Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet for Individuals 2023-2026

What is the Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

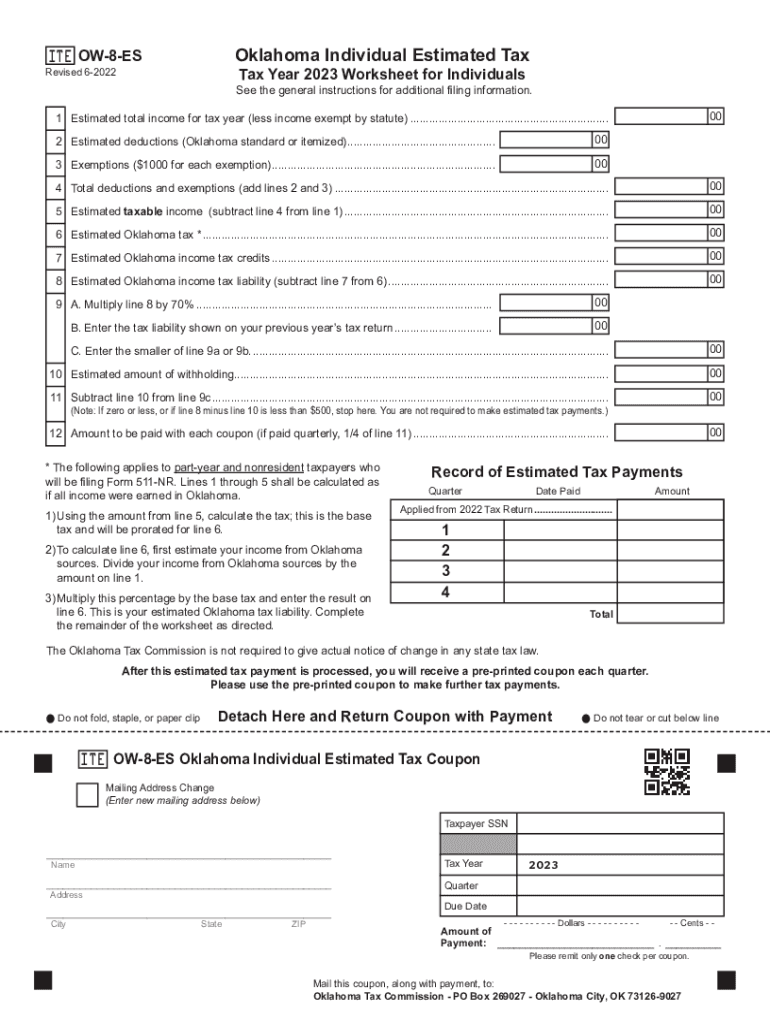

The Form OW 8 ES is an essential document used by individuals in Oklahoma to calculate and report their estimated tax payments for the year. This form is specifically designed for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. It helps individuals determine the amount they should pay quarterly to avoid underpayment penalties. The OW 8 ES is part of the Oklahoma tax system and is crucial for managing tax obligations effectively.

How to use the Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

Using the Form OW 8 ES involves several steps to ensure accurate calculations of estimated tax payments. Taxpayers should start by gathering their financial information, including income sources, deductions, and credits. The form provides a worksheet that guides users through the calculation process. It is important to follow the instructions carefully to determine the correct payment amounts for each quarter. This proactive approach helps in managing tax liabilities throughout the year.

Steps to complete the Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

Completing the Form OW 8 ES requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name and Social Security number.

- Calculate your expected income for the year, taking into account all sources of revenue.

- Determine your deductions and credits, which will affect your taxable income.

- Use the provided worksheet to calculate your estimated tax liability based on the information provided.

- Divide your total estimated tax by four to find your quarterly payment amount.

- Record the payment amounts on the form and keep a copy for your records.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form OW 8 ES is critical for compliance with Oklahoma tax laws. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. It is essential to adhere to these deadlines to avoid penalties for late payments. Marking these dates on your calendar can help ensure timely submissions and maintain good standing with the Oklahoma Tax Commission.

Legal use of the Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

The Form OW 8 ES serves a legal purpose in the Oklahoma tax system. It is used to report estimated tax payments, which are required by law for individuals who expect to owe a certain amount in taxes. Proper use of this form ensures compliance with state tax regulations and helps avoid potential legal issues related to underpayment or late filing. Taxpayers should ensure that all information provided is accurate and complete to uphold the legal integrity of their filings.

Who Issues the Form

The Form OW 8 ES is issued by the Oklahoma Tax Commission. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The commission provides the necessary forms and guidelines for individuals to fulfill their tax obligations. It is advisable for taxpayers to refer to the Oklahoma Tax Commission's official resources for the most current version of the form and any updates regarding tax regulations.

Quick guide on how to complete form ow 8 es oklahoma individual estimated tax year worksheet for individuals

Easily Prepare Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to efficiently create, modify, and eSign your documents without delay. Manage Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals Effortlessly

- Obtain Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals and click on Get Form to initiate the process.

- Utilize the provided tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify all information and click on the Done button to save your changes.

- Choose your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ow 8 es oklahoma individual estimated tax year worksheet for individuals

Create this form in 5 minutes!

How to create an eSignature for the form ow 8 es oklahoma individual estimated tax year worksheet for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ow 8 es 2024?

airSlate SignNow is a digital solution that enables businesses to send and eSign documents easily. With features specifically designed for efficiency, it is built to meet the evolving needs of companies in 2024, making it ideal for those looking for solutions related to ow 8 es 2024.

-

How much does airSlate SignNow cost for businesses focusing on ow 8 es 2024?

The pricing for airSlate SignNow is competitive and designed to provide excellent value for businesses. Plans start at a reasonable monthly fee, allowing teams to utilize the platform’s features while aligning with their budget for ow 8 es 2024.

-

What are the key features of airSlate SignNow that support ow 8 es 2024?

Key features of airSlate SignNow include document templates, advanced eSigning capabilities, and integration with various applications. These functionalities cater to the growing demands for solutions like ow 8 es 2024, ensuring efficient document workflows.

-

Can airSlate SignNow help improve my business efficiency in relation to ow 8 es 2024?

Absolutely! airSlate SignNow streamlines document management from sending to signing, which signNowly enhances operational efficiency. As companies adapt to trends associated with ow 8 es 2024, utilizing this platform can lead to faster turnaround times.

-

What integrations does airSlate SignNow offer for users interested in ow 8 es 2024?

airSlate SignNow integrates seamlessly with popular applications, enhancing its utility for businesses focusing on ow 8 es 2024. This connectivity allows users to embed eSigning capabilities directly into their existing workflows.

-

Is airSlate SignNow secure for sensitive documents related to ow 8 es 2024?

Yes, security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and secure access protocols, ensuring that all documents, especially those pertinent to ow 8 es 2024, are protected.

-

How does airSlate SignNow enhance customer experience associated with ow 8 es 2024?

With its user-friendly interface and streamlined processes, airSlate SignNow enhances customer experience signNowly. Businesses can provide a smoother document handling process, which is particularly valuable amidst the changing landscape of ow 8 es 2024.

Get more for Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

- Usable life group enrollment or change form

- Dos 1587 new york state department of state ny gov form

- Afls assessment sample report form

- Sacred pathways test form

- Chain of custody form

- It contractor agreement template form

- Independant contractor agreement template form

- Independent contractor accountant agreement template form

Find out other Form OW 8 ES Oklahoma Individual Estimated Tax Year Worksheet For Individuals

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement