Georgia Form 500 Nol Instructions 2019

What are the Georgia Form 500 NOL Instructions?

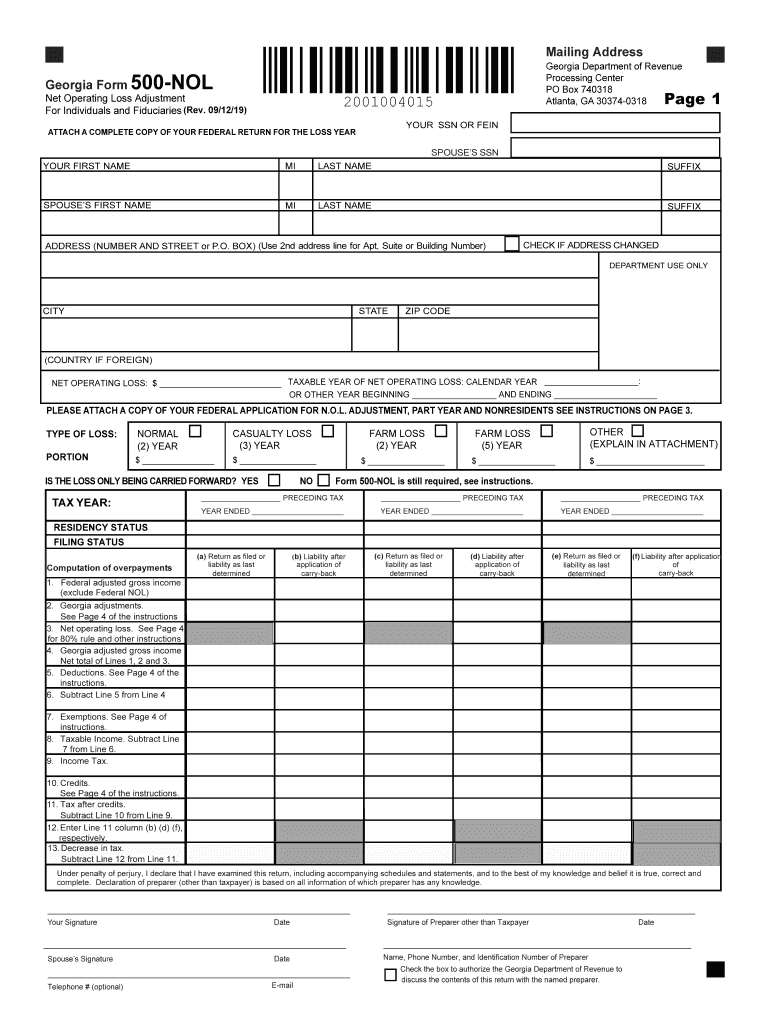

The Georgia Form 500 NOL (Net Operating Loss) instructions provide detailed guidance for taxpayers who need to report net operating losses on their state tax returns. This form is specifically designed for individuals and businesses that have experienced a net operating loss in a given tax year, allowing them to potentially carry back or carry forward these losses to offset taxable income in other years. Understanding these instructions is crucial for ensuring compliance with state tax regulations and maximizing potential tax benefits.

Steps to Complete the Georgia Form 500 NOL Instructions

Completing the Georgia Form 500 NOL involves several key steps:

- Gather necessary financial documents, including income statements and prior year tax returns.

- Determine the amount of net operating loss by reviewing your income and expenses for the applicable tax year.

- Fill out the form accurately, ensuring that all calculations are correct.

- Review the instructions for any specific requirements related to your business entity type, such as LLCs or corporations.

- Submit the completed form by the state deadline, either electronically or by mail.

Legal Use of the Georgia Form 500 NOL Instructions

The legal use of the Georgia Form 500 NOL instructions is essential for ensuring that taxpayers adhere to state tax laws. The form must be filled out correctly to avoid penalties or audits. It is important to note that electronic signatures are legally binding, provided that they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform can help maintain compliance and provide a secure method for submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia Form 500 NOL are critical to avoid late fees and ensure compliance. Generally, the form must be filed by the due date of the tax return for the year in which the loss occurred. For most taxpayers, this is typically April 15 of the following year. However, if you are filing for an extension, be sure to check the specific extended deadlines to ensure timely submission.

Required Documents for the Georgia Form 500 NOL

To complete the Georgia Form 500 NOL, several documents are required:

- Prior year tax returns to establish a baseline for income and losses.

- Financial statements that detail income and expenses for the year in question.

- Any supporting documentation related to deductions or credits that may affect the net operating loss.

Eligibility Criteria for the Georgia Form 500 NOL

Eligibility for filing the Georgia Form 500 NOL typically includes individuals and businesses that have incurred a net operating loss during the tax year. This can apply to various business entities, including sole proprietorships, partnerships, and corporations. To qualify, the loss must arise from trade or business activities and not from passive activities or certain investment losses. It is important to review the specific eligibility requirements outlined in the instructions to ensure compliance.

Quick guide on how to complete georgia form 500 nol instructions 2019

Accomplish Georgia Form 500 Nol Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents quickly and efficiently. Manage Georgia Form 500 Nol Instructions on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Georgia Form 500 Nol Instructions with ease

- Locate Georgia Form 500 Nol Instructions and click Get Form to begin.

- Use the tools provided to fill out your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to secure your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Georgia Form 500 Nol Instructions to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia form 500 nol instructions 2019

Create this form in 5 minutes!

How to create an eSignature for the georgia form 500 nol instructions 2019

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the fillable Georgia Form 500 NOL?

The fillable Georgia Form 500 NOL is a tax document used by businesses to report net operating losses in the state of Georgia. This form allows businesses to carry back or carry forward their NOL deductions, which can signNowly reduce tax liabilities. Using airSlate SignNow, you can easily fill out and eSign this form online.

-

How can I access the fillable Georgia Form 500 NOL?

You can access the fillable Georgia Form 500 NOL directly through the airSlate SignNow platform. Our platform offers a user-friendly interface for creating and managing tax documents. Just sign up and navigate to the tax forms section to find the fillable Georgia Form 500 NOL.

-

Is there a cost associated with using the fillable Georgia Form 500 NOL?

The airSlate SignNow platform provides cost-effective solutions for accessing the fillable Georgia Form 500 NOL. While there may be a subscription fee associated with using our full suite of features, filling out and eSigning tax documents is seamless. Check our pricing page for more details on plans that suit your needs.

-

What are the benefits of using airSlate SignNow for the Georgia Form 500 NOL?

Using airSlate SignNow for the fillable Georgia Form 500 NOL offers several benefits, including ease of use, fast document processing, and secure storage. Our platform allows you to electronically sign and send your completed forms quickly, ensuring timely filing. This helps you stay compliant while focusing on your business.

-

Can the fillable Georgia Form 500 NOL be integrated with other software?

Yes, the fillable Georgia Form 500 NOL can be integrated with various accounting and tax software through airSlate SignNow’s seamless integrations. This allows for automated updates and streamlined workflows, reducing manual data entry. Make your tax process more efficient by connecting your existing tools.

-

What features does airSlate SignNow offer for filling out the Georgia Form 500 NOL?

airSlate SignNow offers a range of features for filling out the Georgia Form 500 NOL, including customizable templates, collaboration tools, and electronic signatures. You can easily invite team members to review and approve forms before submission. These features enhance productivity and accuracy in preparing your tax documents.

-

Is my data secure when using the fillable Georgia Form 500 NOL on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes your data security when using the fillable Georgia Form 500 NOL. We implement industry-leading encryption protocols and security practices to protect your sensitive information and ensure your documents are safe during the eSigning process.

Get more for Georgia Form 500 Nol Instructions

- Wpf ps form

- Wpf ps 010155 010155 declaration of father parentage dclr washington form

- Wpf ps 010160 summons parentage sm washington form

- Washington wpf ps form

- Wpf drpscu 010260 motion declaration for service of summons by publication dclr washington form

- Wpf drpscu 010265 order for service of summons by publication orpub washington form

- Wpf ps 010280 motion and declaration to serve by mail mt washington form

- Washington service mail 497429445 form

Find out other Georgia Form 500 Nol Instructions

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile