Visit Our Website See Need 2020-2026

Understanding the DTF 95 Business Tax Account Update

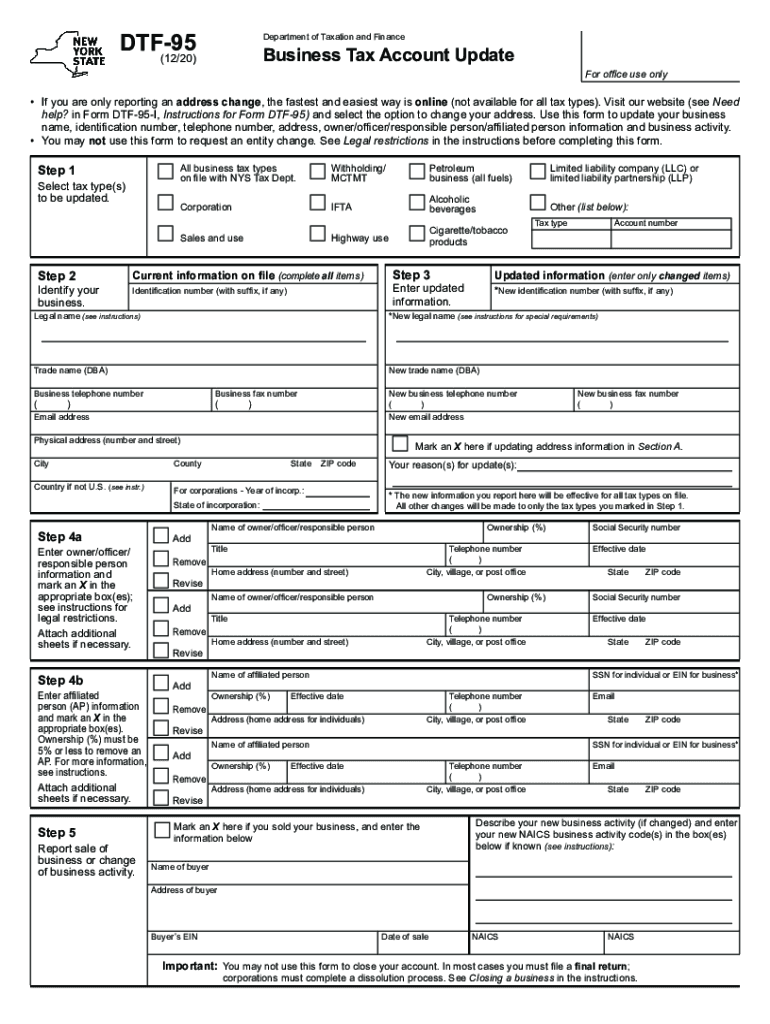

The DTF 95 form is essential for businesses in the United States to update their tax account information with the Department of Taxation and Finance. This form is specifically designed for businesses to report changes such as name changes, address changes, or alterations in business structure. Accurate completion of the DTF 95 ensures that your business remains compliant with state tax regulations and that all correspondence is sent to the correct address.

Steps to Complete the DTF 95 Form

Completing the DTF 95 form involves several straightforward steps:

- Gather necessary information, including your current business name, new name (if applicable), and address details.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form either online or via mail, depending on your preference.

Legal Use of the DTF 95 Form

The DTF 95 form is legally binding once submitted and processed by the relevant tax authority. It is crucial that the information provided is accurate and truthful to avoid any potential legal issues. Misrepresentation or errors can lead to penalties or delays in processing your tax account updates.

Required Documents for Submission

When submitting the DTF 95 form, certain documents may be required to support your changes. These can include:

- Proof of the business name change, such as a certificate of amendment.

- Documentation verifying the new address, like a utility bill or lease agreement.

- Identification details of the business owner or authorized representative.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines associated with the DTF 95 form. Typically, changes should be reported as soon as they occur to avoid complications with tax filings. Check with the Department of Taxation and Finance for specific deadlines that may apply to your situation.

Form Submission Methods

The DTF 95 form can be submitted through various methods to accommodate different business needs:

- Online submission through the Department of Taxation and Finance website, which offers a quick and efficient process.

- Mailing the completed form to the appropriate tax office, ensuring you allow enough time for processing.

- In-person submission at designated tax office locations, if preferred.

Penalties for Non-Compliance

Failing to submit the DTF 95 form when required can result in penalties. These may include fines or additional scrutiny during tax audits. It is essential to keep your business information up to date to avoid complications with tax compliance and to ensure smooth operations.

Quick guide on how to complete visit our website see need

Complete Visit Our Website see Need effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Visit Our Website see Need on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The easiest way to modify and electronically sign Visit Our Website see Need without hassle

- Find Visit Our Website see Need and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your alterations.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Visit Our Website see Need and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct visit our website see need

Create this form in 5 minutes!

How to create an eSignature for the visit our website see need

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is DTF 973 61 and how does it relate to airSlate SignNow?

DTF 973 61 refers to a specific feature set within airSlate SignNow that empowers businesses to manage electronic signatures and document workflows efficiently. With this solution, users can streamline their signing processes, ensuring compliance and security. It essentially enhances the overall user experience when dealing with eSignatures.

-

How cost-effective is airSlate SignNow with DTF 973 61?

airSlate SignNow offers competitive pricing for its DTF 973 61 features, making it accessible for businesses of all sizes. Customers can choose from various subscription plans that cater to different usage requirements and budgets. This cost-effectiveness ensures that users can leverage advanced eSignature technologies without breaking the bank.

-

What are the key features of the DTF 973 61 solution?

The DTF 973 61 solution includes features like document templates, customizable workflows, and advanced security options for eSignatures. It provides real-time tracking of documents and integrates seamlessly with other business applications. These features make it an ideal choice for businesses seeking a comprehensive electronic signature solution.

-

What benefits does DTF 973 61 provide to businesses?

DTF 973 61 helps businesses save time and reduce costs by streamlining document signing processes. It improves turnaround times for contracts and agreements, enhancing overall productivity. Additionally, the solution ensures legal compliance and data protection, which are critical for any organization.

-

Can DTF 973 61 integrate with other software applications?

Yes, airSlate SignNow with DTF 973 61 can easily integrate with various third-party applications such as CRM, accounting software, and project management tools. This integration enhances workflow efficiency, as documents can be shared and signed directly within the software users already use. It provides a seamless experience for managing documents.

-

Is DTF 973 61 suitable for small businesses?

Absolutely! DTF 973 61 is designed to cater to small businesses looking for a reliable eSignature solution. Its user-friendly interface and scalable pricing options make it an excellent choice for companies that require efficient document management without overwhelming complexity or cost.

-

How secure is the DTF 973 61 solution?

Security is a top priority for airSlate SignNow’s DTF 973 61 solution. It employs advanced encryption and authentication processes to protect sensitive information. Moreover, the platform complies with various industry standards, ensuring that your documents are secure throughout the signing process.

Get more for Visit Our Website see Need

- Stolen vehicle police report example form

- Lyft emblem pdf form

- Magsaysay home harbor exit interview form

- Group code of business conduct and ethics icici bank answers form

- Radical forgiveness worksheet form

- Disc assessment worksheet pdf form

- State form 28622

- Bleaseb termination authorization i roberts amp sons form

Find out other Visit Our Website see Need

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word