Form W 3 Transmittal of Wage and Tax Statements QuickBooks 2019

Understanding the Oklahoma Monthly Withholding Tax Form 2018 WTH10001

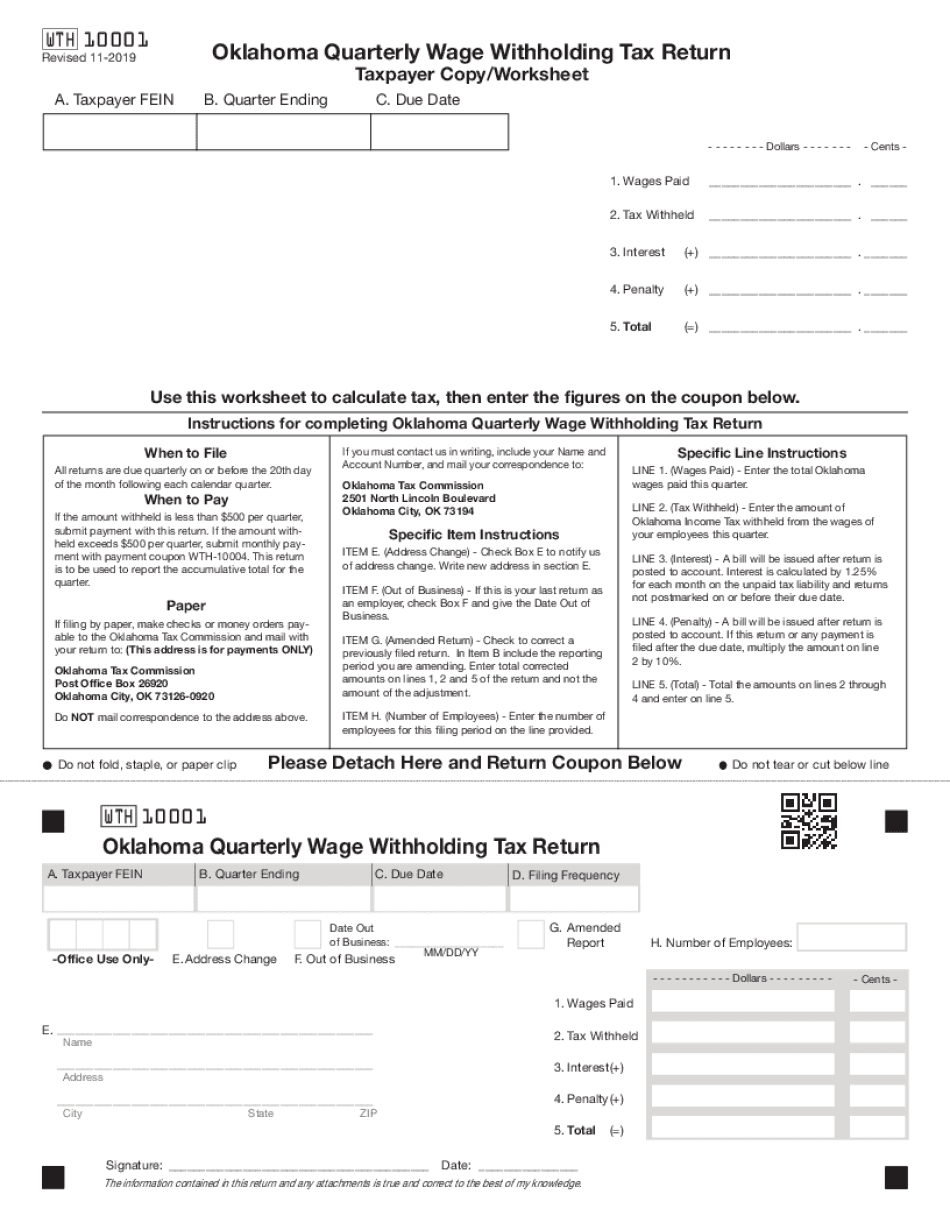

The Oklahoma monthly withholding tax form 2018 WTH10001 is essential for employers in Oklahoma to report and remit state income tax withheld from employees' wages. This form ensures compliance with state tax laws and helps maintain accurate records for both the employer and the state tax commission. Employers must be aware of the specific requirements and deadlines associated with this form to avoid penalties.

Steps to Complete the Oklahoma WTH10001 Form

Filling out the Oklahoma WTH10001 form involves several key steps:

- Gather necessary information, including the employer's identification number, employee details, and total wages paid.

- Calculate the total amount of state income tax withheld for the reporting period.

- Complete the form by entering the required information accurately in the designated fields.

- Review the completed form for any errors or omissions before submission.

Form Submission Methods for Oklahoma WTH10001

Employers have multiple options for submitting the Oklahoma WTH10001 form:

- Online Submission: Many employers choose to file electronically through the Oklahoma Tax Commission's online portal, which offers a streamlined process.

- Mail Submission: Alternatively, employers can print the completed form and mail it to the appropriate address specified by the Oklahoma Tax Commission.

- In-Person Submission: Some employers may prefer to deliver the form in person at a local tax commission office.

Filing Deadlines for Oklahoma WTH10001

It is crucial for employers to adhere to filing deadlines to avoid penalties. The Oklahoma WTH10001 form must be filed monthly, with payments due by the 15th of the following month. For example, the form for January must be submitted by February 15. Employers should mark these dates on their calendars to ensure timely compliance.

Penalties for Non-Compliance with Oklahoma Tax Regulations

Failure to file the Oklahoma WTH10001 form on time or inaccuracies in reporting can lead to significant penalties. The Oklahoma Tax Commission may impose fines based on the amount of tax due or the duration of the delay. Understanding these potential consequences can motivate employers to prioritize accurate and timely submissions.

Legal Use of the Oklahoma WTH10001 Form

The Oklahoma WTH10001 form is legally binding when completed and submitted according to state regulations. It is important for employers to ensure that all information provided is accurate and truthful to maintain compliance with state tax laws. Failure to adhere to these legal requirements can result in audits or legal repercussions.

Quick guide on how to complete form w 3 transmittal of wage and tax statements quickbooks

Effortlessly Prepare Form W 3 Transmittal Of Wage And Tax Statements QuickBooks on Any Device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Form W 3 Transmittal Of Wage And Tax Statements QuickBooks on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

Edit and eSign Form W 3 Transmittal Of Wage And Tax Statements QuickBooks with Ease

- Obtain Form W 3 Transmittal Of Wage And Tax Statements QuickBooks and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or black out sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form W 3 Transmittal Of Wage And Tax Statements QuickBooks to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 3 transmittal of wage and tax statements quickbooks

Create this form in 5 minutes!

How to create an eSignature for the form w 3 transmittal of wage and tax statements quickbooks

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the oklahoma monthly withholding tax form 2018 wth10001?

The oklahoma monthly withholding tax form 2018 wth10001 is a tax form used by employers in Oklahoma to report and pay employee withholding taxes. This form helps ensure compliance with state tax regulations and allows businesses to accurately submit their monthly withholding tax obligations.

-

How can airSlate SignNow assist in completing the oklahoma monthly withholding tax form 2018 wth10001?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the oklahoma monthly withholding tax form 2018 wth10001. By using our eSignature features, businesses can easily complete and send the form digitally, making tax compliance easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for the oklahoma monthly withholding tax form 2018 wth10001?

airSlate SignNow offers various pricing plans that cater to different business needs. While some plans allow for basic document signing, others provide advanced features for managing the oklahoma monthly withholding tax form 2018 wth10001 and other documents, making it a cost-effective solution for every budget.

-

What features does airSlate SignNow provide for managing tax forms like the oklahoma monthly withholding tax form 2018 wth10001?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage to help manage tax forms like the oklahoma monthly withholding tax form 2018 wth10001. Users can streamline their workflows and ensure their documents are secure and easily accessible.

-

Can I integrate airSlate SignNow with other financial software for the oklahoma monthly withholding tax form 2018 wth10001?

Yes, airSlate SignNow offers integrations with various accounting and financial software to streamline the process for handling the oklahoma monthly withholding tax form 2018 wth10001. This allows you to import data directly, reducing errors and saving time.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers multiple benefits including time savings, enhanced security, and easier compliance. The platform allows you to efficiently manage the oklahoma monthly withholding tax form 2018 wth10001 with ease, minimizing the risk of errors and ensuring timely submissions.

-

Is support available for businesses using airSlate SignNow for the oklahoma monthly withholding tax form 2018 wth10001?

Absolutely! airSlate SignNow provides dedicated support to assist businesses in navigating their requirements for the oklahoma monthly withholding tax form 2018 wth10001. From setup to troubleshooting, our support team is available to ensure you have a seamless experience.

Get more for Form W 3 Transmittal Of Wage And Tax Statements QuickBooks

- 90 day notice to terminate year to year lease prior to end of term residential from tenant to landlord west virginia form

- West virginia lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord west virginia form

- Assignment of deed of trust by individual mortgage holder west virginia form

- West virginia holder 497431702 form

- West virginia form 497431703

- West virginia lease 497431704 form

- 30 day notice to terminate month to month lease for nonresidential from landlord to tenant west virginia form

Find out other Form W 3 Transmittal Of Wage And Tax Statements QuickBooks

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word