Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return 2021-2026

What is the Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

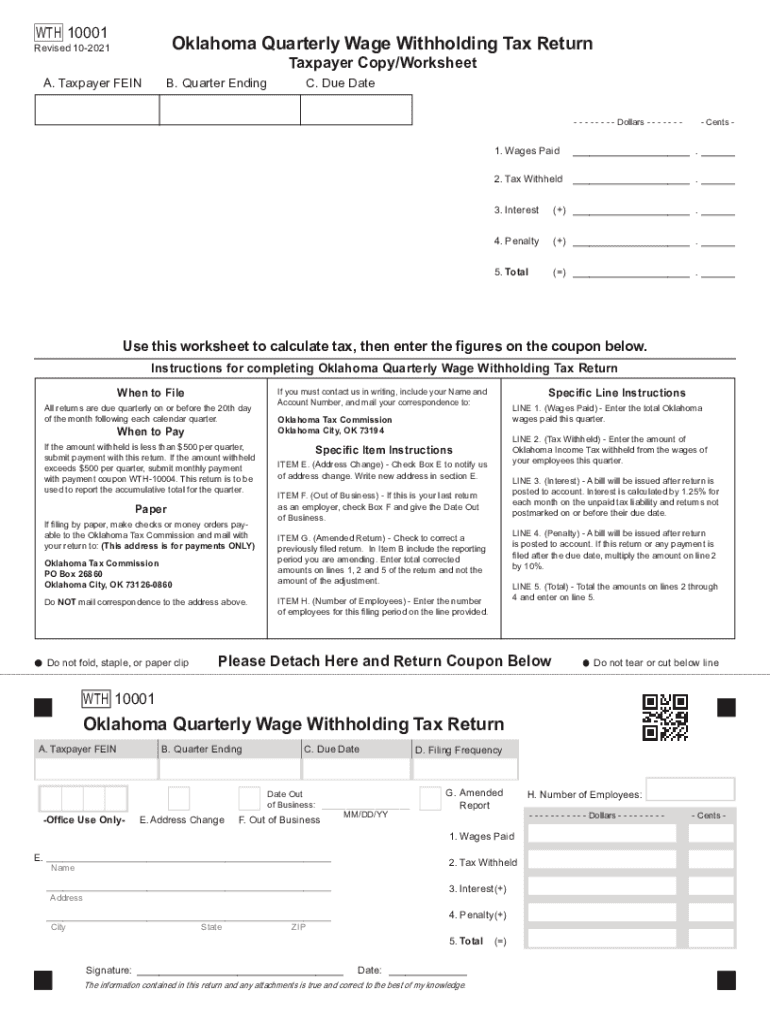

The Form WTH 10001 is the Oklahoma Quarterly Wage Withholding Tax Return, a crucial document for employers in Oklahoma. This form is used to report the amount of state income tax withheld from employees' wages during a specific quarter. Employers are required to submit this form to ensure compliance with state tax laws and to facilitate the proper collection of withholding taxes. Understanding the purpose and requirements of this form is essential for maintaining accurate payroll records and fulfilling tax obligations.

Steps to complete the Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

Completing the Form WTH 10001 involves several key steps:

- Gather necessary information, including total wages paid, the amount of state income tax withheld, and employee details.

- Fill out the form accurately, ensuring that all figures are correct and that you have included all required employee information.

- Double-check the calculations to avoid errors that could lead to penalties or delays.

- Submit the completed form by the designated filing deadline, which is typically the last day of the month following the end of the quarter.

Legal use of the Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

The Form WTH 10001 is legally binding when completed and submitted according to Oklahoma state law. It serves as an official record of the withholding tax collected from employees, which is necessary for both the employer's compliance and the state's revenue collection. To ensure its legal standing, employers must adhere to filing deadlines and accurately report all required information. Failure to do so may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form WTH 10001 to avoid late fees and penalties. The form is due on the last day of the month following the end of each quarter. For example:

- For the first quarter (January to March), the due date is April 30.

- For the second quarter (April to June), the due date is July 31.

- For the third quarter (July to September), the due date is October 31.

- For the fourth quarter (October to December), the due date is January 31 of the following year.

How to obtain the Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

The Form WTH 10001 can be obtained through the Oklahoma Tax Commission's official website. Employers can download the form directly in PDF format for easy access. Additionally, printed copies may be available at local tax offices or through professional tax preparation services. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Penalties for Non-Compliance

Failure to file the Form WTH 10001 or submitting inaccurate information can lead to significant penalties. Oklahoma imposes fines for late filings, which can accumulate over time. Additionally, employers may face interest charges on any unpaid withholding taxes. It is crucial for employers to stay informed about compliance requirements and to file the form accurately and on time to avoid these repercussions.

Quick guide on how to complete form wth 10001 oklahoma quarterly wage withholding tax return

Effortlessly Prepare Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and electronically sign your documents without delays. Handle Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return on any device using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to Modify and eSign Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return with Ease

- Locate Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for that reason.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form wth 10001 oklahoma quarterly wage withholding tax return

Create this form in 5 minutes!

How to create an eSignature for the form wth 10001 oklahoma quarterly wage withholding tax return

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the keyword wth 10001?

airSlate SignNow is a leading eSignature solution that allows businesses to easily send and eSign documents. Utilizing the features associated with wth 10001, users can streamline their document workflows, making it a cost-effective choice for companies looking to enhance productivity.

-

What pricing plans does airSlate SignNow offer for users interested in wth 10001?

airSlate SignNow offers various pricing plans that cater to different business needs. For those considering wth 10001, there are both monthly and annual plans available, ensuring that organizations can find an option that fits their budget while utilizing the powerful features of the platform.

-

What key features should users look for in airSlate SignNow when discussing wth 10001?

Key features of airSlate SignNow include an intuitive interface, customizable templates, and real-time notifications. These features are particularly relevant for users exploring the capabilities of wth 10001, as they enhance the overall eSignature experience and facilitate efficient document management.

-

How does airSlate SignNow benefit businesses using wth 10001?

Businesses using airSlate SignNow with the context of wth 10001 can experience increased efficiency in document processing. The platform allows for quick turnaround times, automates workflows, and reduces paper waste, making it an environmentally friendly and productive solution.

-

Can airSlate SignNow integrate with other software systems relevant to wth 10001?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing its compatibility with business systems related to wth 10001. Users can easily connect with CRM systems, cloud storage solutions, and other applications to streamline their document flows.

-

Is airSlate SignNow secure for users focused on wth 10001?

Absolutely, airSlate SignNow prioritizes security for its users, especially those focusing on wth 10001. The platform employs industry-standard encryption and complies with various data protection regulations, ensuring that all documents and sensitive information are securely handled.

-

What support options are available for users of airSlate SignNow engaging with wth 10001?

Users engaging with airSlate SignNow and the keyword wth 10001 have access to extensive customer support. The platform provides resources such as a knowledge base, live chat, and email support, ensuring that any questions or issues can be promptly resolved.

Get more for Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

Find out other Form WTH 10001 Oklahoma Quarterly Wage Withholding Tax Return

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract