Nebraska Form 12N Nebraska Nonresident Income Tax Agreement 2020

What is the Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

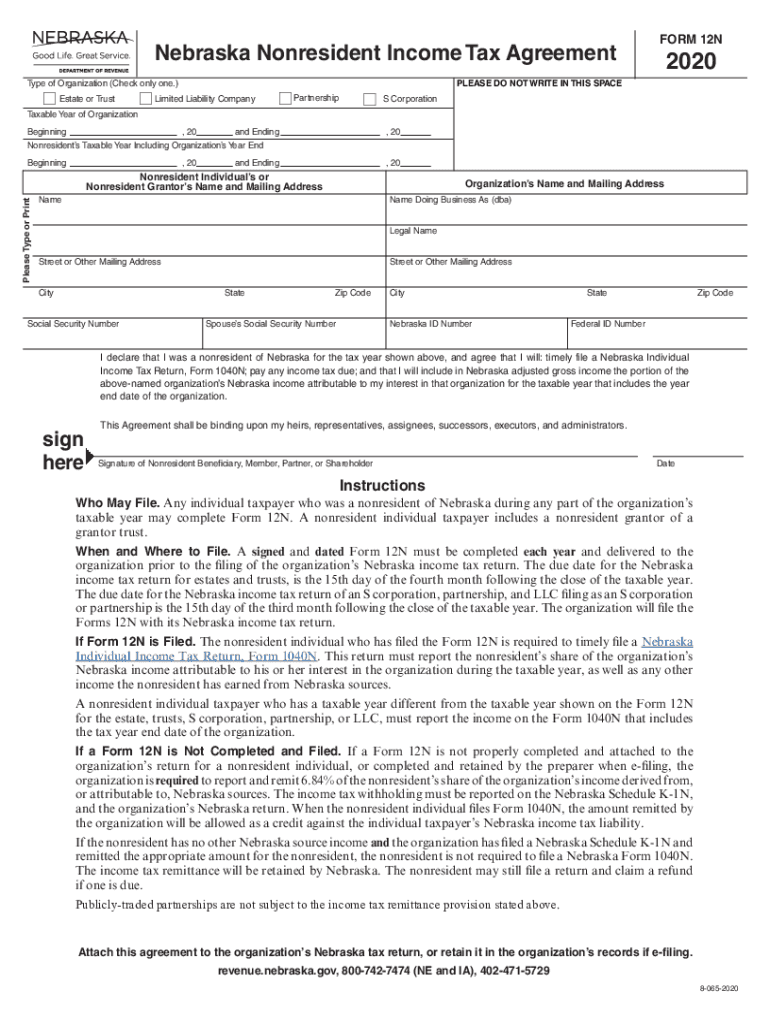

The Nebraska Form 12N is a tax document used by nonresidents to report income earned in Nebraska. This form is essential for individuals who do not reside in Nebraska but have income sourced from the state. By filing the 12N, nonresidents can determine their tax liability and ensure compliance with state tax regulations. It is specifically designed to calculate the tax owed on income generated within Nebraska, allowing nonresidents to claim any applicable deductions or credits.

Steps to complete the Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

Completing the Nebraska Form 12N involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements relevant to your Nebraska earnings. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Report your total income earned in Nebraska and any deductions you are eligible for. After completing the form, review it carefully for any errors before submitting it to the Nebraska Department of Revenue.

How to obtain the Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

The Nebraska Form 12N can be obtained through the Nebraska Department of Revenue's website. It is available as a downloadable PDF, which you can print and fill out manually. Alternatively, you may also find the form at local tax offices or request a copy by contacting the Nebraska Department of Revenue directly. Ensure you have the most current version of the form to avoid any compliance issues.

Legal use of the Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

The Nebraska Form 12N is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed by the taxpayer or authorized representative. The form must also be filed by the designated deadline to avoid penalties. Compliance with the Nebraska tax laws is essential, as failure to file or inaccuracies in reporting can lead to legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Form 12N typically align with the federal tax deadlines. For most taxpayers, the deadline to submit the form is April 15 of the following year after the tax year ends. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to deadlines that may occur due to state regulations or unforeseen circumstances.

Eligibility Criteria

To file the Nebraska Form 12N, individuals must meet specific eligibility criteria. Primarily, the filer must be a nonresident of Nebraska who has earned income sourced from the state. This includes wages, salaries, and other forms of compensation. Additionally, the individual must not have established residency in Nebraska during the tax year. Understanding these criteria is essential to ensure proper filing and compliance with state tax laws.

Quick guide on how to complete nebraska form 12n nebraska nonresident income tax agreement

Easily Prepare Nebraska Form 12N Nebraska Nonresident Income Tax Agreement on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Nebraska Form 12N Nebraska Nonresident Income Tax Agreement on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign Nebraska Form 12N Nebraska Nonresident Income Tax Agreement Effortlessly

- Locate Nebraska Form 12N Nebraska Nonresident Income Tax Agreement and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using functions that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and select the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring reprinting of document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nebraska Form 12N Nebraska Nonresident Income Tax Agreement and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska form 12n nebraska nonresident income tax agreement

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 12n nebraska nonresident income tax agreement

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Nebraska Form 12N?

Nebraska Form 12N is an important tax form used by Nebraska residents to report income and calculate state tax credits. Understanding this form is crucial for accurately filing your taxes and ensuring compliance. Using airSlate SignNow can simplify the eSigning process for submitting the Nebraska Form 12N.

-

How can airSlate SignNow help with Nebraska Form 12N?

airSlate SignNow offers a seamless platform for sending and eSigning documents, including the Nebraska Form 12N. This enables users to quickly complete and submit their tax forms without the hassle of printing and mailing. Our tool ensures that your Nebraska Form 12N can be managed efficiently and securely.

-

Is airSlate SignNow affordable for individuals needing to file the Nebraska Form 12N?

Yes, airSlate SignNow provides a cost-effective solution suitable for individuals and businesses alike. We offer competitive pricing plans that cater to varying needs, ensuring you can access powerful eSignature capabilities when managing your Nebraska Form 12N at an affordable rate.

-

Does airSlate SignNow integrate with other tools for filing Nebraska Form 12N?

Absolutely! airSlate SignNow integrates with several popular platforms, making it easier to manage your documents and workflows related to the Nebraska Form 12N. These integrations streamline your filing process, allowing you to attach necessary documents and receive completed forms quickly.

-

What features does airSlate SignNow offer for managing Nebraska Form 12N?

Among its many features, airSlate SignNow includes customizable templates, secure cloud storage, and real-time tracking. These tools help you efficiently organize and oversee your Nebraska Form 12N and other documents. With our platform, you can ensure your tax forms are handled properly and are accessible whenever needed.

-

How secure is airSlate SignNow when handling Nebraska Form 12N?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and authentication measures to keep your documents safe while you eSign your Nebraska Form 12N. You can trust that your sensitive information remains confidential and protected from unauthorized access.

-

Can I use airSlate SignNow for multiple Nebraska Form 12N submissions?

Yes, you can use airSlate SignNow for multiple submissions of the Nebraska Form 12N as needed. Our platform allows for repeat usage, making it convenient for anyone who may need to file multiple forms continuously or for different years. This ease of use helps streamline your tax processes effectively.

Get more for Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

- Annual financial checkup package west virginia form

- Bill of sale package west virginia form

- Living wills and health care package west virginia form

- Last will and testament package west virginia form

- Subcontractors package west virginia form

- Protecting minors from identity theft package west virginia form

- Identity theft prevention package west virginia form

- West virginia deceased form

Find out other Nebraska Form 12N Nebraska Nonresident Income Tax Agreement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors