2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals 2022

What is the 2022 Form OW-8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals

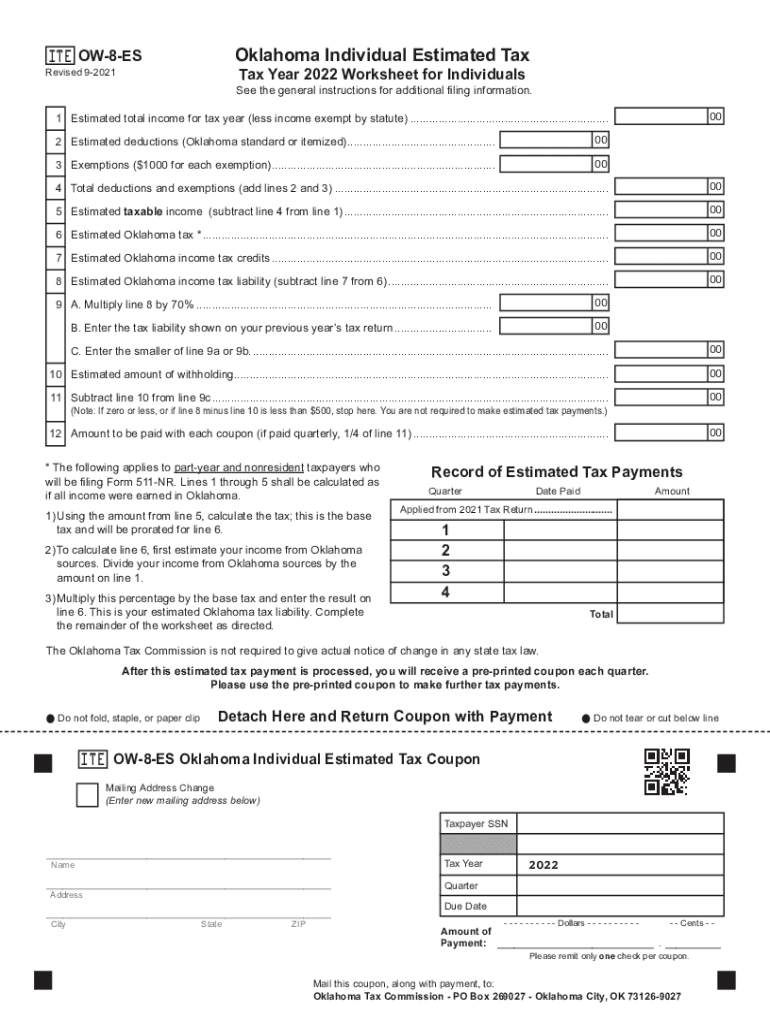

The 2022 Form OW-8 ES is designed for individuals in Oklahoma to calculate and report their estimated tax payments. This form is essential for taxpayers who expect to owe more than one thousand dollars in state tax after subtracting withholding and refundable credits. The OW-8 ES worksheet helps individuals estimate their tax liability based on their income, deductions, and credits for the tax year. It is crucial for self-employed individuals, retirees, and those with significant investment income to ensure they meet their tax obligations throughout the year.

Steps to Complete the 2022 Form OW-8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals

Completing the 2022 Form OW-8 ES involves several key steps:

- Gather necessary documents: Collect your previous year’s tax return, income statements, and any relevant financial documents.

- Estimate your income: Determine your expected income for the current year, including wages, self-employment income, and investment earnings.

- Calculate deductions: Identify any deductions you plan to claim, such as mortgage interest, charitable contributions, or medical expenses.

- Complete the worksheet: Fill out the OW-8 ES form by entering your estimated income, deductions, and applicable credits.

- Determine your estimated tax: Use the worksheet to calculate your estimated tax liability for the year.

- Submit your payments: Based on your calculations, make quarterly estimated tax payments to the Oklahoma Tax Commission.

Legal Use of the 2022 Form OW-8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals

The 2022 Form OW-8 ES is legally recognized for estimating tax liabilities in Oklahoma. It serves as an official document that taxpayers can use to report their estimated tax payments to the state. Proper completion and timely submission of this form help individuals avoid penalties for underpayment of taxes. The form must be used in accordance with Oklahoma tax laws and should reflect accurate and truthful information to maintain compliance.

Filing Deadlines / Important Dates

For the 2022 tax year, estimated tax payments using the OW-8 ES form are generally due on the following dates:

- First quarter: April 15, 2022

- Second quarter: June 15, 2022

- Third quarter: September 15, 2022

- Fourth quarter: January 15, 2023

It is essential to adhere to these deadlines to avoid interest and penalties for late payments. Taxpayers should also be aware of any changes in deadlines due to holidays or other circumstances.

Who Issues the Form

The 2022 Form OW-8 ES is issued by the Oklahoma Tax Commission. This state agency is responsible for administering tax laws and ensuring compliance among Oklahoma taxpayers. The form is available on the Oklahoma Tax Commission's official website and can be obtained in both digital and paper formats. It is important for taxpayers to use the most current version of the form to ensure compliance with state regulations.

Key Elements of the 2022 Form OW-8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals

The OW-8 ES form includes several key elements that taxpayers need to complete accurately:

- Personal information: Taxpayer's name, address, and Social Security number.

- Income estimates: Sections for reporting various sources of income, including wages and self-employment income.

- Deductions and credits: Areas to input anticipated deductions and tax credits that will affect the estimated tax calculation.

- Estimated tax calculation: A section that summarizes the taxpayer's estimated tax liability based on the provided information.

Completing these elements accurately is crucial for ensuring that the estimated tax payments are correctly calculated and reported.

Quick guide on how to complete 2022 form ow 8 es oklahoma individual estimated tax year 2021 worksheet for individuals

Complete 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals effortlessly on any gadget

Digital document management has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals with ease

- Locate 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive info using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Edit and eSign 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ow 8 es oklahoma individual estimated tax year 2021 worksheet for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2022 form ow 8 es oklahoma individual estimated tax year 2021 worksheet for individuals

The best way to create an e-signature for a PDF document online

The best way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Oklahoma estimated tax and how does it work?

Oklahoma estimated tax is a method for taxpayers to prepay their expected state income tax liability throughout the year. This helps individuals and businesses avoid penalties and interest on underpayment by making quarterly payments based on previous earnings. The amount can vary depending on your income, and using tools like airSlate SignNow can streamline the document process for estimated tax payments.

-

How can airSlate SignNow help with Oklahoma estimated tax calculations?

airSlate SignNow provides easy-to-use document management tools that can assist you in organizing your financial records for Oklahoma estimated tax calculations. By using our eSigning feature, you can quickly send and receive necessary tax documents, ensuring you have accurate information for your estimated tax filings. Keeping your documents organized is crucial for correct estimated tax preparation.

-

What are the benefits of using airSlate SignNow for Oklahoma estimated tax eSignatures?

Using airSlate SignNow for Oklahoma estimated tax eSignatures simplifies the signing process of important tax documents. It reduces turnaround times, enhances efficiency, and helps ensure compliance with state requirements. With fast, secure digital signatures, businesses can stay organized and focused on completing their tax obligations on time.

-

Are there integration options with airSlate SignNow for managing Oklahoma estimated tax documents?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software that can help manage your Oklahoma estimated tax documents effectively. These integrations allow for seamless data transfer, making it easier to calculate, submit, and track your estimated tax payments. Simplifying your tax management process leads to accurate filings and reduced stress.

-

How does pricing work for airSlate SignNow when managing Oklahoma estimated tax documents?

airSlate SignNow offers a cost-effective solution with flexible pricing plans suitable for businesses of all sizes. The plans include features that make it easier to manage Oklahoma estimated tax documents efficiently, from sending forms to collecting electronic signatures. Users can choose a plan that best fits their needs without overspending on unnecessary features.

-

Can I use airSlate SignNow to track my Oklahoma estimated tax payments?

While airSlate SignNow is primarily focused on document signing and management, it can help you track important deadlines and receive reminders through organized workflows. By keeping all your Oklahoma estimated tax documents in one place, you can ensure timely payments to avoid penalties. Combining document management with effective tracking can streamline your tax process.

-

What features does airSlate SignNow offer for Oklahoma estimated tax document management?

airSlate SignNow provides a variety of features designed to enhance document management for Oklahoma estimated tax purposes, including customizable templates, secure cloud storage, and electronic signatures. These tools help users create, sign, and send essential tax forms efficiently. By leveraging these features, businesses can better manage their tax submissions and ensure compliance.

Get more for 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

- Sample notice of default commercial lease form

- Residential or rental lease extension agreement florida form

- Commercial rental lease application questionnaire florida form

- Apartment lease rental application questionnaire florida form

- Fl lease form

- Salary verification form for potential lease florida

- Florida agreement tenant form

- Notice of default on residential lease florida form

Find out other 2022 Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure