500 Nol 2020-2026

What is the 500 NOL?

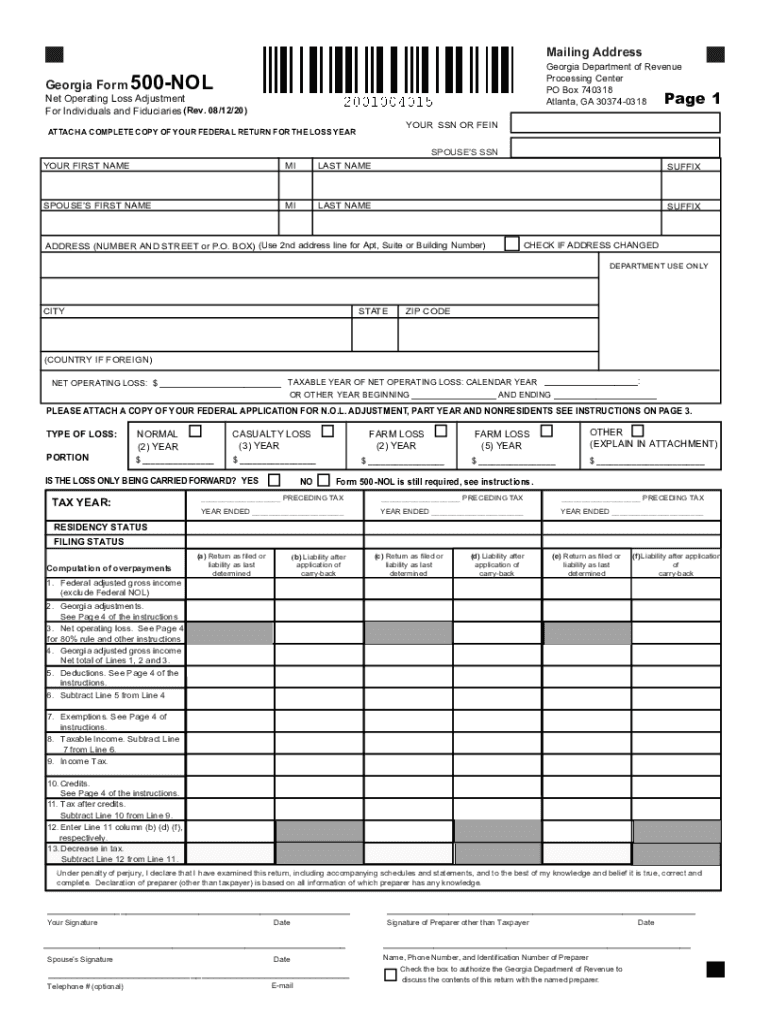

The 500 NOL, or Georgia Schedule 4 Net Operating Loss Application, is a tax form used by businesses and individuals in Georgia to report and apply net operating losses. This form allows taxpayers to carry forward losses to offset future taxable income, thereby reducing their overall tax liability. Understanding the 500 NOL is crucial for those who have experienced financial setbacks and wish to utilize their losses effectively for tax purposes.

Steps to complete the 500 NOL

Completing the 500 NOL involves several key steps to ensure accuracy and compliance with Georgia tax regulations. Begin by gathering all necessary financial documents, including income statements and expense records. Next, fill out the form by providing detailed information about your net operating losses, including the amount and the tax year in which the losses occurred. It is essential to follow the form's instructions carefully to avoid errors that could delay processing.

Eligibility Criteria

To qualify for the 500 NOL, taxpayers must meet specific eligibility criteria set by the Georgia Department of Revenue. Generally, the applicant must have incurred a net operating loss during the tax year being reported. Additionally, the losses must be from a business activity or trade that is recognized by the state. Understanding these criteria is vital for ensuring that your application is accepted and processed without issues.

Required Documents

When submitting the 500 NOL, certain documents are required to support your application. These typically include detailed financial statements, tax returns for the applicable years, and any other documentation that verifies the net operating losses claimed. Having these documents ready will facilitate a smoother application process and help ensure that your submission meets all requirements.

Form Submission Methods

The 500 NOL can be submitted through various methods, including online submission, mail, or in-person delivery to the Georgia Department of Revenue. Each method has its own guidelines and requirements. Online submission is often the quickest and most efficient option, allowing for immediate confirmation of receipt. If mailing the form, ensure it is sent to the correct address and consider using a trackable service for added security.

Legal use of the 500 NOL

The legal use of the 500 NOL is governed by state tax laws and regulations. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. Utilizing the 500 NOL correctly can provide significant tax relief, making it a valuable tool for those who have experienced financial losses in previous years.

Filing Deadlines / Important Dates

Filing deadlines for the 500 NOL are critical to ensure compliance with Georgia tax regulations. Typically, the form must be submitted by the tax return due date for the year in which the net operating loss occurred. Keeping track of these important dates will help prevent missed opportunities to apply for tax relief and ensure that your application is processed in a timely manner.

Quick guide on how to complete 500 nol

Effortlessly Prepare 500 Nol on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without interruptions. Handle 500 Nol on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Modify and Electronically Sign 500 Nol with Ease

- Locate 500 Nol and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Decide how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 500 Nol to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 500 nol

Create this form in 5 minutes!

How to create an eSignature for the 500 nol

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What are GA 500 NOL instructions?

GA 500 NOL instructions are guidelines that help businesses file their GA 500 tax form accurately. These instructions ensure that you report net operating losses correctly, optimizing your tax benefits. Understanding these instructions is crucial for effective tax management.

-

How does airSlate SignNow assist with GA 500 NOL instructions?

airSlate SignNow simplifies the process of sending and signing documents related to GA 500 NOL instructions. By using our platform, you can securely share tax forms and receive electronic signatures quickly. This streamlines your workflow and ensures compliance with tax regulations.

-

Are there any costs associated with using airSlate SignNow for GA 500 NOL instructions?

Our pricing for airSlate SignNow is designed to be cost-effective for businesses needing assistance with GA 500 NOL instructions. We offer various plans based on your specific usage needs, making it easy to choose the right option for your budget. Explore our pricing page to find the best plan for your business.

-

Can I integrate airSlate SignNow with other software for GA 500 NOL instructions?

Yes, airSlate SignNow offers seamless integration with various software that can assist you with GA 500 NOL instructions. Whether you use accounting software or CRM systems, our platform ensures all your tools work together. This integration enhances efficiency and keeps your documents organized.

-

What features does airSlate SignNow offer for handling GA 500 NOL instructions?

airSlate SignNow provides features like document templates, customizable workflows, and secure storage specifically for handling GA 500 NOL instructions. You can automate the signing process and track document status in real-time, which saves time and reduces errors. These features help improve your overall document management.

-

Is airSlate SignNow secure for sharing GA 500 NOL instructions documentation?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documentation related to GA 500 NOL instructions is securely shared. Our platform utilizes industry-standard encryption technology to protect your data. You can confidently send and receive sensitive tax information without fear of unauthorized access.

-

Can I track the status of my GA 500 NOL instructions documents in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your GA 500 NOL instructions documents at any time. You can see who has viewed, signed, or sent back the documents, giving you complete visibility into your workflow. This feature enhances accountability and keeps your processes on track.

Get more for 500 Nol

- Wwwkamp kaninecomwp contentuploadsdoggie daycare agreement kamp kanine form

- Waiver of medical treatment or observation form

- Mychart cone form

- Medicare part b patient intake form

- Wwwuslegalformscomform library490916 acclaimacclaim dermatology intake form us legal forms

- Patient enrollment form medexpress pharmacy

- Have you had a professional massage before form

- Oncology referral form new patient existing

Find out other 500 Nol

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document