Revenue Nebraska Govtax Forms2021FORM 12N Nebraska Nonresident Income Tax Agreement 2022-2026

Understanding the Nebraska Form 12N

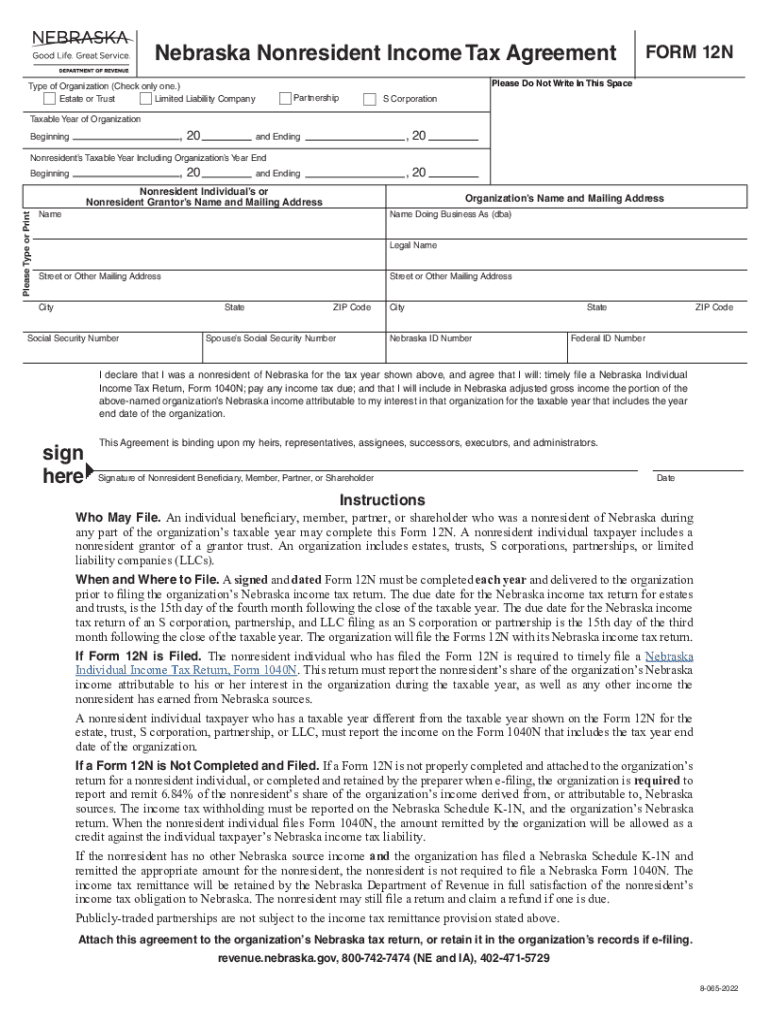

The Nebraska Form 12N is a vital document for nonresidents who earn income in Nebraska. This form serves as the Nonresident Income Tax Agreement, allowing individuals to report income earned within the state while ensuring compliance with Nebraska tax regulations. It is crucial for nonresidents to accurately complete this form to determine their tax obligations and avoid potential penalties.

Steps to Complete the Nebraska Form 12N

Completing the Nebraska Form 12N involves several key steps:

- Gather necessary documentation, including income statements and any supporting tax documents.

- Fill out the form accurately, ensuring all income sources are reported.

- Double-check calculations to ensure accuracy in reporting taxable income.

- Sign and date the form to validate your submission.

By following these steps, you can ensure that your Nebraska Form 12N is completed correctly and submitted on time.

Legal Use of the Nebraska Form 12N

The Nebraska Form 12N is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, it is essential to comply with the eSignature laws, which require that electronic signatures meet specific legal standards. Using a reliable eSignature solution can enhance the legal standing of your submitted form, providing a digital certificate that verifies the authenticity of your signature.

Eligibility Criteria for the Nebraska Form 12N

To be eligible to file the Nebraska Form 12N, individuals must meet certain criteria:

- Must be a nonresident earning income in Nebraska.

- Income must be sourced from Nebraska to qualify for this form.

- Must comply with Nebraska tax laws and regulations.

Understanding these criteria is essential for nonresidents to ensure they are filing the correct forms and meeting their tax obligations.

Filing Deadlines for the Nebraska Form 12N

Filing deadlines for the Nebraska Form 12N are crucial for compliance. Typically, the form must be submitted by April 15 of the year following the tax year in which the income was earned. It is important to stay informed about any changes to deadlines, as they can vary based on specific circumstances or state regulations.

Form Submission Methods for the Nebraska Form 12N

The Nebraska Form 12N can be submitted through various methods:

- Online submission via the Nebraska Department of Revenue website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure timely and accurate processing of your tax documents.

Key Elements of the Nebraska Form 12N

Several key elements are essential when filling out the Nebraska Form 12N:

- Personal identification information, including name and address.

- Details of income earned in Nebraska.

- Calculation of tax owed based on Nebraska tax rates.

- Signature and date to validate the form.

Ensuring that all these elements are correctly addressed will facilitate a smoother filing process and compliance with state tax laws.

Quick guide on how to complete revenuenebraskagovtax forms2021form 12n nebraska nonresident income tax agreement 2021

Effortlessly prepare Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement on any device

Managing documents online has become increasingly favored by both businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement on any platform through the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement with ease

- Obtain Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuenebraskagovtax forms2021form 12n nebraska nonresident income tax agreement 2021

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Form 12N?

The Nebraska Form 12N is a critical document for businesses that need to report certain tax information to the Nebraska Department of Revenue. Using airSlate SignNow makes it easy to fill, send, and eSign the Nebraska Form 12N efficiently and securely.

-

How can airSlate SignNow help with completing the Nebraska Form 12N?

airSlate SignNow provides a user-friendly interface that allows you to easily input data into the Nebraska Form 12N. Our platform offers templates and automated workflows to streamline the filling and signing process, ensuring compliance with Nebraska tax regulations.

-

What are the key features of airSlate SignNow for handling the Nebraska Form 12N?

AirSlate SignNow offers electronic signatures, document templates, and customizable workflows that enhance the process of managing the Nebraska Form 12N. With features like secure cloud storage and real-time tracking, you can stay organized and compliant.

-

Is airSlate SignNow cost-effective for businesses that need to file the Nebraska Form 12N?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file the Nebraska Form 12N. With flexible pricing plans and no hidden fees, you can efficiently manage your document signing and filing needs without breaking the bank.

-

Can airSlate SignNow integrate with other software for handling the Nebraska Form 12N?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRM, accounting, and project management tools. This integration helps simplify the process of preparing and submitting the Nebraska Form 12N along with other essential documents.

-

What benefits do I get from using airSlate SignNow for the Nebraska Form 12N?

By using airSlate SignNow for the Nebraska Form 12N, you gain access to enhanced security for sensitive information, faster turnaround times, and a paperless workflow. These benefits signNowly reduce the chances of errors and improve overall efficiency.

-

How secure is the airSlate SignNow platform when handling the Nebraska Form 12N?

AirSlate SignNow prioritizes security with features like data encryption and strict access controls. When handling the Nebraska Form 12N, you can trust that your information remains secure and complies with regulatory standards.

Get more for Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement

Find out other Revenue nebraska govtax forms2021FORM 12N Nebraska Nonresident Income Tax Agreement

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form