Tax Form 2020

What is the SA109 Form?

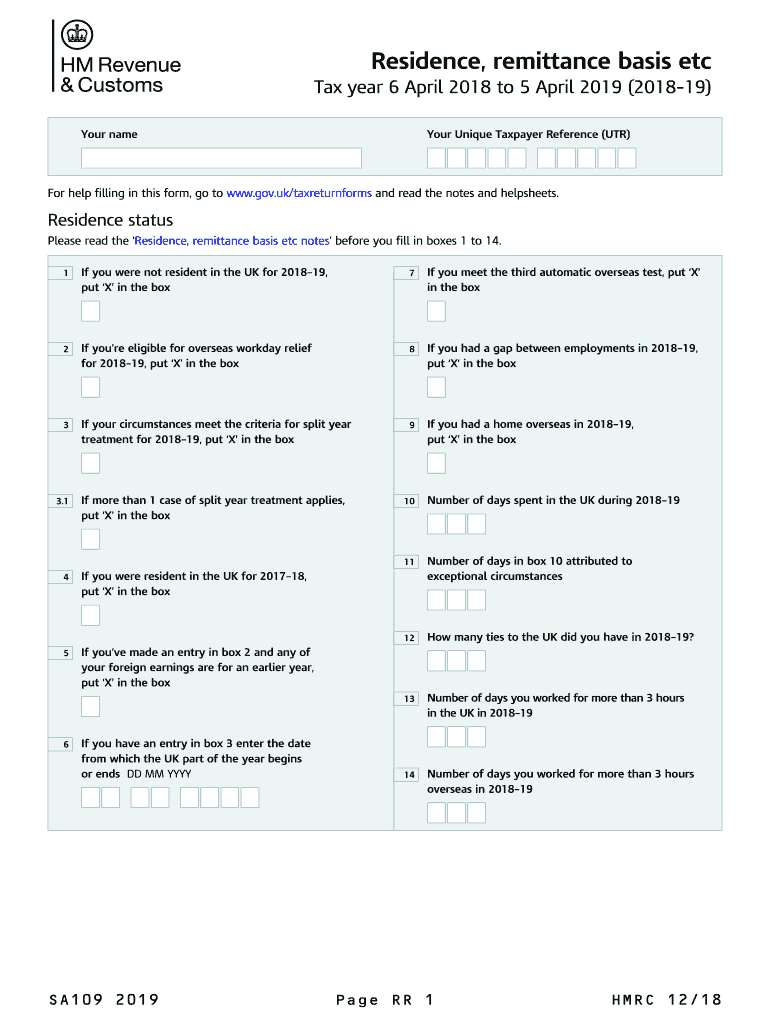

The SA109 form, also known as the tax return form SA109, is a supplementary document used by individuals in the United Kingdom to claim tax relief on foreign income. This form is particularly important for those who are tax residents in the UK and have income sourced from outside the country. The SA109 allows taxpayers to declare their residency status and provide necessary information regarding their foreign income, ensuring compliance with UK tax regulations.

How to Use the SA109 Form

Using the SA109 form involves several steps to ensure accurate completion. First, gather all relevant information regarding your foreign income and residency status. Next, fill out the form by providing details such as your name, address, and the countries where you have income. It is essential to accurately report the amounts earned and any tax already paid to foreign authorities. Finally, submit the completed form along with your main tax return to HM Revenue and Customs (HMRC) to ensure proper processing.

Steps to Complete the SA109 Form

Completing the SA109 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather Information: Collect all necessary documents related to your foreign income, including payslips, tax statements, and residency certificates.

- Fill Out Personal Details: Enter your personal information, including your name, address, and National Insurance number.

- Declare Foreign Income: Provide details of your foreign income, specifying the amounts and the countries of origin.

- Claim Tax Relief: Indicate any foreign taxes paid that you wish to claim relief for, ensuring you have the documentation to support your claim.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your main tax return.

Legal Use of the SA109 Form

The SA109 form is legally binding when completed and submitted correctly. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies could lead to penalties or legal issues with HMRC. The form must be submitted within the designated filing deadlines to avoid late fees or complications in processing your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the SA109 form align with the overall tax return deadlines set by HMRC. Typically, the deadline for submitting your tax return, including the SA109, is January 31 for the previous tax year. It is crucial to be aware of these dates to ensure timely submission and avoid penalties for late filing.

Required Documents

When completing the SA109 form, certain documents are necessary to support your claims. These may include:

- Proof of foreign income, such as payslips or tax returns from other countries.

- Tax statements showing foreign taxes paid.

- Residency certificates from foreign tax authorities.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete tax form 2019

Complete Tax Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Form on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Tax Form with ease

- Find Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form 2019

Create this form in 5 minutes!

How to create an eSignature for the tax form 2019

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the SA109 form and why is it important?

The SA109 form is a supplementary tax form used in the UK for reporting income from self-employment and other forms of income. It is crucial for ensuring that your tax records are complete and accurate, allowing you to avoid penalties. Properly filling out the SA109 form can help streamline your tax process and clarify your financial status to HMRC.

-

How can airSlate SignNow help with the SA109 form?

With airSlate SignNow, you can easily fill out and eSign the SA109 form digitally, eliminating the need for printed documents. This efficient process saves time and minimizes errors, ensuring that your tax submissions are accurate and submitted on time. Additionally, the platform’s intuitive interface makes the completion of the SA109 form straightforward.

-

Is there a cost associated with using airSlate SignNow for the SA109 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, ensuring a cost-effective solution for handling the SA109 form. These plans allow unlimited eSignature requests and document templates, making it a valuable investment for businesses that frequently deal with tax forms. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for handling tax forms like the SA109 form?

airSlate SignNow provides a range of features designed for efficient document management, including customizable templates, automated workflows, and secure eSigning capabilities. These features enhance user experience and ensure that the SA109 form is completed accurately and efficiently. Additionally, the platform supports real-time collaboration, so teams can work together seamlessly.

-

Can I integrate airSlate SignNow with other software for handling my SA109 form?

Absolutely! airSlate SignNow integrates with various popular software solutions, such as CRM systems and accounting software, to streamline your document workflow. This means you can link your data and access your SA109 form alongside other important documents within your preferred tools. Integration enhances productivity by reducing repetitive tasks in document processing.

-

Is airSlate SignNow secure for handling sensitive documents like the SA109 form?

Yes, airSlate SignNow prioritizes security by employing advanced encryption methods to protect all your documents, including the SA109 form. The platform is compliant with various data protection regulations, ensuring that your personal and financial information remains secure. This level of security gives you peace of mind when dealing with sensitive tax information.

-

Can I save my completed SA109 form with airSlate SignNow?

Definitely! After completing your SA109 form using airSlate SignNow, you can save and store it securely in your account. The platform allows you to access all your completed documents whenever you need them, making it easier to reference or re-submit when necessary. This feature streamlines your document management process signNowly.

Get more for Tax Form

- Wisconsin sentence adjustment form

- Wisconsin district attorney form

- Wisconsin sentence adjustment 497430803 form

- Time served 497430804 form

- Wi release form 497430805

- Department of corrections approval to file petition for determination of eligibility for the earned release program section form

- Eligibility release form

- Order for examination under section 97116 not guilty by reason of mental disease or defect wisconsin form

Find out other Tax Form

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement