Form 12N Nebraska Nonresident Income Tax Agreement 2017

What is the Form 12N Nebraska Nonresident Income Tax Agreement

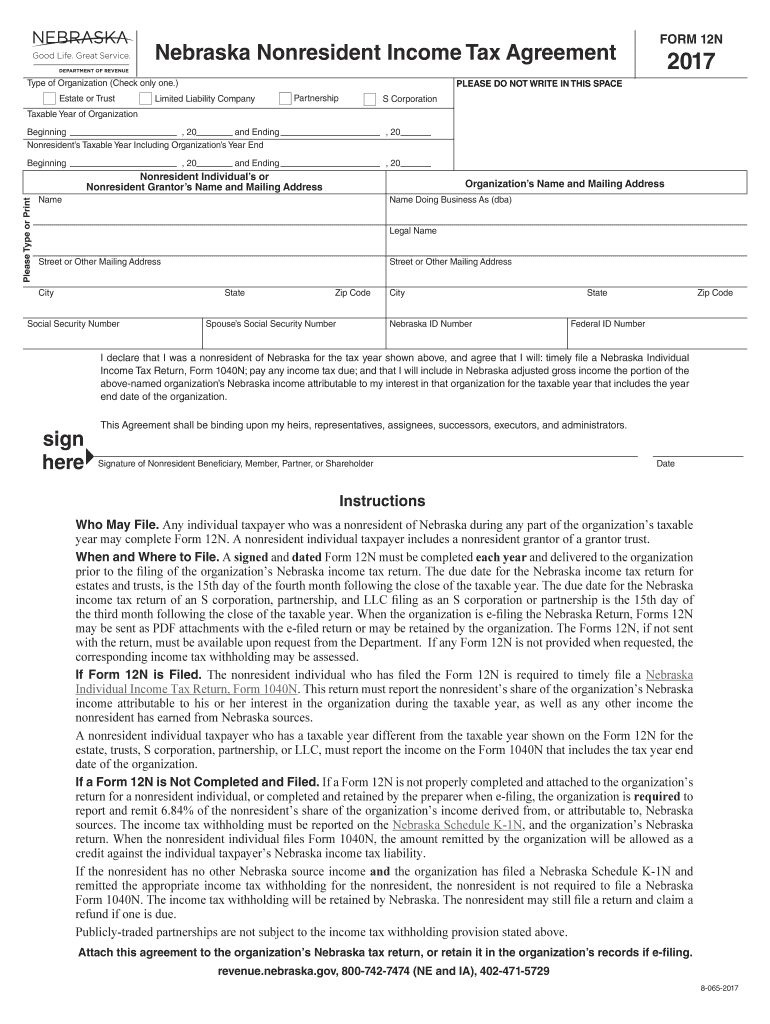

The Form 12N Nebraska Nonresident Income Tax Agreement is a tax document specifically designed for nonresident individuals who earn income in Nebraska. This form allows nonresidents to report their income and determine their tax obligations to the state. It is essential for those who do not reside in Nebraska but have earned income from Nebraska sources, ensuring compliance with state tax laws.

Steps to complete the Form 12N Nebraska Nonresident Income Tax Agreement

Completing the Form 12N involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s or 1099s that report your Nebraska income. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, accurately report your income earned in Nebraska and calculate the tax owed. Finally, review the form for any errors before submitting it to the appropriate state tax authority.

How to obtain the Form 12N Nebraska Nonresident Income Tax Agreement

The Form 12N can be obtained directly from the Nebraska Department of Revenue's official website. It is available for download in a printable format, allowing you to fill it out by hand or electronically. Additionally, tax preparation offices may provide copies of the form as part of their services. Ensure you have the most current version of the form to avoid any compliance issues.

Legal use of the Form 12N Nebraska Nonresident Income Tax Agreement

The legal use of the Form 12N is critical for nonresidents earning income in Nebraska. The form must be filled out accurately and submitted by the designated deadline to avoid penalties. By using this form, nonresidents can fulfill their tax obligations and avoid potential legal issues related to income reporting in Nebraska. Compliance with state tax regulations is essential for maintaining good standing with the Nebraska Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12N are typically aligned with the general tax filing deadlines in Nebraska. Nonresidents must submit the form by April 15 of the year following the tax year in which the income was earned. It is important to stay informed about any changes to these deadlines, as they can vary based on state regulations or changes in tax law.

Required Documents

To complete the Form 12N, several documents are required. These include your W-2 forms or 1099 forms that report income earned in Nebraska. Additionally, you may need documentation related to deductions or credits you intend to claim. Having all necessary documents organized and ready will facilitate a smoother filing process.

Quick guide on how to complete form 12n 2017 nebraska nonresident income tax agreement

Complete Form 12N Nebraska Nonresident Income Tax Agreement effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a great eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 12N Nebraska Nonresident Income Tax Agreement on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign Form 12N Nebraska Nonresident Income Tax Agreement seamlessly

- Locate Form 12N Nebraska Nonresident Income Tax Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 12N Nebraska Nonresident Income Tax Agreement and ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12n 2017 nebraska nonresident income tax agreement

Create this form in 5 minutes!

How to create an eSignature for the form 12n 2017 nebraska nonresident income tax agreement

How to make an electronic signature for your Form 12n 2017 Nebraska Nonresident Income Tax Agreement online

How to create an eSignature for your Form 12n 2017 Nebraska Nonresident Income Tax Agreement in Google Chrome

How to make an electronic signature for signing the Form 12n 2017 Nebraska Nonresident Income Tax Agreement in Gmail

How to create an eSignature for the Form 12n 2017 Nebraska Nonresident Income Tax Agreement right from your mobile device

How to create an electronic signature for the Form 12n 2017 Nebraska Nonresident Income Tax Agreement on iOS devices

How to make an eSignature for the Form 12n 2017 Nebraska Nonresident Income Tax Agreement on Android devices

People also ask

-

What is the Form 12N Nebraska Nonresident Income Tax Agreement?

The Form 12N Nebraska Nonresident Income Tax Agreement is a tax form used by nonresidents to report their income earned in Nebraska. It allows individuals to determine their tax liability and ensure compliance with state tax laws. Utilizing airSlate SignNow can streamline the eSignature process for this important document.

-

How can airSlate SignNow help with filing the Form 12N Nebraska Nonresident Income Tax Agreement?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your Form 12N Nebraska Nonresident Income Tax Agreement. With its user-friendly features, users can quickly complete and submit their forms, ensuring a hassle-free filing experience. This service can help reduce the time spent on paperwork, allowing focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for Form 12N Nebraska Nonresident Income Tax Agreement?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for frequent users of the Form 12N Nebraska Nonresident Income Tax Agreement. These plans are competitively priced to ensure you receive excellent value for your electronic signing needs. Many users find that the cost savings on time and paper justify the investment in this service.

-

What features does airSlate SignNow offer for the Form 12N Nebraska Nonresident Income Tax Agreement?

AirSlate SignNow offers key features such as customizable templates, real-time tracking, and secure storage for your Form 12N Nebraska Nonresident Income Tax Agreement. Users can easily create, sign, and manage documents all in one place. These features enhance the efficiency and effectiveness of document handling.

-

How secure is airSlate SignNow when handling the Form 12N Nebraska Nonresident Income Tax Agreement?

AirSlate SignNow prioritizes security with advanced encryption and authentication measures for your Form 12N Nebraska Nonresident Income Tax Agreement. This ensures that sensitive information remains confidential and protected during the signing process. Users can complete their transactions with peace of mind, knowing their data is secure.

-

Can airSlate SignNow integrate with other tools for managing the Form 12N Nebraska Nonresident Income Tax Agreement?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing users to manage their Form 12N Nebraska Nonresident Income Tax Agreement alongside other important documents. This integration enhances workflow efficiency and data management, supporting businesses in streamlining their operations. You can connect it with platforms like CRM systems and cloud storage solutions.

-

What are the benefits of using airSlate SignNow for the Form 12N Nebraska Nonresident Income Tax Agreement?

Using airSlate SignNow for your Form 12N Nebraska Nonresident Income Tax Agreement offers signNow benefits, including improved efficiency, reduced paperwork, and faster turnaround times. The ability to eSign documents allows quick compliance with state tax requirements. Additionally, the user-friendly interface ensures that anyone can navigate the platform with ease.

Get more for Form 12N Nebraska Nonresident Income Tax Agreement

- Greater hartford association of realtors inc rental application form

- Lf305 04 form

- Pnp pds form

- State of michigan certificate of no fault insurance yellowhammer form

- Iowa department of public health certificate of immunization clover form

- Pldt subscription certificate form

- Big league dreams manteca ca form

- Dd1998 form

Find out other Form 12N Nebraska Nonresident Income Tax Agreement

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document