CDTFA 146 RES, Exemption Certificate and Statement of Delivery in Indian Country Exemption Certificate and Statement of Delivery 2020-2026

Understanding the CDTFA 146 RES

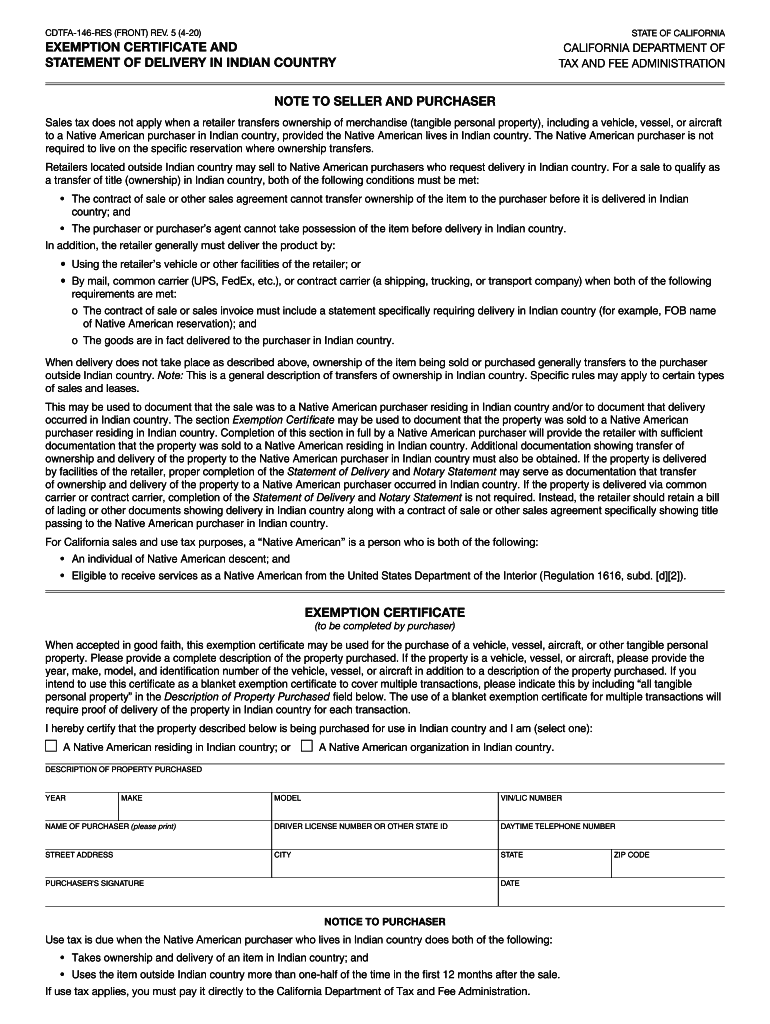

The CDTFA 146 RES, or Exemption Certificate and Statement of Delivery in Indian Country, is a crucial document for businesses operating within or delivering goods to Indian Country. This form allows sellers to claim exemptions from sales tax for transactions involving qualified buyers, such as tribal governments or members of federally recognized tribes. It is essential to understand the specific requirements and legal implications of using this form to ensure compliance with California tax regulations.

Steps to Complete the CDTFA 146 RES

Completing the CDTFA 146 RES involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including details about the buyer and the specific transaction. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to provide the buyer's tribal affiliation and any pertinent identification numbers. After completing the form, review it for any errors before submission. Finally, retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Legal Use of the CDTFA 146 RES

The CDTFA 146 RES is legally binding when completed correctly and used in accordance with California tax laws. To ensure its legal validity, the form must be signed by the buyer, verifying that the transaction qualifies for the exemption. Additionally, both parties should maintain records of the transaction and the exemption certificate for at least four years, as required by the California Department of Tax and Fee Administration. Understanding the legal framework surrounding this form is critical for businesses to avoid potential penalties.

Key Elements of the CDTFA 146 RES

Several key elements must be included in the CDTFA 146 RES to ensure its effectiveness. These include the buyer's name and address, the seller's information, a detailed description of the goods or services provided, and the reason for the exemption. Additionally, the form requires the buyer's signature and date to validate the exemption claim. Ensuring that all these elements are correctly filled out is essential for the form's acceptance by tax authorities.

Eligibility Criteria for Using the CDTFA 146 RES

To utilize the CDTFA 146 RES, certain eligibility criteria must be met. Primarily, the buyer must be a member of a federally recognized tribe or a tribal government entity. The transaction must also involve goods or services delivered directly to Indian Country. It is essential for sellers to verify the buyer's eligibility to ensure compliance with tax regulations and to avoid potential issues with tax authorities.

Form Submission Methods

The CDTFA 146 RES can be submitted through various methods to accommodate different business needs. It can be completed and submitted electronically via secure online platforms, ensuring quick processing and record-keeping. Alternatively, businesses may choose to print the form and submit it via mail or in person at designated tax offices. Each submission method has its advantages, and businesses should select the one that best suits their operational processes.

Common Scenarios for Using the CDTFA 146 RES

Businesses may encounter various scenarios where the CDTFA 146 RES is applicable. For example, a retailer selling goods to a tribal member for use on a reservation would need to complete this form to claim a sales tax exemption. Similarly, service providers delivering services to tribal governments or entities would also use the CDTFA 146 RES to ensure compliance with tax laws. Understanding these scenarios helps businesses navigate tax obligations effectively.

Quick guide on how to complete cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery 522372514

Complete CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery easily on any device

Digital document management has become favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to produce, adjust, and eSign your documents quickly with no delays. Manage CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to modify and eSign CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery with ease

- Find CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight essential parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery 522372514

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery 522372514

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the purpose of the cdtfa 146 res?

The cdtfa 146 res is a crucial form for businesses to report and remit sales and use taxes to the California Department of Tax and Fee Administration. It ensures compliance with state tax regulations and helps maintain accurate financial records.

-

How does airSlate SignNow help with cdtfa 146 res forms?

airSlate SignNow provides an efficient platform for completing and signing cdtfa 146 res forms electronically. With our intuitive interface, you can prepare, send, and securely sign documents, streamlining the filing process.

-

What are the pricing options for using airSlate SignNow for cdtfa 146 res?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. You can choose a plan that fits your budget, allowing you to efficiently manage your cdtfa 146 res filings without breaking the bank.

-

Can I integrate airSlate SignNow with my existing systems for cdtfa 146 res processing?

Yes, airSlate SignNow integrates seamlessly with various tools and systems you may already be using. This functionality allows for easy management of the cdtfa 146 res and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for cdtfa 146 res submissions?

Using airSlate SignNow for cdtfa 146 res submissions speeds up the document flow and reduces the risk of errors. You'll benefit from secure, timely eSignatures and a comprehensive audit trail for all your tax-related documents.

-

Is airSlate SignNow secure for handling cdtfa 146 res information?

Absolutely! AirSlate SignNow prioritizes security, employing robust encryption and compliance with industry standards. Your cdtfa 146 res information is protected, ensuring confidentiality and trust in our services.

-

Can I access my cdtfa 146 res documents from anywhere with airSlate SignNow?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your cdtfa 146 res documents from any device with internet connectivity. This means you can manage your filings on the go, enhancing your flexibility and convenience.

Get more for CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery

Find out other CDTFA 146 RES, Exemption Certificate And Statement Of Delivery In Indian Country Exemption Certificate And Statement Of Delivery

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement