2551q BIR FormTaxation in the United StatesIncome Tax 2018-2026

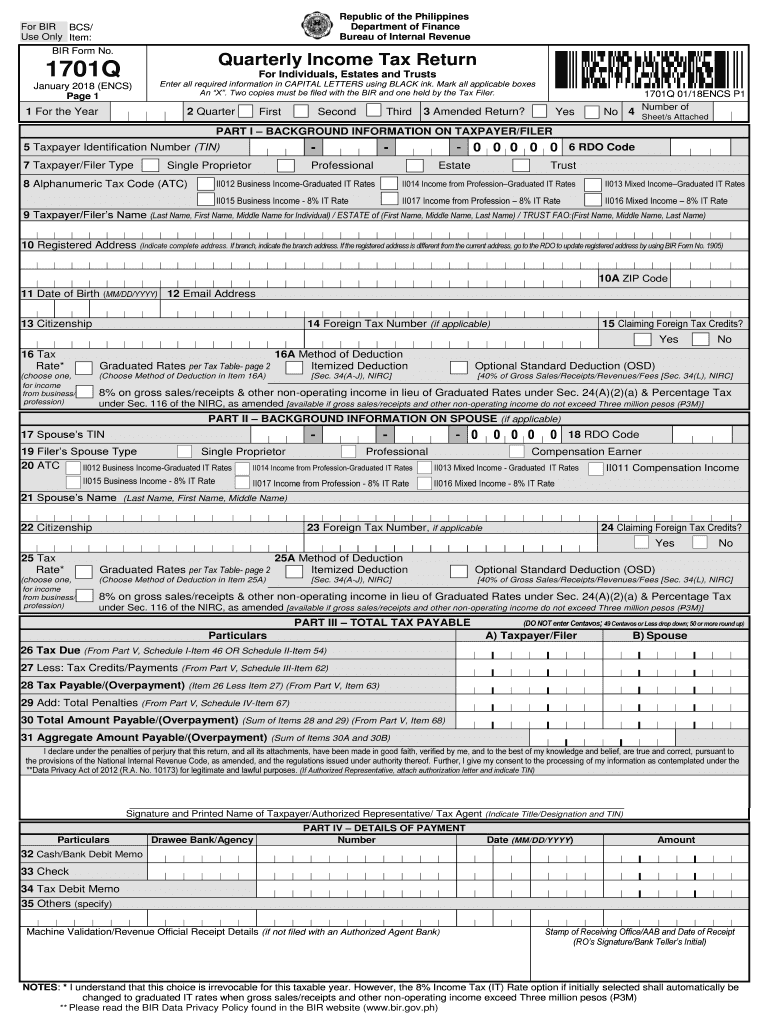

What is the BIR Form 1701Q?

The BIR Form 1701Q is a tax form used for the quarterly filing of income tax returns in the United States. This form is specifically designed for self-employed individuals, professionals, and those earning income from business activities. It allows taxpayers to report their income, calculate their tax liabilities, and ensure compliance with federal tax regulations. Understanding the purpose and requirements of the 1701Q form is essential for accurate tax reporting and avoiding penalties.

Steps to Complete the BIR Form 1701Q

Completing the BIR Form 1701Q involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form by entering your total income, allowable deductions, and any tax credits. It is important to double-check all entries for accuracy. After completing the form, calculate your tax due and include any payments if applicable. Finally, sign and date the form before submission.

Legal Use of the BIR Form 1701Q

The BIR Form 1701Q is legally binding once it is completed and submitted according to IRS regulations. Electronic signatures are accepted, provided they comply with the ESIGN Act and UETA guidelines. It is crucial to retain a copy of the submitted form for your records, as it serves as proof of compliance with tax obligations. Understanding the legal implications of this form helps ensure that all filings are legitimate and can withstand scrutiny from tax authorities.

Filing Deadlines for the BIR Form 1701Q

Filing deadlines for the BIR Form 1701Q are typically set quarterly. Taxpayers must submit the form by the last day of the month following the end of each quarter. For instance, the deadlines for the first, second, third, and fourth quarters are usually April 15, July 15, October 15, and January 15 of the following year, respectively. Staying informed about these deadlines is essential to avoid late fees and penalties.

Form Submission Methods

The BIR Form 1701Q can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for immediate processing and confirmation of submission. For those opting to mail the form, it is advisable to use certified mail to ensure it is received by the IRS by the deadline. In-person submissions provide the opportunity to ask questions and receive assistance from tax professionals.

Required Documents for the BIR Form 1701Q

When preparing to file the BIR Form 1701Q, it is important to gather all required documents to ensure a smooth filing process. Key documents include:

- Income statements from all sources

- Receipts for deductible expenses

- Previous tax returns for reference

- Any relevant documentation for tax credits

Having these documents ready will facilitate accurate reporting and help in calculating any tax owed.

Penalties for Non-Compliance

Failing to file the BIR Form 1701Q on time or submitting inaccurate information can result in penalties. Common penalties include late filing fees and interest on unpaid taxes. Additionally, repeated non-compliance may lead to more severe consequences, such as audits or legal action. Understanding these risks emphasizes the importance of timely and accurate tax filings.

Quick guide on how to complete 2551q bir formtaxation in the united statesincome tax

Effortlessly Prepare 2551q BIR FormTaxation In The United StatesIncome Tax on Any Device

Managing documents online has gained signNow popularity among both enterprises and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle 2551q BIR FormTaxation In The United StatesIncome Tax on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign 2551q BIR FormTaxation In The United StatesIncome Tax Effortlessly

- Find 2551q BIR FormTaxation In The United StatesIncome Tax and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight essential sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or mismanaged files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign 2551q BIR FormTaxation In The United StatesIncome Tax to ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2551q bir formtaxation in the united statesincome tax

Create this form in 5 minutes!

How to create an eSignature for the 2551q bir formtaxation in the united statesincome tax

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the process for bir forms download on airSlate SignNow?

The process for bir forms download on airSlate SignNow is straightforward. Users can navigate to the desired form, fill it out electronically, and then download it directly to their device. This ensures that you have easy access to your completed BIR forms whenever needed.

-

Are there any costs associated with bir forms download?

Downloading BIR forms through airSlate SignNow is included in our subscription plans, which are competitively priced to offer great value. We offer various pricing tiers to suit businesses of all sizes. This means you can effectively manage your document needs without breaking the bank.

-

What features does airSlate SignNow provide for bir forms download?

airSlate SignNow offers a range of features to enhance your bir forms download experience. These include customizable templates, automated workflows, and secure storage options. Each feature is designed to streamline the document management process, ensuring you can focus on what matters most.

-

How can I ensure security when downloading bir forms?

Security is a top priority at airSlate SignNow. When downloading bir forms, your data is protected with advanced encryption technologies. This ensures that your information remains safe and is only accessible to authorized users.

-

Can I integrate airSlate SignNow with other tools for bir forms download?

Yes, airSlate SignNow offers integrations with various business tools, enhancing your workflow when downloading bir forms. Popular integrations include CRM systems, accounting software, and cloud storage solutions. This allows for seamless transitions between platforms and easier document management.

-

What are the benefits of using airSlate SignNow for bir forms download?

Using airSlate SignNow for bir forms download comes with numerous benefits, including increased efficiency and reduced paper waste. Our user-friendly platform ensures quick turnaround times, allowing you to get your documents processed faster. Plus, our electronic signature features streamline the signing process.

-

Is there a mobile app available for bir forms download?

Yes, airSlate SignNow provides a mobile app that allows users to download bir forms on the go. This mobile accessibility ensures you can manage your documents anytime, anywhere. It's perfect for busy professionals who need to stay productive while away from their desks.

Get more for 2551q BIR FormTaxation In The United StatesIncome Tax

- Motor fuel tax general overview motor fuel tax illinois form

- Illinois attorney general estate tax downloadable forms

- 2021 e file signature authorization for rct 101 pa corporate tax report pa 8879 c formspublications

- 2021 birt schedule sc form

- Wwwtaxformfinderorgindianaform it 20indiana form it 20 corporate adjusted gross income tax forms

- 2011 form nj office of the attorney general complaint fill

- Muschealthorgpatients visitorsmedical recordsobtaining musc medical recordsmusc healthcharleston sc form

- Macquarie withdrawal form fill out and sign printablemacquarie investment managementmacquarie investment management

Find out other 2551q BIR FormTaxation In The United StatesIncome Tax

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist