GovForm941SS for

What is the GovForm941SS For

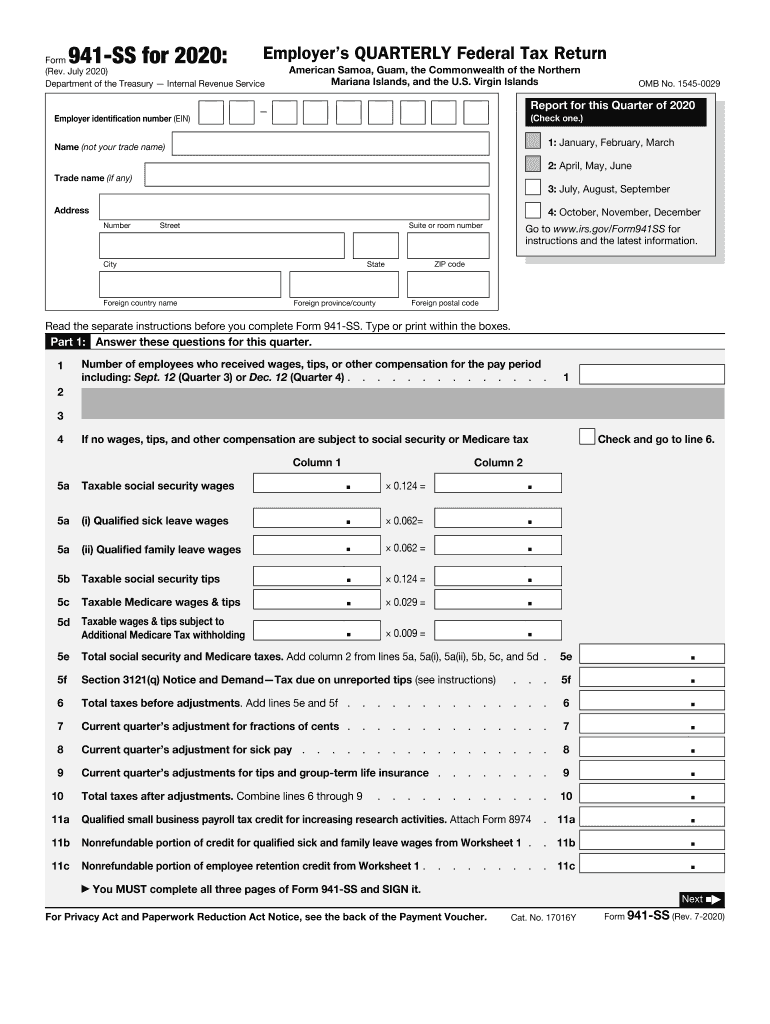

The GovForm941SS is specifically designed for employers in the United States to report wages, tips, and other compensation paid to employees, as well as to calculate the federal income tax withheld from these payments. This form is essential for employers who need to report their payroll taxes accurately to the IRS. The 941SS form is particularly relevant for employers in U.S. territories, including Guam and the Virgin Islands, ensuring that they comply with federal tax regulations while addressing their unique circumstances.

How to use the GovForm941SS For

Using the GovForm941SS involves several steps to ensure accurate reporting of payroll information. Employers must gather data on total wages paid, tips received, and the federal income tax withheld. Once this information is compiled, it should be entered into the appropriate sections of the form. Employers must also calculate any adjustments for tax credits or overpayments from previous quarters. After completing the form, it can be filed electronically or submitted via mail, depending on the employer's preference and compliance requirements.

Steps to complete the GovForm941SS For

Completing the GovForm941SS requires careful attention to detail. Follow these steps:

- Gather all necessary payroll records for the reporting period.

- Calculate total wages, tips, and other compensation paid to employees.

- Determine the federal income tax withheld from these payments.

- Complete the form by entering the gathered data in the designated fields.

- Review the form for accuracy and completeness.

- Submit the completed form electronically or via mail by the deadline.

Legal use of the GovForm941SS For

The GovForm941SS must be completed and submitted in accordance with IRS regulations to ensure its legal validity. Employers are required to file this form quarterly, and failure to do so can result in penalties. The information reported on the form must be accurate, as discrepancies can lead to audits or further legal complications. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that all signatures are verifiable and compliant with federal eSignature laws.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the GovForm941SS to avoid penalties. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for the 2020 tax year are as follows:

- Q1 (January - March): April 30

- Q2 (April - June): July 31

- Q3 (July - September): October 31

- Q4 (October - December): January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The GovForm941SS can be submitted through various methods, providing flexibility for employers. The options include:

- Online: Employers can file electronically using approved IRS e-file providers, which often streamline the submission process.

- Mail: The completed form can be printed and sent to the appropriate IRS address based on the employer's location.

- In-Person: While less common, some employers may choose to deliver their forms directly to local IRS offices.

Quick guide on how to complete govform941ss for

Complete GovForm941SS For seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent sustainable alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle GovForm941SS For on any device with airSlate SignNow’s Android or iOS apps and streamline any document-based procedure today.

The easiest way to modify and eSign GovForm941SS For effortlessly

- Obtain GovForm941SS For and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign GovForm941SS For and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the govform941ss for

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to SS 2020?

airSlate SignNow is an eSignature solution that empowers businesses to streamline document signing processes. The 'ss 2020' term refers to our 2020 software release, which introduced advanced features that make it easier to send, sign, and manage documents securely.

-

What are the key features of airSlate SignNow in the context of SS 2020?

The SS 2020 update brought several key features including improved document templates, enhanced user dashboards, and multi-signature options. These features enable users to efficiently manage workflows and improve overall productivity in document handling.

-

How much does airSlate SignNow cost, especially after the SS 2020 updates?

airSlate SignNow offers various pricing plans that cater to different business needs. After the SS 2020 updates, our pricing remains cost-effective and we provide a free trial, allowing potential customers to explore the benefits of our eSignature solution.

-

Can airSlate SignNow integrate with other software systems post-SS 2020?

Yes, airSlate SignNow has robust integration capabilities post-SS 2020, allowing users to connect with popular applications like Google Drive, Salesforce, and Microsoft Office. This flexibility enhances workflow automation and ensures seamless document management.

-

What benefits can businesses expect from using airSlate SignNow with SS 2020 features?

By utilizing airSlate SignNow with its SS 2020 features, businesses can expect quicker turnaround times for document processing and a signNow reduction in paper usage. The ease of use and efficiency offered transforms the way organizations handle essential paperwork.

-

Is airSlate SignNow suitable for large enterprises post-SS 2020 updates?

Absolutely! With the SS 2020 updates, airSlate SignNow has optimized its platform to support large enterprises by providing scalable solutions, enhanced security protocols, and custom workflows. Businesses of any size can benefit from our powerful eSigning capabilities.

-

How does airSlate SignNow ensure the security of documents in relation to SS 2020?

airSlate SignNow adheres to strict security standards to protect your documents. Following the SS 2020 update, enhanced encryption and compliance with regulations such as GDPR ensure that your sensitive information remains secure during the signing process.

Get more for GovForm941SS For

- Food pantry client information form resurrection life

- Drag race audition tape requirements form

- Storage unit eviction notice template form

- Oasis northrop grumman form

- 202 2023 unusual enrollment northeast state community college form

- Brendon burchard planner pdf form

- Wwwtnccedu sites defaultthomas nelson community college local board terms of office form

- Class schedule planning form sinclair

Find out other GovForm941SS For

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later