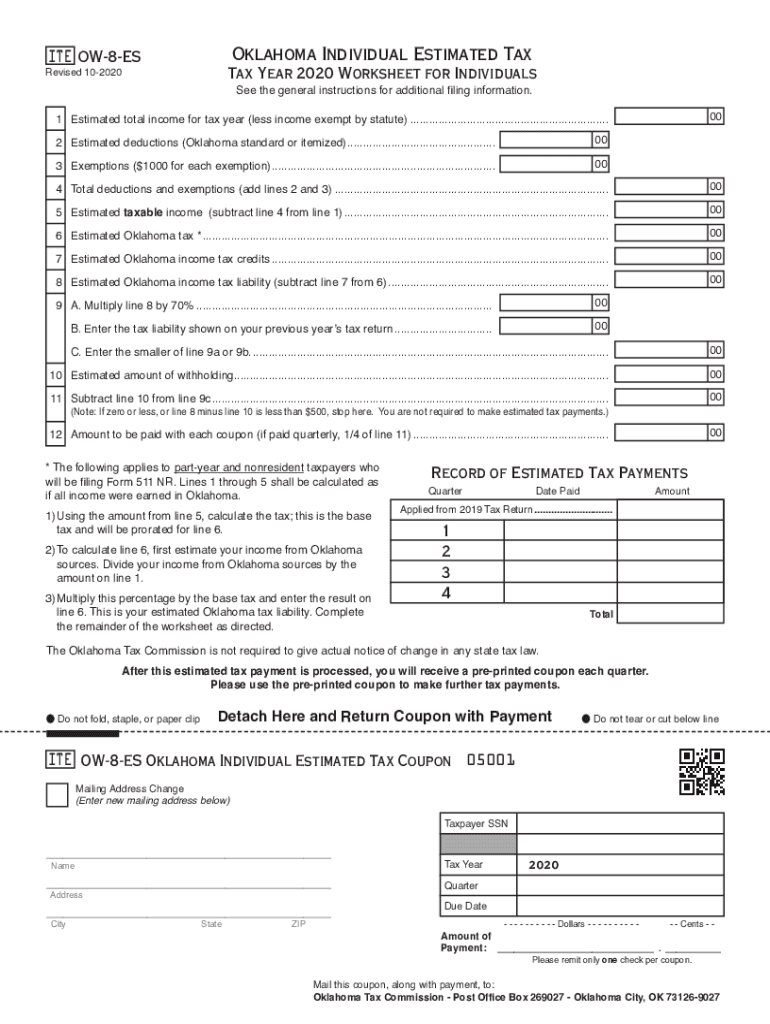

The Oklahoma Form OW-8ES is an essential document used for making estimated tax payments for individuals in the state of Oklahoma. This form is specifically designed for taxpayers who expect to owe $1,000 or more in state income tax for the year. By submitting this form, individuals can ensure they meet their tax obligations throughout the year, rather than waiting until the annual tax return is filed. The OW-8ES form includes details such as payment amounts and due dates, making it a key component in managing personal tax responsibilities.

Steps to Complete the Oklahoma Form OW-8ES

Completing the Oklahoma Form OW-8ES involves several straightforward steps:

- Gather necessary financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability based on your income projections.

- Determine the amount to be paid with the OW-8ES form, which is typically one-fourth of your total estimated tax liability.

- Fill out the form accurately, ensuring all personal details and calculations are correct.

- Submit the completed form along with your payment by the specified due date to avoid penalties.

Filing Deadlines for the Oklahoma Form OW-8ES

Timely submission of the Oklahoma Form OW-8ES is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first payment

- June 15 for the second payment

- September 15 for the third payment

- January 15 of the following year for the fourth payment

It is important to mark these dates on your calendar to ensure compliance with Oklahoma tax regulations.

Required Documents for Filing the Oklahoma Form OW-8ES

To accurately complete the Oklahoma Form OW-8ES, you will need several documents, including:

- Your previous year's tax return to estimate your current tax liability.

- Any relevant income statements, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

Having these documents on hand will streamline the process and enhance the accuracy of your estimated tax calculations.

Legal Use of the Oklahoma Form OW-8ES

The Oklahoma Form OW-8ES is legally recognized as a valid method for individuals to report and pay estimated taxes. Compliance with state tax laws is essential, and using this form helps ensure that taxpayers fulfill their obligations. It is important to note that failure to file or pay estimated taxes can result in penalties and interest charges, making it vital to adhere to the guidelines set forth by the Oklahoma Tax Commission.

Who Issues the Oklahoma Form OW-8ES?

The Oklahoma Form OW-8ES is issued by the Oklahoma Tax Commission, the state agency responsible for administering tax laws and collecting revenue. This agency provides guidelines, resources, and support for individuals navigating their tax responsibilities. For any questions or clarifications regarding the form, taxpayers can refer to the Oklahoma Tax Commission's official resources or contact their offices directly.

Quick guide on how to complete pdf oklahoma individual estimated tax oklahoma wwwokgov

Effortlessly Prepare PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and eSign PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov with Ease

- Obtain PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow portions of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), conversation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov to ensure outstanding communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf oklahoma individual estimated tax oklahoma wwwokgov

Create this form in 5 minutes!

How to create an eSignature for the pdf oklahoma individual estimated tax oklahoma wwwokgov

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Oklahoma Form OW8ES for 2019, and how can airSlate SignNow help?

The Oklahoma Form OW8ES for 2019 is a document used for reporting specific employment information to the state. airSlate SignNow simplifies the completion and submission of this form, allowing users to eSign and share it securely. With our user-friendly interface, businesses can easily manage their paperwork without any hassle.

-

Is airSlate SignNow suitable for filing the Oklahoma Form OW8ES for 2019?

Yes, airSlate SignNow is perfectly suited for filing the Oklahoma Form OW8ES for 2019. Our platform provides tools for easy document creation, signing, and management that comply with state requirements. You can ensure a smooth filing process without the complexity of manual paperwork.

-

What are the pricing options for using airSlate SignNow for the Oklahoma Form OW8ES for 2019?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you need basic features or advanced tools for managing documents like the Oklahoma Form OW8ES for 2019. Our solutions are designed to be cost-effective, making it easier for organizations to comply with state regulations.

-

What features does airSlate SignNow offer for handling documents like the Oklahoma Form OW8ES for 2019?

airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These tools make it easy to fill out and send the Oklahoma Form OW8ES for 2019 quickly and efficiently. Our platform also ensures secure storage and easy access to your documents.

-

Can I track the status of my Oklahoma Form OW8ES for 2019 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents, including the Oklahoma Form OW8ES for 2019, in real-time. You will receive notifications when the form is viewed and signed, keeping you informed throughout the process.

-

What are the benefits of using airSlate SignNow for the Oklahoma Form OW8ES for 2019?

Using airSlate SignNow for the Oklahoma Form OW8ES for 2019 streamlines your documentation process. It reduces the time and effort spent on manual tasks and minimizes errors associated with paper forms. Our platform enhances productivity, allowing your team to focus on more important tasks.

-

Does airSlate SignNow integrate with other tools for handling the Oklahoma Form OW8ES for 2019?

Yes, airSlate SignNow integrates seamlessly with various popular business applications, making it easier to manage the Oklahoma Form OW8ES for 2019 alongside your existing workflows. You can connect with tools like CRM systems or project management software to enhance document handling and efficiency.

Get more for PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov

- Letter from landlord to tenant as notice to remove unauthorized inhabitants west virginia form

- Utility shut off 497431689 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat west virginia form

- Release claim lien form

- Conditional waiver and release of claim of lien upon final payment west virginia form

- 90 day notice to terminate year to year lease prior to end of term residential from landlord to tenant west virginia form

- West virginia notice 497431696 form

- Wv month form

Find out other PDF Oklahoma Individual Estimated Tax Oklahoma, Www OK gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors