Bir Form 1701q 2018

What is the Bir Form 1701q

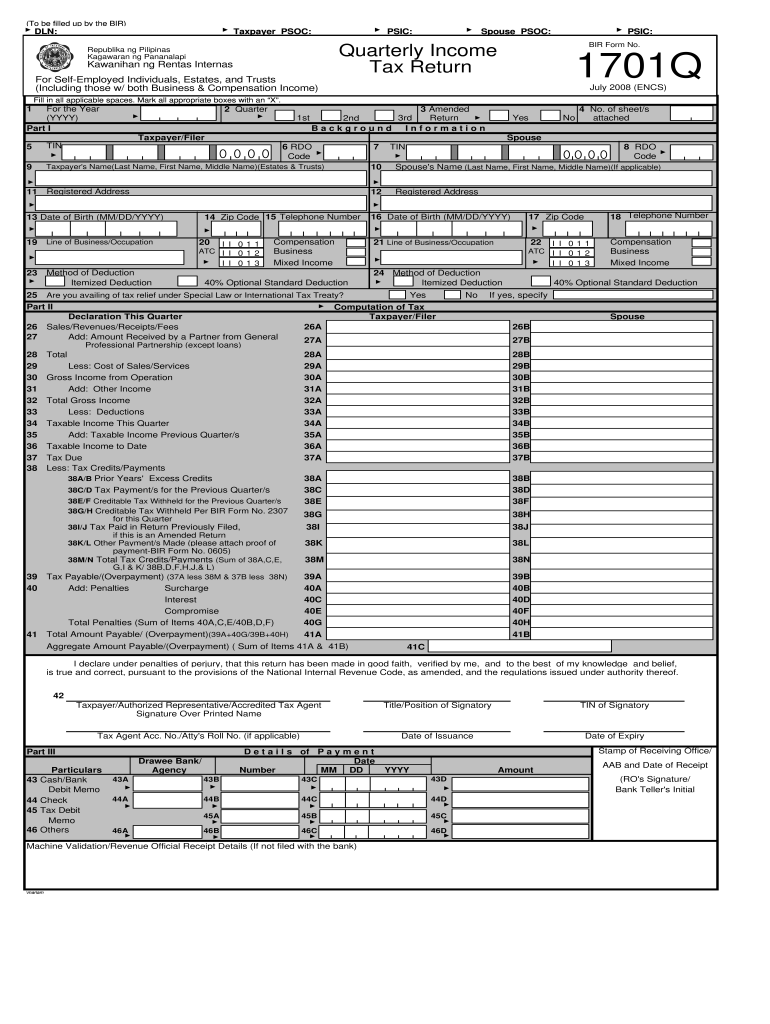

The Bir Form 1701q is a tax form used for the quarterly income tax return in the Philippines. It is specifically designed for individuals, including self-employed persons and those earning income from business or profession. This form is essential for reporting income, calculating tax liabilities, and ensuring compliance with tax regulations. Understanding the purpose and requirements of the 1701q bir form is crucial for accurate tax reporting.

How to use the Bir Form 1701q

Using the Bir Form 1701q involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form with your income details, deductions, and any applicable tax credits. After completing the form, review it for accuracy before submitting it to the Bureau of Internal Revenue (BIR) either online or via mail. Familiarizing yourself with the form's structure and requirements can help streamline the process.

Steps to complete the Bir Form 1701q

Completing the Bir Form 1701q requires careful attention to detail. Here are the key steps:

- Collect all relevant financial documents, such as income statements and receipts.

- Fill in personal information, including your Tax Identification Number (TIN).

- Report all sources of income, including business and professional earnings.

- Calculate allowable deductions and tax credits.

- Determine your total tax liability based on the information provided.

- Sign and date the form, ensuring all information is accurate.

Legal use of the Bir Form 1701q

The legal use of the Bir Form 1701q is governed by tax regulations in the Philippines. To be considered valid, the form must be filled out accurately and submitted within the prescribed deadlines. Compliance with the Bureau of Internal Revenue's guidelines ensures that the form is legally binding and can be used as evidence of tax compliance in case of audits or disputes. Utilizing reliable digital tools can further enhance the legal standing of your completed form.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the Bir Form 1701q is essential for avoiding penalties. Typically, the quarterly income tax return is due on the 15th day of the month following the end of the quarter. For example, the first quarter return is due on April 15, the second quarter on July 15, the third quarter on October 15, and the fourth quarter by January 15 of the following year. Marking these dates on your calendar can help ensure timely submissions.

Required Documents

To complete the Bir Form 1701q, several documents are necessary. These include:

- Income statements from all sources, including business and professional earnings.

- Receipts for deductible expenses related to your business activities.

- Previous tax returns, if applicable, for reference.

- Any relevant tax credit certificates.

Having these documents ready can facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete bir form 1701q

Complete Bir Form 1701q effortlessly on any device

Managing documents online has become increasingly popular for organizations and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your files quickly and smoothly. Manage Bir Form 1701q on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Bir Form 1701q without stress

- Obtain Bir Form 1701q and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools specifically available from airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Bir Form 1701q while ensuring exceptional communication throughout any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir form 1701q

Create this form in 5 minutes!

How to create an eSignature for the bir form 1701q

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is 1701q bir, and how does it benefit my business?

The 1701q bir is a crucial tax document for businesses in the Philippines. By utilizing airSlate SignNow, you can easily prepare, sign, and send this form electronically, streamlining your filing process and reducing the potential for errors. This not only saves time but also ensures your documents are securely stored and easily accessible.

-

How much does airSlate SignNow cost for processing 1701q bir?

Pricing for airSlate SignNow is competitive and tailored to fit various business needs. We offer different plans that can accommodate businesses of all sizes, allowing you to handle documents like the 1701q bir efficiently. Check our website for specific pricing options and any available discounts.

-

Are there any features specifically designed for handling the 1701q bir?

Yes, airSlate SignNow provides features specifically tailored for documents like the 1701q bir. These include customizable templates that simplify data entry, electronic signatures for quick approvals, and secure cloud storage for easy access and sharing. This makes managing your tax documents more efficient than ever.

-

Can I integrate airSlate SignNow with other software for managing 1701q bir?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, including accounting and CRM tools. This means you can easily sync your data and manage your 1701q bir alongside other financial documents without any hassle.

-

What are the benefits of using airSlate SignNow for my 1701q bir filings?

Using airSlate SignNow for your 1701q bir filings comes with numerous benefits. You'll experience faster processing times, reduced paperwork clutter, and enhanced security for your sensitive tax information. Additionally, our platform’s user-friendly interface ensures that you can handle your tax documents with ease.

-

Is airSlate SignNow secure for handling sensitive documents like the 1701q bir?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption and compliance protocols to keep your 1701q bir and other sensitive data safe. You can confidently send and store your documents, knowing that they are protected against unauthorized access.

-

How does airSlate SignNow simplify the eSignature process for the 1701q bir?

airSlate SignNow simplifies the eSignature process for the 1701q bir by providing intuitive tools that allow you to sign documents electronically in just a few clicks. You can invite others to sign your forms via email, track the signing status in real-time, and get notified once the process is complete. This reduces delays and increases efficiency.

Get more for Bir Form 1701q

- Docsawsamazoncom general latestamazon api gateway endpoints and quotas aws general reference form

- 2021 instructions for schedule j 2021 instructions for schedule j income averaging for farmers and fishermen form

- Income taxable form

- Form nyc 210 claim for new york city school tax credit tax year 2021

- Form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1022

- Form indiana department of revenue mailingcontact information ivt 1

- About form 2106 employee business expensesinternal revenue service

- Gettingattentionorgform 990 schedule b donorform 990 schedule b ampamp donor disclosures whats required

Find out other Bir Form 1701q

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed