Republic of the Philippines for BIR BCS Department of 2018-2026

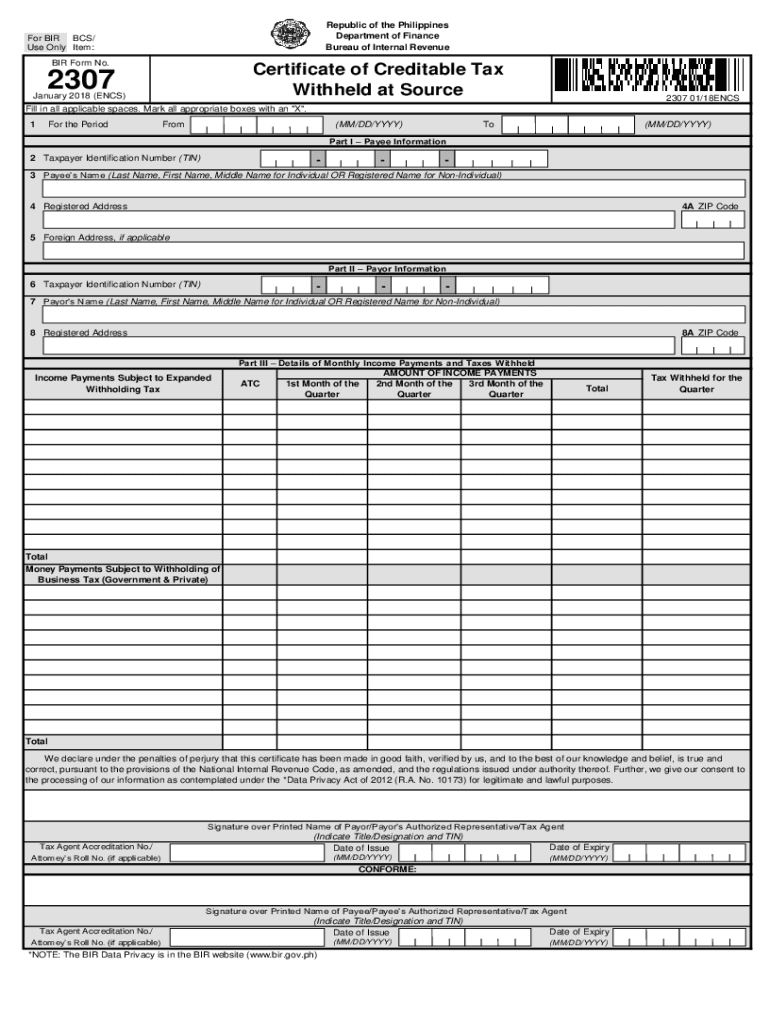

What is the BIR Form 2307?

The BIR Form 2307, also known as the Certificate of Creditable Tax Withheld at Source, is a document issued by a withholding agent to a taxpayer. This form serves as proof of tax withheld on certain income payments, allowing taxpayers to claim tax credits when filing their income tax returns. The form is essential for individuals and businesses to ensure compliance with tax regulations in the Philippines.

Steps to Complete the BIR Form 2307

Filling out the BIR Form 2307 requires careful attention to detail. Here are the steps to complete the form:

- Gather necessary information: Collect details such as the taxpayer's name, Tax Identification Number (TIN), and the amount of income subject to withholding.

- Fill in the form: Enter the required information in the appropriate fields, ensuring accuracy in the amounts and details provided.

- Review for accuracy: Double-check all entries to avoid errors that could affect tax credits or compliance.

- Sign and date: The withholding agent must sign and date the form to validate it before providing it to the taxpayer.

Legal Use of the BIR Form 2307

The BIR Form 2307 is legally recognized as proof of taxes withheld, which can be used by taxpayers to offset their tax liabilities. It is crucial for ensuring compliance with tax laws, as it provides a clear record of withholding amounts. Taxpayers must retain this form for their records and present it during tax filing to claim the appropriate credits.

Form Submission Methods

The BIR Form 2307 can be submitted in various ways, depending on the requirements of the withholding agent and the taxpayer. Common submission methods include:

- Online submission: Many taxpayers can submit their forms electronically through the BIR's online portal, ensuring a quicker processing time.

- Mail: Taxpayers may also choose to send their completed forms via postal service to the relevant BIR office.

- In-person submission: Submitting the form in person at a local BIR office is another option, allowing for immediate confirmation of receipt.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the BIR Form 2307. Typically, the form must be submitted within a specified period after the income payment is made. Taxpayers should keep track of these deadlines to avoid penalties and ensure compliance with tax regulations.

Examples of Using the BIR Form 2307

The BIR Form 2307 is commonly used in various scenarios, including:

- Freelancers: Independent contractors use this form to document taxes withheld by clients on payments for services rendered.

- Businesses: Corporations may issue this form to employees or suppliers to report taxes withheld on salaries or payments.

- Investors: Individuals receiving dividends or interest income may receive this form as proof of tax withheld at source.

Quick guide on how to complete republic of the philippines for bir bcs department of

Effortlessly Prepare Republic Of The Philippines For BIR BCS Department Of on Any Device

The use of online document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources essential for quickly creating, modifying, and electronically signing your documents without delays. Manage Republic Of The Philippines For BIR BCS Department Of on any device through the airSlate SignNow Android or iOS applications and simplify your document-centric procedures today.

The Easiest Method to Modify and eSign Republic Of The Philippines For BIR BCS Department Of with Ease

- Find Republic Of The Philippines For BIR BCS Department Of and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that objective.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Alter and eSign Republic Of The Philippines For BIR BCS Department Of to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct republic of the philippines for bir bcs department of

Create this form in 5 minutes!

How to create an eSignature for the republic of the philippines for bir bcs department of

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the bir 2307 form and why is it important?

The bir 2307 form is a tax-related document used in the Philippines to signNow the withholding tax that a business has deducted from payments made to suppliers or contractors. Proper handling and submission of this form are crucial for compliance with tax regulations, making the bir 2307 form download essential for businesses looking to avoid penalties.

-

How can I obtain the bir 2307 form download through airSlate SignNow?

You can easily obtain the bir 2307 form download by signing up for airSlate SignNow. Once registered, you'll have access to our library of templates, including the bir 2307 form, which you can customize and download whenever needed, streamlining your documentation process.

-

Is there a cost associated with downloading the bir 2307 form?

Downloading the bir 2307 form via airSlate SignNow is part of our subscription plans. We offer various pricing tiers that allow businesses to choose a plan that fits their needs, ensuring you have budget-friendly access to essential forms like the bir 2307.

-

What features does airSlate SignNow offer for managing tax forms like the bir 2307?

airSlate SignNow offers features such as electronic signatures, customizable templates, and document tracking. These tools make it easy to manage and eSign forms like the bir 2307, ensuring your documents are both compliant and efficiently processed.

-

Can I integrate airSlate SignNow with other software for handling the bir 2307 form?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow for documents such as the bir 2307 form. With integrations available for popular tools like Google Drive and Dropbox, you can manage your files more effectively.

-

What are the benefits of using airSlate SignNow for the bir 2307 form?

By using airSlate SignNow for the bir 2307 form, you gain a user-friendly platform that simplifies the eSigning process, reduces paperwork, and ensures compliance with tax laws. This enables your team to focus on core business activities while maintaining accurate and timely document management.

-

How secure is the bir 2307 form download on airSlate SignNow?

AirSlate SignNow prioritizes your data security with advanced encryption and compliance measures. When you download the bir 2307 form, you can be confident that your information is protected at every step, ensuring that your sensitive documents remain confidential.

Get more for Republic Of The Philippines For BIR BCS Department Of

Find out other Republic Of The Philippines For BIR BCS Department Of

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template